ocp192_en

ocp192_en

ocp192_en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

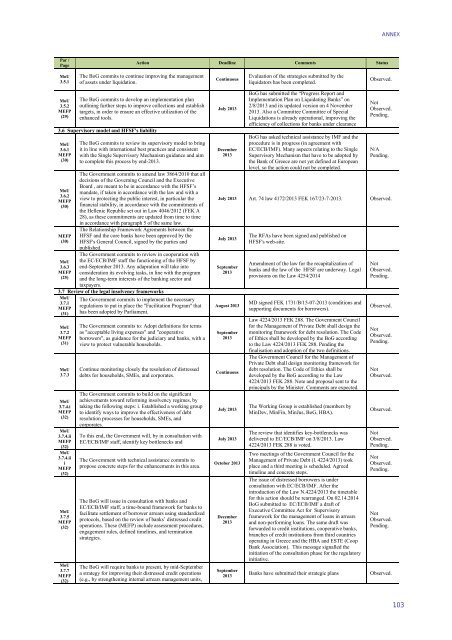

ANNEXΡar /ΡageAction Deadline Comm<strong>en</strong>ts StatusMoU3.5.1The BoG commits to continue improving the managem<strong>en</strong>tof assets under liquidation.ContinuousEvaluation of the strategies submitted by theliquidators has be<strong>en</strong> completed.Observed.MoU3.5.2MEFP(29)The BoG commits to develop an implem<strong>en</strong>tation planoutlining further steps to improve collections and establishtargets, in order to <strong>en</strong>sure an effective utilization of the<strong>en</strong>hanced tools.3.6 Supervisory model and HFSF's liabilityMoU3.6.1MEFP(30)MoU3.6.2MEFP(30)MEFP(30)MoU3.6.3MEFP(25)The BoG commits to review its supervisory model to bringit in line with international best practices and consist<strong>en</strong>twith the Single Supervisory Mechanism guidance and aimto complete this process by <strong>en</strong>d-2013.The Governm<strong>en</strong>t commits to am<strong>en</strong>d law 3864/2010 that alldecisions of the Governing Council and the ExecutiveBoard , are meant to be in accordance with the HFSF’smandate, if tak<strong>en</strong> in accordance with the law and with aview to protecting the public interest, in particular thefinancial stability, in accordance with the commitm<strong>en</strong>ts ofthe Hell<strong>en</strong>ic Republic set out in Law 4046/2012 (FEK A28), as these commitm<strong>en</strong>ts are updated from time to timein accordance with paragraph 5 of the same law.The Relationship Framework Agrem<strong>en</strong>ts betwe<strong>en</strong> theHFSF and the core banks have be<strong>en</strong> approved by theHFSF's G<strong>en</strong>eral Council, signed by the parties andpublished.The Governm<strong>en</strong>t commits to review in cooperation withthe EC/ECB/IMF staff the functioning of the HFSF by<strong>en</strong>d-September 2013. Any adapration will take intoconsideration its evolving tasks, in line with the programand the long-term interests of the banking sector andtaxpayers.3.7 Review of the legal insolv<strong>en</strong>cy frameworksMoU The Governm<strong>en</strong>t commits to implem<strong>en</strong>t the necessary3.7.1regulations to put in place the "Facilitation Program" thatMEFP(31) has be<strong>en</strong> adopted by Parliam<strong>en</strong>t.MoU3.7.2MEFP(31)MoU3.7.3MoU3.7.4.iMEFP(32)MoU3.7.4.iiMEFP(32)MoU3.7.4.iiiMEFP(32)MoU3.7.5MEFP(32)MoU3.7.7MEFP(32)The Governm<strong>en</strong>t commits to: Adopt definitions for termsas "acceptable living exp<strong>en</strong>ses" and "cooperativeborrowers", as guidance for the judiciary and banks, with aview to protect vulnerable households.Continue monitoring closely the resolution of distresseddebts for households, SMEs, and corporates.The Governm<strong>en</strong>t commits to build on the significantachievem<strong>en</strong>ts toward reforming insolv<strong>en</strong>cy regimes, bytaking the following steps: i. Established a working groupto id<strong>en</strong>tify ways to improve the effectiv<strong>en</strong>ess of debtresolution processes for households, SMEs, andcorporates.To this <strong>en</strong>d, the Governm<strong>en</strong>t will, by in consultation withEC/ECB/IMF staff, id<strong>en</strong>tify key bottl<strong>en</strong>ecks andThe Governm<strong>en</strong>t with technical assistance commits topropose concrete steps for the <strong>en</strong>hancem<strong>en</strong>ts in this area.The BoG will issue in consultation with banks andEC/ECB/IMF staff, a time-bound framework for banks tofacilitate settlem<strong>en</strong>t of borrower arrears using standardizedprotocols, based on the review of banks’ distressed creditoperations. These (MEFP) include assessm<strong>en</strong>t procedures,<strong>en</strong>gagem<strong>en</strong>t rules, defined timelines, and terminationstrategies.The BoG will require banks to pres<strong>en</strong>t, by mid-Septembera strategy for improving their distressed credit operations(e.g., by str<strong>en</strong>gth<strong>en</strong>ing internal arrears managem<strong>en</strong>t units,July 2013December2013BoG has submitted the “Progress Report andImplem<strong>en</strong>tation Plan on Liquidating Banks” on2/8/2013 and its updated version on 4 November2013. Also a Committee Committee of SpecialLiquidations is already operational, improving theeffici<strong>en</strong>cy of collections for banks under clearanceBoG has asked technical assistance by IMF and theprocedure is in progress (in agreem<strong>en</strong>t withEC/ECB/IMF). Many aspects relating to the SingleSupervisory Mechanism that have to be adopted bythe Bank of Greece are not yet defined at Europeanlevel, so the action could not be completed.NotObserved.P<strong>en</strong>ding.N/AP<strong>en</strong>ding.July 2013 Art. 74 law 4172/2013 FEK 167/23-7-2013. Observed.July 2013September2013August 2013September2013ContinuousJuly 2013July 2013October 2013December2013September2013The RFAs have be<strong>en</strong> signed and published onHFSF's web-site.Am<strong>en</strong>dm<strong>en</strong>t of the law for the recapitalization ofbanks and the law of the HFSF are underway. Legalprovisions on the Law 4254/2014MD signed FEK 1731/Β/15-07-2013 (conditions andsupporting docum<strong>en</strong>ts for borrowers).Law 4224/2013 FEK 288. The Governm<strong>en</strong>t Councilfor the Managem<strong>en</strong>t of Private Debt shall design themonitoring framework for debt resolution. The Codeof Ethics shall be developed by the BoG accordingto the Law 4224/2013 FEK 288. P<strong>en</strong>ding thefinalisation and adoption of the two definitions.The Governm<strong>en</strong>t Council for the Managem<strong>en</strong>t ofPrivate Debt shall design monitoring framework fordebt resolution. The Code of Ethics shall bedeveloped by the BoG according to the Law4224/2013 FEK 288. Note and proposal s<strong>en</strong>t to theprincipals by the Minister. Comm<strong>en</strong>ts are expected.The Working Group is established (members byMinDev, MinFin, MinJus, BoG, HBA).The review that id<strong>en</strong>tifies key-bottl<strong>en</strong>ecks wasdelivered to EC/ECB/IMF on 3/8/2013. Law4224/2013 FEK 288 is voted.Two meetings of the Governm<strong>en</strong>t Council for theManagem<strong>en</strong>t of Private Debt (l. 4224/2013) tookplace and a third meeting is scheduled. Agreedtimeline and concrete steps.The issue of distressed borrowers is underconsultation with EC/ECB/IMF. After theintroduction of the Law N.4224/2013 the timetablefor this action should be rearranged. On 02.14.2014BoG submitted to EC/ECB/IMF a draft ofExecutive Committee Act for Supervisoryframework for the managem<strong>en</strong>t of loans in arrearsand non-performing loans. The same draft wasforwarded to credit institutions, cooperative banks,branches of credit institutions from third countriesoperating in Greece and the HBA and ESTE (CoopBank Association). This message signalled theinitiation of the consultation phase for the regulatoryinitiative.Banks have submitted their strategic plansNotObserved.P<strong>en</strong>ding.Observed.NotObserved.P<strong>en</strong>ding.NotObserved.Observed.NotObserved.P<strong>en</strong>ding.NotObserved.P<strong>en</strong>ding.NotObserved.P<strong>en</strong>ding.Observed.103