J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

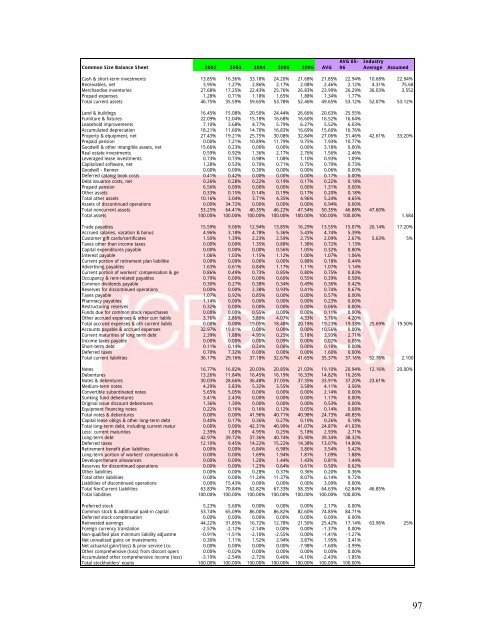

Common Size Balance Sheet 2002 2003 2004 2005 2006 AVGAVG 05-06IndustryAverage<strong>As</strong>sumedCash & short-term investments 13.85% 16.36% 33.18% 24.20% 21.68% 21.85% 22.94% 10.68% 22.94%Receivables, net 3.95% 1.27% 2.86% 2.17% 2.08% 2.46% 2.12% 4.31% 75.68Merch<strong>and</strong>ise inventories 27.68% 17.25% 22.43% 25.76% 26.83% 23.99% 26.29% 36.03% 3.552Prepaid expenses 1.28% 0.71% 1.18% 1.65% 1.88% 1.34% 1.77%Total current assets 46.75% 35.59% 59.65% 53.78% 52.46% 49.65% 53.12% 52.07% 53.12%L<strong>and</strong> & buildings 16.45% 15.08% 20.50% 24.44% 26.66% 20.63% 25.55%Furniture & fixtures 22.09% 12.04% 15.18% 16.68% 16.60% 16.52% 16.64%Leasehold improvements 7.10% 3.68% 4.77% 5.79% 6.27% 5.52% 6.03%Accumulated depreciation 18.21% 11.60% 14.70% 16.83% 16.69% 15.60% 16.76%Property & equipment, net 27.43% 19.21% 25.75% 30.08% 32.84% 27.06% 31.46% 42.61% 33.20%Prepaid pension 0.00% 7.21% 10.89% 11.79% 9.75% 7.93% 10.77%Goodwill & other intangible assets, net 15.66% 0.23% 0.00% 0.00% 0.00% 3.18% 0.00%Real estate investments 0.59% 0.92% 1.36% 2.17% 2.76% 1.56% 2.46%Leveraged lease investments 0.73% 0.73% 0.98% 1.08% 1.10% 0.93% 1.09%Capitalized s<strong>of</strong>tware, net 1.28% 0.53% 0.70% 0.71% 0.75% 0.79% 0.73%Goodwill - Renner 0.00% 0.00% 0.30% 0.00% 0.00% 0.06% 0.00%Deferred catalog book costs 0.41% 0.42% 0.00% 0.00% 0.00% 0.17% 0.00%Debt issuance costs, net 0.26% 0.28% 0.22% 0.19% 0.17% 0.22% 0.18%Prepaid pension 6.56% 0.00% 0.00% 0.00% 0.00% 1.31% 0.00%Other assets 0.33% 0.15% 0.14% 0.19% 0.17% 0.20% 0.18%Total other assets 10.16% 3.04% 3.71% 4.35% 4.96% 5.24% 4.65%<strong>As</strong>sets <strong>of</strong> discontinued operations 0.00% 34.72% 0.00% 0.00% 0.00% 6.94% 0.00%Total noncurrent assets 53.25% 64.41% 40.35% 46.22% 47.54% 50.35% 46.88% 47.60%Total assets 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 1.584Trade payables 15.59% 9.06% 12.94% 13.85% 16.29% 13.55% 15.07% 26.14% 17.20%Accrued salaries, vacation & bonus 4.96% 3.18% 4.78% 5.36% 5.43% 4.74% 5.39%Customer gift cards/certificates 1.50% 1.39% 2.23% 2.59% 2.75% 2.09% 2.67% 5.63% 5%Taxes other than income taxes 0.00% 0.00% 1.35% 0.88% 1.38% 0.72% 1.13%Capital expenditures payable 0.00% 0.00% 0.00% 0.56% 1.05% 0.32% 0.80%Interest payable 1.06% 1.03% 1.15% 1.12% 1.00% 1.07% 1.06%Current portion <strong>of</strong> retirement plan liabilitie 0.00% 0.00% 0.00% 0.00% 0.88% 0.18% 0.44%Advertising payables 1.63% 0.61% 0.84% 1.17% 1.11% 1.07% 1.14%Current portion <strong>of</strong> workers' compensation & ge 0.86% 0.49% 0.73% 0.85% 0.80% 0.75% 0.83%Occupancy & rent-related payables 0.79% 0.00% 0.00% 0.60% 0.55% 0.39% 0.58%Common dividends payable 0.30% 0.27% 0.38% 0.34% 0.49% 0.36% 0.42%Reserves for discontinued operations 0.00% 0.00% 2.38% 0.93% 0.41% 0.74% 0.67%Taxes payable 1.07% 0.92% 0.85% 0.00% 0.00% 0.57% 0.00%Pharmacy payables 1.14% 0.00% 0.00% 0.00% 0.00% 0.23% 0.00%Restructuring reserves 0.32% 0.00% 0.00% 0.00% 0.00% 0.06% 0.00%Funds due for common stock repurchases 0.00% 0.00% 0.55% 0.00% 0.00% 0.11% 0.00%Other accrued expenses & other curr liabils 3.76% 2.86% 3.80% 4.07% 4.33% 3.76% 4.20%Total accrued expenses & oth current liabils 0.00% 0.00% 19.05% 18.48% 20.18% 19.23% 19.33% 25.69% 19.50%Accounts payable & accrued expenses 32.97% 19.81% 0.00% 0.00% 0.00% 10.56% 0.00%Current maturities <strong>of</strong> long term debt 2.39% 1.88% 4.95% 0.25% 5.18% 2.93% 2.71%<strong>Inc</strong>ome taxes payable 0.00% 0.00% 0.00% 0.09% 0.00% 0.02% 0.05%Short-term debt 0.11% 0.14% 0.24% 0.00% 0.00% 0.10% 0.00%Deferred taxes 0.70% 7.32% 0.00% 0.00% 0.00% 1.60% 0.00%Total current liabilities 36.17% 29.16% 37.18% 32.67% 41.65% 35.37% 37.16% 52.76% 2.100Notes 16.77% 16.82% 20.03% 20.85% 21.03% 19.10% 20.94% 12.16% 20.00%Debentures 13.26% 11.84% 16.45% 16.19% 16.33% 14.82% 16.26%Notes & debentures 30.03% 28.66% 36.48% 37.05% 37.35% 33.91% 37.20% 23.61%Medium-term notes 4.29% 3.83% 5.32% 3.55% 3.58% 4.11% 3.56%Convertible subordinated notes 5.65% 5.05% 0.00% 0.00% 0.00% 2.14% 0.00%Sunking fund debentures 3.41% 2.43% 0.00% 0.00% 0.00% 1.17% 0.00%Original issue discount debentures 1.36% 1.30% 0.00% 0.00% 0.00% 0.53% 0.00%Equipment financing notes 0.22% 0.16% 0.16% 0.12% 0.05% 0.14% 0.08%Total notes & debentures 0.00% 0.00% 41.96% 40.71% 40.98% 24.73% 40.85%Capital lease obligs & other long-term debt 0.40% 0.17% 0.36% 0.27% 0.10% 0.26% 0.18%Total long-term debt, including current matur 0.00% 0.00% 42.31% 40.99% 41.07% 24.87% 41.03%Less: current maturities 2.39% 1.88% 4.95% 0.25% 5.18% 2.93% 2.71%Long-term debt 42.97% 39.72% 37.36% 40.74% 35.90% 39.34% 38.32%Deferred taxes 12.10% 9.45% 14.22% 15.22% 14.38% 13.07% 14.80%Retirement benefit plan liabilities 0.00% 0.00% 6.84% 6.98% 3.86% 3.54% 5.42%Long-term portion <strong>of</strong> workers' compensation & 0.00% 0.00% 1.69% 1.94% 1.81% 1.09% 1.88%Developer/tenant allowances 0.00% 0.00% 1.20% 1.44% 1.43% 0.81% 1.44%Reserves for discontinued operations 0.00% 0.00% 1.23% 0.64% 0.61% 0.50% 0.62%Other liabilities 0.00% 0.00% 0.28% 0.37% 0.36% 0.20% 0.36%Total other liabilities 0.00% 0.00% 11.24% 11.37% 8.07% 6.14% 9.72%Liabilities <strong>of</strong> discontinued operations 0.00% 15.43% 0.00% 0.00% 0.00% 3.09% 0.00%Total NonCurrent Liabilities 63.83% 70.84% 62.82% 67.33% 58.35% 64.63% 62.84% 46.85%Total liabilities 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%Preferred stock 5.23% 5.60% 0.00% 0.00% 0.00% 2.17% 0.00%Common stock & additional paid-in capital 53.74% 65.09% 86.00% 86.82% 82.60% 74.85% 84.71%Deferred stock compensation 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%Reinvested earnings 44.22% 31.85% 16.72% 12.78% 21.50% 25.42% 17.14% 63.96% 25%Foreign currency translation -2.57% -2.12% -2.14% 0.00% 0.00% -1.37% 0.00%Non-qualified plan minimum liability adjustme -0.91% -1.51% -2.10% -2.55% 0.00% -1.41% -1.27%Net unrealized gains on investments 0.30% 1.11% 1.52% 2.94% 3.87% 1.95% 3.41%Net actuarial gain/(loss) & prior service (co 0.00% 0.00% 0.00% 0.00% -7.98% -1.60% -3.99%Other comprehensive (loss) from discont opers 0.00% -0.02% 0.00% 0.00% 0.00% 0.00% 0.00%Accumulated other comprehensive income (loss) -3.19% -2.54% -2.72% 0.40% -4.10% -2.43% -1.85%Total stockholders' equity 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%97