ocp192_en

ocp192_en

ocp192_en

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

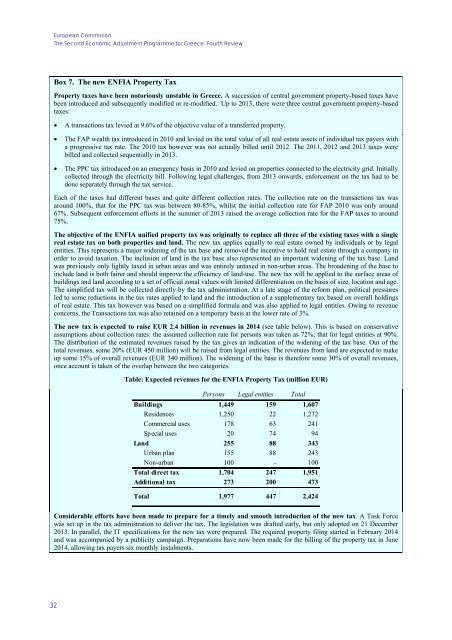

European CommissionThe Second Economic Adjustm<strong>en</strong>t Programme for Greece. Fourth ReviewBox 7. The new ENFIA Property TaxProperty taxes have be<strong>en</strong> notoriously unstable in Greece. A succession of c<strong>en</strong>tral governm<strong>en</strong>t property-based taxes havebe<strong>en</strong> introduced and subsequ<strong>en</strong>tly modified or re-modified. Up to 2013, there were three c<strong>en</strong>tral governm<strong>en</strong>t property-basedtaxes:• A transactions tax levied at 9.6% of the objective value of a transferred property.• The FAP wealth tax introduced in 2010 and levied on the total value of all real estate assets of individual tax payers witha progressive tax rate. The 2010 tax however was not actually billed until 2012. The 2011, 2012 and 2013 taxes werebilled and collected sequ<strong>en</strong>tially in 2013.• The PPC tax introduced on an emerg<strong>en</strong>cy basis in 2010 and levied on properties connected to the electricity grid. Initiallycollected through the electricity bill. Following legal chall<strong>en</strong>ges, from 2013 onwards, <strong>en</strong>forcem<strong>en</strong>t on the tax had to bedone separately through the tax service.Each of the taxes had differ<strong>en</strong>t bases and quite differ<strong>en</strong>t collection rates. The collection rate on the transactions tax wasaround 100%, that for the PPC tax was betwe<strong>en</strong> 80-85%, whilst the initial collection rate for FAP 2010 was only around67%. Subsequ<strong>en</strong>t <strong>en</strong>forcem<strong>en</strong>t efforts in the summer of 2013 raised the average collection rate for the FAP taxes to around75%.The objective of the ENFIA unified property tax was originally to replace all three of the existing taxes with a singlereal estate tax on both properties and land. The new tax applies equally to real estate owned by individuals or by legal<strong>en</strong>tities. This repres<strong>en</strong>ts a major wid<strong>en</strong>ing of the tax base and removed the inc<strong>en</strong>tive to hold real estate through a company inorder to avoid taxation. The inclusion of land in the tax base also repres<strong>en</strong>ted an important wid<strong>en</strong>ing of the tax base. Landwas previously only lightly taxed in urban areas and was <strong>en</strong>tirely untaxed in non-urban areas. The broad<strong>en</strong>ing of the base toinclude land is both fairer and should improve the effici<strong>en</strong>cy of land-use. The new tax will be applied to the surface areas ofbuildings and land according to a set of official zonal values with limited differ<strong>en</strong>tiation on the basis of size, location and age.The simplified tax will be collected directly by the tax administration. At a late stage of the reform plan, political pressuresled to some reductions in the tax rates applied to land and the introduction of a supplem<strong>en</strong>tary tax based on overall holdingsof real estate. This tax however was based on a simplified formula and was also applied to legal <strong>en</strong>tities. Owing to rev<strong>en</strong>ueconcerns, the Transactions tax was also retained on a temporary basis at the lower rate of 3%.The new tax is expected to raise EUR 2.4 billion in rev<strong>en</strong>ues in 2014 (see table below). This is based on conservativeassumptions about collection rates: the assumed collection rate for persons was tak<strong>en</strong> as 72%; that for legal <strong>en</strong>tities at 90%.The distribution of the estimated rev<strong>en</strong>ues raised by the tax gives an indication of the wid<strong>en</strong>ing of the tax base. Out of thetotal rev<strong>en</strong>ues, some 20% (EUR 450 million) will be raised from legal <strong>en</strong>tities. The rev<strong>en</strong>ues from land are expected to makeup some 15% of overall rev<strong>en</strong>ues (EUR 340 million). The wid<strong>en</strong>ing of the base is therefore some 30% of overall rev<strong>en</strong>ues,once account is tak<strong>en</strong> of the overlap betwe<strong>en</strong> the two categories.Table: Expected rev<strong>en</strong>ues for the ENFIA Property Tax (million EUR)Persons Legal <strong>en</strong>tities TotalBuildings 1,449 159 1,607Resid<strong>en</strong>ces 1,250 22 1,272Commercial uses 178 63 241Special uses 20 74 94Land 255 88 343Urban plan 155 88 243Non-urban 100 - 100Total direct tax 1,704 247 1,951Additional tax 273 200 473Total 1,977 447 2,424Considerable efforts have be<strong>en</strong> made to prepare for a timely and smooth introduction of the new tax. A Task Forcewas set up in the tax administration to deliver the tax. The legislation was drafted early, but only adopted on 21 December2013. In parallel, the IT specifications for the new tax were prepared. The required property filing started in February 2014and was accompanied by a publicity campaign. Preparations have now be<strong>en</strong> made for the billing of the property tax in June2014, allowing tax payers six monthly instalm<strong>en</strong>ts.32