J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

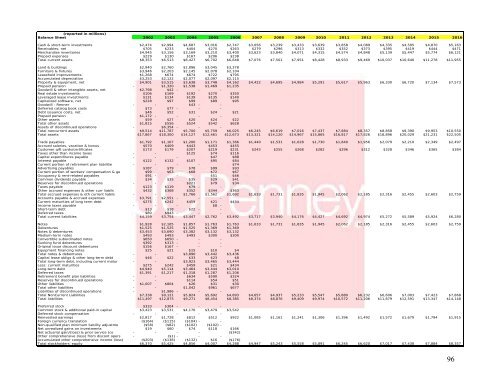

(reported in millions)Balance Sheet 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016Cash & short-term investments $2,474 $2,994 $4,687 $3,016 $2,747 $3,056 $3,239 $3,433 $3,639 $3,858 $4,089 $4,335 $4,595 $4,870 $5,163Receivables, net $705 $233 $404 $270 $263 $279 $296 $313 $332 $352 $373 $395 $419 $444 $471Merch<strong>and</strong>ise inventories $4,945 $3,156 $3,169 $3,210 $3,400 $3,623 $3,840 $4,071 $4,315 $4,574 $4,848 $5,139 $5,447 $5,774 $6,121Prepaid expenses $229 $130 $167 $206 $238Total current assets $8,353 $6,513 $8,427 $6,702 $6,648 $7,076 $7,501 $7,951 $8,428 $8,933 $9,469 $10,037 $10,640 $11,278 $11,955L<strong>and</strong> & buildings $2,940 $2,760 $2,896 $3,045 $3,378Furniture & fixtures $3,946 $2,203 $2,145 $2,078 $2,104Leasehold improvements $1,268 $674 $674 $722 $795Accumulated depreciation $3,253 $2,122 $2,077 $2,097 $2,115Property & equipment, net $4,901 $3,515 $3,638 $3,748 $4,162 $4,422 $4,695 $4,984 $5,291 $5,617 $5,963 $6,330 $6,720 $7,134 $7,573Prepaid pension - $1,320 $1,538 $1,469 $1,235Goodwill & other intangible assets, net $2,798 $42 - - -Real estate investments $106 $169 $192 $270 $350Leveraged lease investments $131 $134 $139 $135 $140Capitalized s<strong>of</strong>tware, net $228 $97 $99 $89 $95Goodwill - Renner - - $43 - -Deferred catalog book costs $73 $77 - - -Debt issuance costs, net $46 $52 $31 $24 $21Prepaid pension $1,172 - - - -Other assets $59 $27 $20 $24 $22Total other assets $1,815 $556 $524 $542 $628<strong>As</strong>sets <strong>of</strong> discontinued operations - $6,354 - - -Total noncurrent assets $9,514 $11,787 $5,700 $5,759 $6,025 $6,245 $6,619 $7,016 $7,437 $7,884 $8,357 $8,858 $9,390 $9,953 $10,550Total assets $17,867 $18,300 $14,127 $12,461 $12,673 $13,321 $14,120 $14,967 $15,865 $16,817 $17,826 $18,896 $20,029 $21,231 $22,505Trade payables $1,792 $1,167 $1,200 $1,171 $1,366 $1,440 $1,531 $1,628 $1,730 $1,840 $1,956 $2,079 $2,210 $2,349 $2,497Accrued salaries, vacation & bonus $570 $409 $443 $453 $455Customer gift cards/certificates $173 $179 $207 $219 $231 $243 $255 $268 $282 $296 $312 $328 $346 $365 $384Taxes other than income taxes - - $125 $74 $116Capital expenditures payable - - - $47 $88Interest payable $122 $132 $107 $95 $84Current portion <strong>of</strong> retirement plan liabilitie - - - - $74Advertising payables $187 $79 $78 $99 $93Current portion <strong>of</strong> workers' compensation & ge $99 $63 $68 $72 $67Occupancy & rent-related payables $91 - - $51 $46Common dividends payable $34 $35 $35 $29 $41Reserves for discontinued operations - - $221 $79 $34Taxes payable $123 $119 $79 - -Other accrued expenses & other curr liabils $432 $368 $352 $344 $363Total accrued expenses & oth current liabils - - $1,766 $1,562 $1,692 $1,633 $1,731 $1,835 $1,945 $2,062 $2,185 $2,316 $2,455 $2,603 $2,759Accounts payable & accrued expenses $3,791 $2,551 - - -Current maturities <strong>of</strong> long term debt $275 $242 $459 $21 $434<strong>Inc</strong>ome taxes payable - - - $8 -Short-term debt $13 $18 $22 - -Deferred taxes $80 $943 - - -Total current liabilities $4,159 $3,754 $3,447 $2,762 $3,492 $3,717 $3,940 $4,176 $4,427 $4,692 $4,974 $5,272 $5,589 $5,924 $6,280Notes $1,928 $2,165 $1,857 $1,763 $1,763 $1,633 $1,731 $1,835 $1,945 $2,062 $2,185 $2,316 $2,455 $2,603 $2,759Debentures $1,525 $1,525 $1,525 $1,369 $1,369Notes & debentures $3,453 $3,690 $3,382 $3,132 $3,132Medium-term notes $493 $493 $493 $300 $300Convertible subordinated notes $650 $650 - - -Sunking fund debentures $392 $313 - - -Original issue discount debentures $156 $167 - - -Equipment financing notes $25 $21 $15 $10 $4Total notes & debentures - - $3,890 $3,442 $3,436Capital lease obligs & other long-term debt $46 $22 $33 $23 $8Total long-term debt, including current matur - - $3,923 $3,465 $3,444Less: current maturities $275 $242 $459 $21 $434Long-term debt $4,940 $5,114 $3,464 $3,444 $3,010Deferred taxes $1,391 $1,217 $1,318 $1,287 $1,206Retirement benefit plan liabilities - - $634 $590 $324Reserves for discontinued operations - - $114 $54 $51Other liabilities $1,007 $804 $26 $31 $30Total other liabilities - - $1,042 $961 $677Liabilities <strong>of</strong> discontinued operations - $1,986 - - -Total NonCurrent Liabilities $7,338 $9,121 $5,824 $5,692 $4,893 $4,657 $4,937 $5,233 $5,547 $5,880 $6,232 $6,606 $7,003 $7,423 $7,868Total liabilities $11,497 $12,875 $9,271 $8,454 $8,385 $8,374 $8,876 $9,409 $9,974 $10,572 $11,206 $11,879 $12,591 $13,347 $14,148Preferred stock $333 $304 - - -Common stock & additional paid-in capital $3,423 $3,531 $4,176 $3,479 $3,542Deferred stock compensation - - - - -Reinvested earnings $2,817 $1,728 $812 $512 $922 $1,085 $1,161 $1,241 $1,306 $1,396 $1,492 $1,572 $1,679 $1,794 $1,915Foreign currency translation ($164) ($115) ($104) - -Non-qualified plan minimum liability adjustme ($58) ($82) ($102) ($102) -Net unrealized gains on investments $19 $60 $74 $118 $166Net actuarial gain/(loss) & prior service (co - - - - ($342)Other comprehensive (loss) from discont opers - ($1) - - -Accumulated other comprehensive income (loss) ($203) ($138) ($132) $16 ($176)Total stockholders' equity $6,370 $5,425 $4,856 $4,007 $4,288 $4,947 $5,243 $5,558 $5,891 $6,245 $6,620 $7,017 $7,438 $7,884 $8,35796