ocp192_en

ocp192_en

ocp192_en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

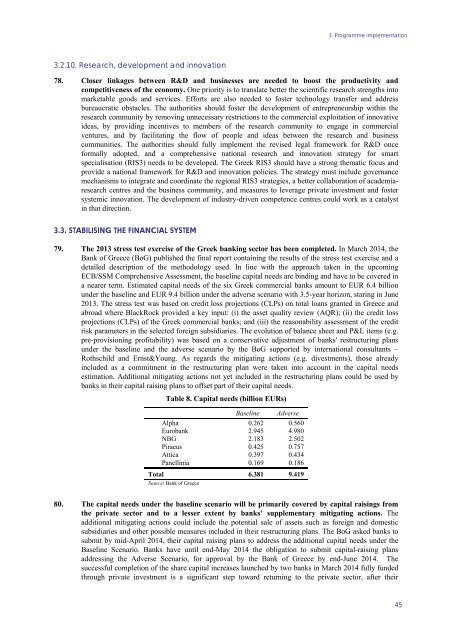

3. Programme implem<strong>en</strong>tation3.2.10. Research, developm<strong>en</strong>t and innovation78. Closer linkages betwe<strong>en</strong> R&D and businesses are needed to boost the productivity andcompetitiv<strong>en</strong>ess of the economy. One priority is to translate better the sci<strong>en</strong>tific research str<strong>en</strong>gths intomarketable goods and services. Efforts are also needed to foster technology transfer and addressbureaucratic obstacles. The authorities should foster the developm<strong>en</strong>t of <strong>en</strong>trepr<strong>en</strong>eurship within theresearch community by removing unnecessary restrictions to the commercial exploitation of innovativeideas, by providing inc<strong>en</strong>tives to members of the research community to <strong>en</strong>gage in commercialv<strong>en</strong>tures, and by facilitating the flow of people and ideas betwe<strong>en</strong> the research and businesscommunities. The authorities should fully implem<strong>en</strong>t the revised legal framework for R&D onceformally adopted, and a compreh<strong>en</strong>sive national research and innovation strategy for smartspecialisation (RIS3) needs to be developed. The Greek RIS3 should have a strong thematic focus andprovide a national framework for R&D and innovation policies. The strategy must include governancemechanisms to integrate and coordinate the regional RIS3 strategies, a better collaboration of academiaresearchc<strong>en</strong>tres and the business community, and measures to leverage private investm<strong>en</strong>t and fostersystemic innovation. The developm<strong>en</strong>t of industry-driv<strong>en</strong> compet<strong>en</strong>ce c<strong>en</strong>tres could work as a catalystin that direction.3.3. STABILISING THE FINANCIAL SYSTEM79. The 2013 stress test exercise of the Greek banking sector has be<strong>en</strong> completed. In March 2014, theBank of Greece (BoG) published the final report containing the results of the stress test exercise and adetailed description of the methodology used. In line with the approach tak<strong>en</strong> in the upcomingECB/SSM Compreh<strong>en</strong>sive Assessm<strong>en</strong>t, the baseline capital needs are binding and have to be covered ina nearer term. Estimated capital needs of the six Greek commercial banks amount to EUR 6.4 billionunder the baseline and EUR 9.4 billion under the adverse sc<strong>en</strong>ario with 3.5-year horizon, staring in June2013. The stress test was based on credit loss projections (CLPs) on total loans granted in Greece andabroad where BlackRock provided a key input: (i) the asset quality review (AQR); (ii) the credit lossprojections (CLPs) of the Greek commercial banks; and (iii) the reasonability assessm<strong>en</strong>t of the creditrisk parameters in the selected foreign subsidiaries. The evolution of balance sheet and P&L items (e.g.pre-provisioning profitability) was based on a conservative adjustm<strong>en</strong>t of banks' restructuring plansunder the baseline and the adverse sc<strong>en</strong>ario by the BoG supported by international consultants –Rothschild and Ernst&Young. As regards the mitigating actions (e.g. divestm<strong>en</strong>ts), those alreadyincluded as a commitm<strong>en</strong>t in the restructuring plan were tak<strong>en</strong> into account in the capital needsestimation. Additional mitigating actions not yet included in the restructuring plans could be used bybanks in their capital raising plans to offset part of their capital needs.Table 8. Capital needs (billion EURs)Baseline AdverseAlpha 0.262 0.560Eurobank 2.945 4.980NBG 2.183 2.502Piraeus 0.425 0.757Attica 0.397 0.434Panellinia 0.169 0.186Total 6.381 9.419Source: Bank of Greece80. The capital needs under the baseline sc<strong>en</strong>ario will be primarily covered by capital raisings fromthe private sector and to a lesser ext<strong>en</strong>t by banks’ supplem<strong>en</strong>tary mitigating actions. Theadditional mitigating actions could include the pot<strong>en</strong>tial sale of assets such as foreign and domesticsubsidiaries and other possible measures included in their restructuring plans. The BoG asked banks tosubmit by mid-April 2014, their capital raising plans to address the additional capital needs under theBaseline Sc<strong>en</strong>ario. Banks have until <strong>en</strong>d-May 2014 the obligation to submit capital-raising plansaddressing the Adverse Sc<strong>en</strong>ario, for approval by the Bank of Greece by <strong>en</strong>d-June 2014. Thesuccessful completion of the share capital increases launched by two banks in March 2014 fully fundedthrough private investm<strong>en</strong>t is a significant step toward returning to the private sector, after their45