ocp192_en

ocp192_en

ocp192_en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

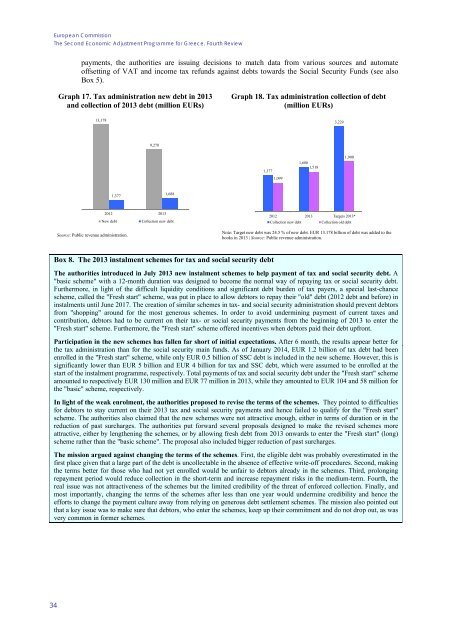

European CommissionThe Second Economic Adjustm<strong>en</strong>t Programme for Greece. Fourth Reviewpaym<strong>en</strong>ts, the authorities are issuing decisions to match data from various sources and automateoffsetting of VAT and income tax refunds against debts towards the Social Security Funds (see alsoBox 5).Graph 17. Tax administration new debt in 2013and collection of 2013 debt (million EURs)Graph 18. Tax administration collection of debt(million EURs)13,1783,2299,2781,3771,0991,6881,5181,9001,3771,6882012 2013New debtCollection new debtSource: Public rev<strong>en</strong>ue administration.2012 2013 Targets 2013*Collection new debt Collection old debtNote: Target new debt was 24.5 % of new debt. EUR 13.178 billion of debt was added to thebooks in 2013 | Source: Public rev<strong>en</strong>ue administration.Box 8. The 2013 instalm<strong>en</strong>t schemes for tax and social security debtThe authorities introduced in July 2013 new instalm<strong>en</strong>t schemes to help paym<strong>en</strong>t of tax and social security debt. A"basic scheme" with a 12-month duration was designed to become the normal way of repaying tax or social security debt.Furthermore, in light of the difficult liquidity conditions and significant debt burd<strong>en</strong> of tax payers, a special last-chancescheme, called the "Fresh start" scheme, was put in place to allow debtors to repay their "old" debt (2012 debt and before) ininstalm<strong>en</strong>ts until June 2017. The creation of similar schemes in tax- and social security administration should prev<strong>en</strong>t debtorsfrom "shopping" around for the most g<strong>en</strong>erous schemes. In order to avoid undermining paym<strong>en</strong>t of curr<strong>en</strong>t taxes andcontribution, debtors had to be curr<strong>en</strong>t on their tax- or social security paym<strong>en</strong>ts from the beginning of 2013 to <strong>en</strong>ter the"Fresh start" scheme. Furthermore, the "Fresh start" scheme offered inc<strong>en</strong>tives wh<strong>en</strong> debtors paid their debt upfront.Participation in the new schemes has fall<strong>en</strong> far short of initial expectations. After 6 month, the results appear better forthe tax administration than for the social security main funds. As of January 2014, EUR 1.2 billion of tax debt had be<strong>en</strong><strong>en</strong>rolled in the "Fresh start" scheme, while only EUR 0.5 billion of SSC debt is included in the new scheme. However, this issignificantly lower than EUR 5 billion and EUR 4 billion for tax and SSC debt, which were assumed to be <strong>en</strong>rolled at thestart of the instalm<strong>en</strong>t programme, respectively. Total paym<strong>en</strong>ts of tax and social security debt under the "Fresh start" schemeamounted to respectively EUR 130 million and EUR 77 million in 2013, while they amounted to EUR 104 and 58 million forthe "basic" scheme, respectively.In light of the weak <strong>en</strong>rolm<strong>en</strong>t, the authorities proposed to revise the terms of the schemes. They pointed to difficultiesfor debtors to stay curr<strong>en</strong>t on their 2013 tax and social security paym<strong>en</strong>ts and h<strong>en</strong>ce failed to qualify for the "Fresh start"scheme. The authorities also claimed that the new schemes were not attractive <strong>en</strong>ough, either in terms of duration or in thereduction of past surcharges. The authorities put forward several proposals designed to make the revised schemes moreattractive, either by l<strong>en</strong>gth<strong>en</strong>ing the schemes, or by allowing fresh debt from 2013 onwards to <strong>en</strong>ter the "Fresh start" (long)scheme rather than the "basic scheme". The proposal also included bigger reduction of past surcharges.The mission argued against changing the terms of the schemes. First, the eligible debt was probably overestimated in thefirst place giv<strong>en</strong> that a large part of the debt is uncollectable in the abs<strong>en</strong>ce of effective write-off procedures. Second, makingthe terms better for those who had not yet <strong>en</strong>rolled would be unfair to debtors already in the schemes. Third, prolongingrepaym<strong>en</strong>t period would reduce collection in the short-term and increase repaym<strong>en</strong>t risks in the medium-term. Fourth, thereal issue was not attractiv<strong>en</strong>ess of the schemes but the limited credibility of the threat of <strong>en</strong>forced collection. Finally, andmost importantly, changing the terms of the schemes after less than one year would undermine credibility and h<strong>en</strong>ce theefforts to change the paym<strong>en</strong>t culture away from relying on g<strong>en</strong>erous debt settlem<strong>en</strong>t schemes. The mission also pointed outthat a key issue was to make sure that debtors, who <strong>en</strong>ter the schemes, keep up their commitm<strong>en</strong>t and do not drop out, as wasvery common in former schemes.34