ocp192_en

ocp192_en

ocp192_en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

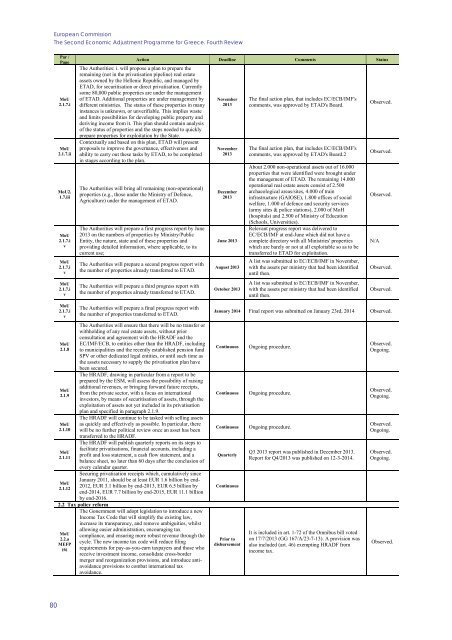

European CommissionThe Second Economic Adjustm<strong>en</strong>t Programme for Greece. Fourth ReviewΡar /ΡageMoU2.1.7.iMoU2.1.7.iiMoU2.1.7.iiiMoU2.1.7.ivMoU2.1.7.ivMoU2.1.7.ivAction Deadline Comm<strong>en</strong>ts StatusThe Authorities: i. will propose a plan to prepare theremaining (not in the privatisation pipeline) real estateassets owned by the Hell<strong>en</strong>ic Republic, and managed byETAD, for securitisation or direct privatisation. Curr<strong>en</strong>tlysome 80,000 public properties are under the managem<strong>en</strong>tof ETAD. Additional properties are under managem<strong>en</strong>t bydiffer<strong>en</strong>t ministries. The status of these properties in manyinstances is unknown, or unverifiable. This implies wasteand limits possibilities for developing public property andderiving income from it. This plan should contain analysisof the status of properties and the steps needed to quicklyprepare properties for exploitation by the State.Contextually and based on this plan, ETAD will pres<strong>en</strong>tproposals to improve the governance, effectiv<strong>en</strong>ess andability to carry out these tasks by ETAD, to be completedin stages according to the plan.The Authorities will bring all remaining (non-operational)properties (e.g., those under the Ministry of Def<strong>en</strong>ce,Agriculture) under the managem<strong>en</strong>t of ETAD.The Authorities will prepare a first progress report by June2013 on the numbers of properties by Ministry/PublicEntity, the nature, state and of these properties andproviding detailed information, where applicable, to itscurr<strong>en</strong>t use;The Authorities will prepare a second progress report withthe number of properties already transferred to ETAD.The Authorities will prepare a third progress report withthe number of properties already transferred to ETAD.November2013November2013December2013June 2013August 2013October 2013The final action plan, that includes EC/ECB/IMF'scomm<strong>en</strong>ts, was approved by ETAD's Board.The final action plan, that includes EC/ECB/IMF'scomm<strong>en</strong>ts, was approved by ETAD's Board.2About 2.000 non-operational assets out of 16.000properties that were id<strong>en</strong>tified were brought underthe managem<strong>en</strong>t of ETAD. The remaining 14.000operational real estate assets consist of 2.500archaeological areas/sites, 4.000 of traininfrastructure (GAIOSE), 1.800 offices of socialwelfare, 1.000 of def<strong>en</strong>ce and security services(army sites & police stations), 2.000 of MoH(hospitals) and 2.500 of Ministry of Education(Schools, Universities).Relevant progress report was delivered toEC/ECB/IMF at <strong>en</strong>d-June which did not have acomplete directory with all Ministries' propertieswhich are barely or not at all exploitable so as to betransferred to ETAD for exploitation.A list was submitted to EC/ECB/IMF in November,with the assets per ministry that had be<strong>en</strong> id<strong>en</strong>tifieduntil th<strong>en</strong>.A list was submitted to EC/ECB/IMF in November,with the assets per ministry that had be<strong>en</strong> id<strong>en</strong>tifieduntil th<strong>en</strong>.Observed.Observed.Observed.N/AObserved.Observed.MoU2.1.7.ivMoU2.1.8MoU2.1.9MoU2.1.10MoU2.1.11MoU2.1.12The Authorities will prepare a final progress report withthe number of properties transferred to ETAD.The Authorities will <strong>en</strong>sure that there will be no transfer orwithholding of any real estate assets, without priorconsultation and agreem<strong>en</strong>t with the HRADF and theEC/IMF/ECB, to <strong>en</strong>tities other than the HRADF, includingto municipalities and the rec<strong>en</strong>tly established p<strong>en</strong>sion fundSPV or other dedicated legal <strong>en</strong>tities, or until such time asthe assets necessary to supply the privatisation plan havebe<strong>en</strong> secured.The HRADF, drawing in particular from a report to beprepared by the ESM, will assess the possibility of raisingadditional rev<strong>en</strong>ues, or bringing forward future receipts,from the private sector, with a focus on internationalinvestors, by means of securitisation of assets, through theexploitation of assets not yet included in its privatisationplan and specified in paragraph 2.1.9.The HRADF will continue to be tasked with selling assetsas quickly and effectively as possible. In particular, therewill be no further political review once an asset has be<strong>en</strong>transferred to the HRADF.The HRADF will publish quarterly reports on its steps tofacilitate privatisations, financial accounts, including aprofit and loss statem<strong>en</strong>t, a cash flow statem<strong>en</strong>t, and abalance sheet, no later than 60 days after the conclusion ofevery cal<strong>en</strong>dar quarter.Securing privatisation receipts which, cumulatively sinceJanuary 2011, should be at least EUR 1.6 billion by <strong>en</strong>d-2012, EUR 3.1 billion by <strong>en</strong>d-2013, EUR 6.5 billion by<strong>en</strong>d-2014, EUR 7.7 billion by <strong>en</strong>d-2015, EUR 11.1 billionby <strong>en</strong>d-2016.2.2 Tax policy reformMoU2.2.aMEFP(6)The Gonernm<strong>en</strong>t will adopt legislation to introduce a newIncome Tax Code that will simplify the existing law,increase its transpar<strong>en</strong>cy, and remove ambiguities, whilstallowing easier administration, <strong>en</strong>couraging taxcompliance, and <strong>en</strong>suring more robust rev<strong>en</strong>ue through thecycle. The new income tax code will reduce filingrequirem<strong>en</strong>ts for pay-as-you-earn taxpayers and those whoreceive investm<strong>en</strong>t income, consolidate cross-bordermerger and reorganization provisions, and introduce antiavoidanceprovisions to combat international taxavoidance.January 2014 Final report was submitted on January 23rd, 2014 Observed.ContinuousContinuousContinuousQuarterlyContinuousPrior todisbursem<strong>en</strong>tOngoing procedure.Ongoing procedure.Ongoing procedure.Q3 2013 report was published in December 2013.Report for Q4/2013 was published on 12-3-2014.It is included in art. 1-72 of the Omnibus bill votedon 17/7/2013 (GG 167/A/23-7-13). A provision wasalso included (art. 46) exempting HRADF fromincome tax.Observed.Ongoing.Observed.Ongoing.Observed.Ongoing.Observed.Ongoing.Observed.80