ocp192_en

ocp192_en

ocp192_en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

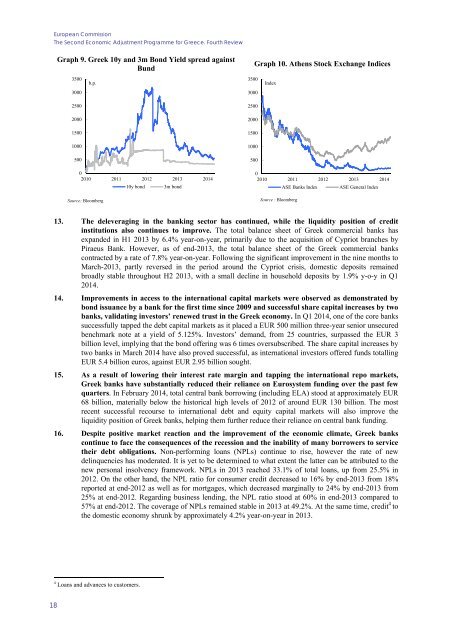

European CommissionThe Second Economic Adjustm<strong>en</strong>t Programme for Greece. Fourth ReviewGraph 9. Greek 10y and 3m Bond Yield spread againstBund350030002500200015001000500b.p.02010 2011 2012 2013 2014Source: Bloomberg10y bond3m bondGraph 10. Ath<strong>en</strong>s Stock Exchange Indices3500Index3000250020001500100050002010 2011 2012 2013 2014ASE Banks Index ASE G<strong>en</strong>eral IndexSource : Bloomberg13. The deleveraging in the banking sector has continued, while the liquidity position of creditinstitutions also continues to improve. The total balance sheet of Greek commercial banks hasexpanded in H1 2013 by 6.4% year-on-year, primarily due to the acquisition of Cypriot branches byPiraeus Bank. However, as of <strong>en</strong>d-2013, the total balance sheet of the Greek commercial bankscontracted by a rate of 7.8% year-on-year. Following the significant improvem<strong>en</strong>t in the nine months toMarch-2013, partly reversed in the period around the Cypriot crisis, domestic deposits remainedbroadly stable throughout H2 2013, with a small decline in household deposits by 1.9% y-o-y in Q12014.14. Improvem<strong>en</strong>ts in access to the international capital markets were observed as demonstrated bybond issuance by a bank for the first time since 2009 and successful share capital increases by twobanks, validating investors’ r<strong>en</strong>ewed trust in the Greek economy. In Q1 2014, one of the core bankssuccessfully tapped the debt capital markets as it placed a EUR 500 million three-year s<strong>en</strong>ior unsecuredb<strong>en</strong>chmark note at a yield of 5.125%. Investors’ demand, from 25 countries, surpassed the EUR 3billion level, implying that the bond offering was 6 times oversubscribed. The share capital increases bytwo banks in March 2014 have also proved successful, as international investors offered funds totallingEUR 5.4 billion euros, against EUR 2.95 billion sought.15. As a result of lowering their interest rate margin and tapping the international repo markets,Greek banks have substantially reduced their reliance on Eurosystem funding over the past fewquarters. In February 2014, total c<strong>en</strong>tral bank borrowing (including ELA) stood at approximately EUR68 billion, materially below the historical high levels of 2012 of around EUR 130 billion. The mostrec<strong>en</strong>t successful recourse to international debt and equity capital markets will also improve theliquidity position of Greek banks, helping them further reduce their reliance on c<strong>en</strong>tral bank funding.16. Despite positive market reaction and the improvem<strong>en</strong>t of the economic climate, Greek bankscontinue to face the consequ<strong>en</strong>ces of the recession and the inability of many borrowers to servicetheir debt obligations. Non-performing loans (NPLs) continue to rise, however the rate of newdelinqu<strong>en</strong>cies has moderated. It is yet to be determined to what ext<strong>en</strong>t the latter can be attributed to th<strong>en</strong>ew personal insolv<strong>en</strong>cy framework. NPLs in 2013 reached 33.1% of total loans, up from 25.5% in2012. On the other hand, the NPL ratio for consumer credit decreased to 16% by <strong>en</strong>d-2013 from 18%reported at <strong>en</strong>d-2012 as well as for mortgages, which decreased marginally to 24% by <strong>en</strong>d-2013 from25% at <strong>en</strong>d-2012. Regarding business l<strong>en</strong>ding, the NPL ratio stood at 60% in <strong>en</strong>d-2013 compared to57% at <strong>en</strong>d-2012. The coverage of NPLs remained stable in 2013 at 49.2%. At the same time, credit 4 tothe domestic economy shrunk by approximately 4.2% year-on-year in 2013.4 Loans and advances to customers.18