ocp192_en

ocp192_en

ocp192_en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

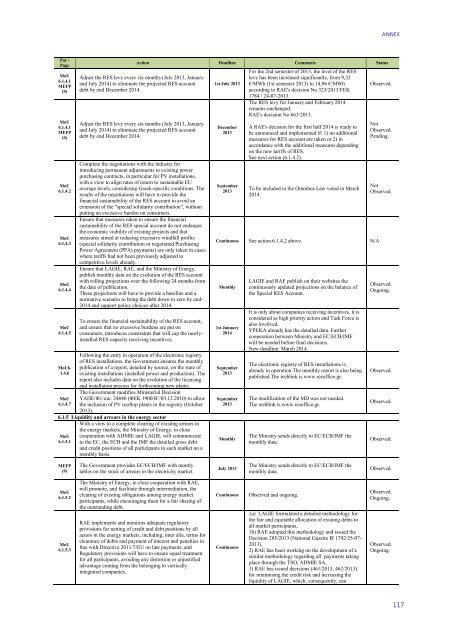

ANNEXΡar /ΡageMoU6.1.4.1MEFP(9)MoU6.1.4.1MEFP(9)MoU6.1.4.2MoU6.1.4.3MoU6.1.4.4MoU6.1.4.5MoU6.1.4.6MoU6.1.4.7Action Deadline Comm<strong>en</strong>ts StatusAdjust the RES levy every six months (July 2013, Januaryand July 2014) to eliminate the projected RES accountdebt by <strong>en</strong>d December 2014.Adjust the RES levy every six months (July 2013, Januaryand July 2014) to eliminate the projected RES accountdebt by <strong>en</strong>d December 2014.Complete the negotiations with the industry forintroducing perman<strong>en</strong>t adjustm<strong>en</strong>ts to existing powerpurchasing contracts, in particular for PV installations,with a view to align rates of return to sustainable EUaverage levels, considering Greek-specific conditions. Theresults of the negotiations will have to provide thefinancial sustainability of the RES account to avoid anext<strong>en</strong>sion of the “special solidarity contribution”, withoutputting an excessive burd<strong>en</strong> on consumers.Ensure that measures tak<strong>en</strong> to <strong>en</strong>sure the financialsustainability of the RES special account do not <strong>en</strong>dangerthe economic viability of existing projects and thatmeasures aimed at reducing excessive windfall profits(special solidarity contribution or negotiated PurchasingPower Agreem<strong>en</strong>t (PPA) paym<strong>en</strong>ts) are only tak<strong>en</strong> in caseswhere tariffs had not be<strong>en</strong> previously adjusted tocompetitive levels already.Ensure that LAGIE, RAE, and the Ministry of Energy,publish monthly data on the evolution of the RES accountwith rolling projections over the following 24 months fromthe date of publication.These projections will have to provide a baseline and anormative sc<strong>en</strong>ario to bring the debt down to zero by <strong>en</strong>d-2014 and support policy choices after 2014.To <strong>en</strong>sure the financial sustainability of the RES account,and <strong>en</strong>sure that no excessive burd<strong>en</strong>s are put onconsumers, introduces constraints that will cap the newlyinstalledRES capacity receiving inc<strong>en</strong>tives.Following the <strong>en</strong>try in operation of the electronic registryof RES installations, the Governm<strong>en</strong>t <strong>en</strong>sures the monthlypublication of a report, detailed by source, on the state ofexisting installations (installed power and production). Thereport also includes data on the evolution of the lic<strong>en</strong>singand installation process for forthcoming new plants.The Governm<strong>en</strong>t modifies Ministerial DecisionΥΑΠΕ/Φ1/οικ. 24840 (ΦΕΚ 1900/Β’/03.12.2010) to allowthe inclusion of PV rooftop plants in the registry (October2013).6.1.5 Liquidity and arrears in the <strong>en</strong>ergy sectorWith a view to a complete clearing of existing arrears inthe <strong>en</strong>ergy markets, the Ministry of Energy, in closeMoU cooperation with ADMIE and LAGIE, will communicate6.1.5.1 to the EC, the ECB and the IMF the detailed gross debtand credit positions of all participants in such market on amonthly basis.1st July 2013December2013September2013For the 2nd semester of 2013, the level of the RESlevy has be<strong>en</strong> increased significantly, from 9,32€/MWh (1st semester 2013) to 14,96 €/MWhaccording to RAE's decision No 323/2013/FEK1784 / 24-07-2013.Τhe RES levy for January and February 2014remains unchanged.RAE's decision No 663/2013.Α RAE's decision for the first half 2014 is ready tobe announced and implem<strong>en</strong>ted if: 1) no additionalmeasures for RES account are tak<strong>en</strong> or 2) inaccordance with the additional measures dep<strong>en</strong>dingon the new tariffs of RES.See next action (6.1.4.2).To be included in the Omnibus Law voted in March2014.Continuous See action 6.1.4.2 above. N/AMonthly1st January2014September2013September2013MonthlyLAGIE and RAE publish on their websites thecontinuously updated projections on the balance ofthe Special RES Account.It is only about companies receiving inc<strong>en</strong>tives, it isconsidered as high priority action and Task Force isalso involved.YPEKA already has the detailed data. Furthercooperation betwe<strong>en</strong> Ministry and EC/ECB/IMFwill be needed before final decisions.New deadline: March 2014.The electronic registry of RES installations isalready in operation.The monthly report is also beingpublished.The weblink is www.resoffice.gr.The modification of the MD was not needed.The weblink is www.resoffice.gr.The Ministry s<strong>en</strong>ds directly to EC/ECB/IMF themonthly data.Observed.NotObserved.P<strong>en</strong>ding.NotObserved.Observed.Ongoing.Observed.Observed.Observed.MEFP(9)The Governm<strong>en</strong>t provides EC/ECB/IMF with montlytables on the stock of arrears in the electricity market.July 2013The Ministry s<strong>en</strong>ds directly to EC/ECB/IMF themonthly data.Observed.MoU6.1.5.2MoU6.1.5.3The Ministry of Energy, in close cooperation with RAE,will promote, and facilitate through intermediation, theclearing of existing obligations among <strong>en</strong>ergy marketparticipants, while <strong>en</strong>couraging them for a fair sharing ofthe outstanding debt.RAE implem<strong>en</strong>ts and monitors adequate regulatoryprovisions for netting of credit and debt positions by allactors in the <strong>en</strong>ergy markets, including, inter alia, terms forclearance of debts and paym<strong>en</strong>t of interest and p<strong>en</strong>alties inline with Directive 2011/7/EU on late paym<strong>en</strong>ts, andRegulatory provisions will have to <strong>en</strong>sure equal treatm<strong>en</strong>tfor all participants, avoiding any distortion or unjustifiedadvantage coming from the belonging to verticallyintegrated companies.ContinuousContinuousObserved and ongoing.1a) LAGIE formulated a detailed methodology forthe fair and equitable allocation of existing debts toall market participants,1b) RAE adopted this methodology and issued theDecision 285/2013 (National Gazette Β' 1792/25-07-2013),2) RAE has be<strong>en</strong> working on the developm<strong>en</strong>t of asimilar methodology regarding all paym<strong>en</strong>ts takingplace through the TSO, ADMIE SA,3) RAE has issued decisions (461/2013, 462/2013)for minimising the credit risk and increasing theliquidity of LAGIE, which, consequ<strong>en</strong>tly, canObserved.Ongoing.Observed.Ongoing.117