ocp192_en

ocp192_en

ocp192_en

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

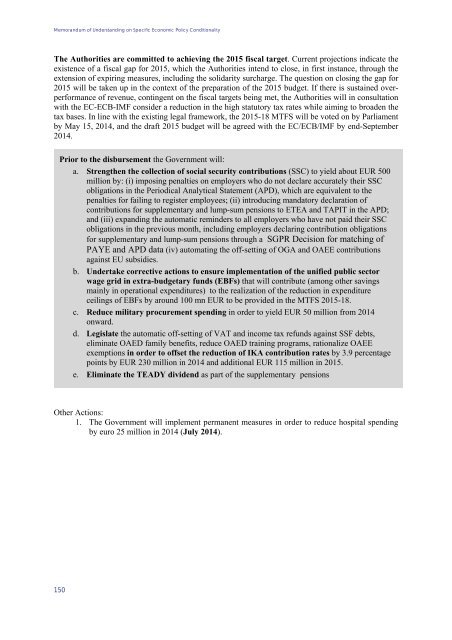

Memorandum of Understanding on Specific Economic Policy ConditionalityThe Authorities are committed to achieving the 2015 fiscal target. Curr<strong>en</strong>t projections indicate theexist<strong>en</strong>ce of a fiscal gap for 2015, which the Authorities int<strong>en</strong>d to close, in first instance, through theext<strong>en</strong>sion of expiring measures, including the solidarity surcharge. The question on closing the gap for2015 will be tak<strong>en</strong> up in the context of the preparation of the 2015 budget. If there is sustained overperformanceof rev<strong>en</strong>ue, conting<strong>en</strong>t on the fiscal targets being met, the Authorities will in consultationwith the EC-ECB-IMF consider a reduction in the high statutory tax rates while aiming to broad<strong>en</strong> thetax bases. In line with the existing legal framework, the 2015-18 MTFS will be voted on by Parliam<strong>en</strong>tby May 15, 2014, and the draft 2015 budget will be agreed with the EC/ECB/IMF by <strong>en</strong>d-September2014.Prior to the disbursem<strong>en</strong>t the Governm<strong>en</strong>t will:a. Str<strong>en</strong>gth<strong>en</strong> the collection of social security contributions (SSC) to yield about EUR 500million by: (i) imposing p<strong>en</strong>alties on employers who do not declare accurately their SSCobligations in the Periodical Analytical Statem<strong>en</strong>t (APD), which are equival<strong>en</strong>t to thep<strong>en</strong>alties for failing to register employees; (ii) introducing mandatory declaration ofcontributions for supplem<strong>en</strong>tary and lump-sum p<strong>en</strong>sions to ETEA and TAPIT in the APD;and (iii) expanding the automatic reminders to all employers who have not paid their SSCobligations in the previous month, including employers declaring contribution obligationsfor supplem<strong>en</strong>tary and lump-sum p<strong>en</strong>sions through a SGPR Decision for matching ofPAYE and APD data (iv) automating the off-setting of OGA and OAEE contributionsagainst EU subsidies.b. Undertake corrective actions to <strong>en</strong>sure implem<strong>en</strong>tation of the unified public sectorwage grid in extra-budgetary funds (EBFs) that will contribute (among other savingsmainly in operational exp<strong>en</strong>ditures) to the realization of the reduction in exp<strong>en</strong>ditureceilings of EBFs by around 100 mn EUR to be provided in the MTFS 2015-18.c. Reduce military procurem<strong>en</strong>t sp<strong>en</strong>ding in order to yield EUR 50 million from 2014onward.d. Legislate the automatic off-setting of VAT and income tax refunds against SSF debts,eliminate OAED family b<strong>en</strong>efits, reduce OAED training programs, rationalize OAEEexemptions in order to offset the reduction of IKA contribution rates by 3.9 perc<strong>en</strong>tagepoints by EUR 230 million in 2014 and additional EUR 115 million in 2015.e. Eliminate the TEADY divid<strong>en</strong>d as part of the supplem<strong>en</strong>tary p<strong>en</strong>sionsOther Actions:1. The Governm<strong>en</strong>t will implem<strong>en</strong>t perman<strong>en</strong>t measures in order to reduce hospital sp<strong>en</strong>dingby euro 25 million in 2014 (July 2014).150