J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

J. C. Penney Company, Inc. Equity Valuation and Analysis As of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

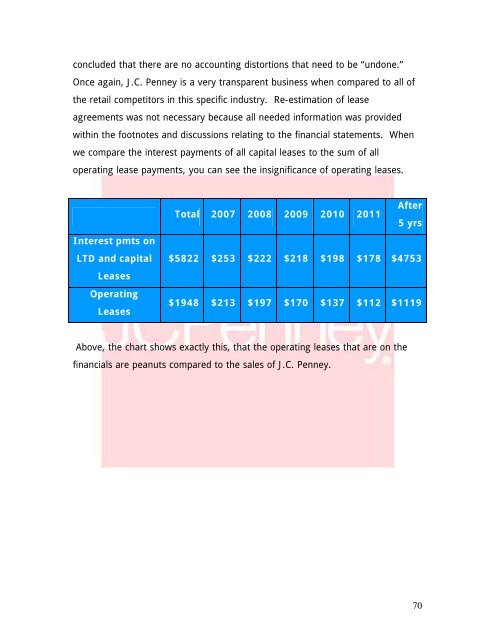

concluded that there are no accounting distortions that need to be “undone.”Once again, J.C. <strong>Penney</strong> is a very transparent business when compared to all <strong>of</strong>the retail competitors in this specific industry. Re-estimation <strong>of</strong> leaseagreements was not necessary because all needed information was providedwithin the footnotes <strong>and</strong> discussions relating to the financial statements. Whenwe compare the interest payments <strong>of</strong> all capital leases to the sum <strong>of</strong> alloperating lease payments, you can see the insignificance <strong>of</strong> operating leases.Interest pmts onLTD <strong>and</strong> capitalLeasesOperatingLeasesTotal 2007 2008 2009 2010 2011After5 yrs$5822 $253 $222 $218 $198 $178 $4753$1948 $213 $197 $170 $137 $112 $1119Above, the chart shows exactly this, that the operating leases that are on thefinancials are peanuts compared to the sales <strong>of</strong> J.C. <strong>Penney</strong>.70