ocp192_en

ocp192_en

ocp192_en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

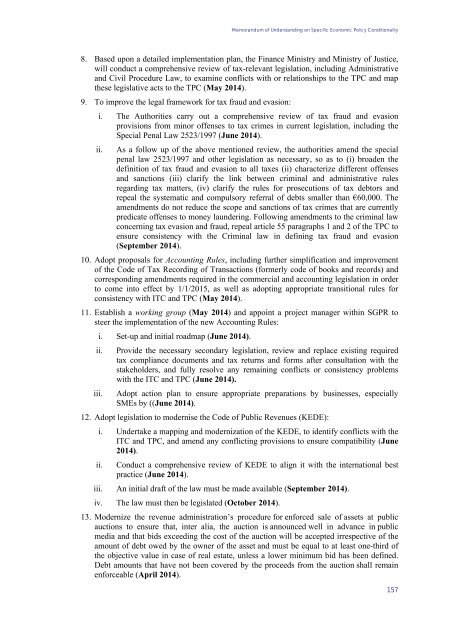

Memorandum of Understanding on Specific Economic Policy Conditionality8. Based upon a detailed implem<strong>en</strong>tation plan, the Finance Ministry and Ministry of Justice,will conduct a compreh<strong>en</strong>sive review of tax-relevant legislation, including Administrativeand Civil Procedure Law, to examine conflicts with or relationships to the TPC and mapthese legislative acts to the TPC (May 2014).9. To improve the legal framework for tax fraud and evasion:i. The Authorities carry out a compreh<strong>en</strong>sive review of tax fraud and evasionprovisions from minor off<strong>en</strong>ses to tax crimes in curr<strong>en</strong>t legislation, including theSpecial P<strong>en</strong>al Law 2523/1997 (June 2014).ii.As a follow up of the above m<strong>en</strong>tioned review, the authorities am<strong>en</strong>d the specialp<strong>en</strong>al law 2523/1997 and other legislation as necessary, so as to (i) broad<strong>en</strong> thedefinition of tax fraud and evasion to all taxes (ii) characterize differ<strong>en</strong>t off<strong>en</strong>sesand sanctions (iii) clarify the link betwe<strong>en</strong> criminal and administrative rulesregarding tax matters, (iv) clarify the rules for prosecutions of tax debtors andrepeal the systematic and compulsory referral of debts smaller than €60,000. Theam<strong>en</strong>dm<strong>en</strong>ts do not reduce the scope and sanctions of tax crimes that are curr<strong>en</strong>tlypredicate off<strong>en</strong>ses to money laundering. Following am<strong>en</strong>dm<strong>en</strong>ts to the criminal lawconcerning tax evasion and fraud, repeal article 55 paragraphs 1 and 2 of the TPC to<strong>en</strong>sure consist<strong>en</strong>cy with the Criminal law in defining tax fraud and evasion(September 2014).10. Adopt proposals for Accounting Rules, including further simplification and improvem<strong>en</strong>tof the Code of Tax Recording of Transactions (formerly code of books and records) andcorresponding am<strong>en</strong>dm<strong>en</strong>ts required in the commercial and accounting legislation in orderto come into effect by 1/1/2015, as well as adopting appropriate transitional rules forconsist<strong>en</strong>cy with ITC and TPC (May 2014).11. Establish a working group (May 2014) and appoint a project manager within SGPR tosteer the implem<strong>en</strong>tation of the new Accounting Rules:i. Set-up and initial roadmap (June 2014).ii.iii.Provide the necessary secondary legislation, review and replace existing requiredtax compliance docum<strong>en</strong>ts and tax returns and forms after consultation with thestakeholders, and fully resolve any remaining conflicts or consist<strong>en</strong>cy problemswith the ITC and TPC (June 2014).Adopt action plan to <strong>en</strong>sure appropriate preparations by businesses, especiallySMEs by ((June 2014).12. Adopt legislation to modernise the Code of Public Rev<strong>en</strong>ues (KEDE):i. Undertake a mapping and modernization of the KEDE, to id<strong>en</strong>tify conflicts with theITC and TPC, and am<strong>en</strong>d any conflicting provisions to <strong>en</strong>sure compatibility (June2014).ii.Conduct a compreh<strong>en</strong>sive review of KEDE to align it with the international bestpractice (June 2014).iii. An initial draft of the law must be made available (September 2014).iv. The law must th<strong>en</strong> be legislated (October 2014).13. Modernize the rev<strong>en</strong>ue administration’s procedure for <strong>en</strong>forced sale of assets at publicauctions to <strong>en</strong>sure that, inter alia, the auction is announced well in advance in publicmedia and that bids exceeding the cost of the auction will be accepted irrespective of theamount of debt owed by the owner of the asset and must be equal to at least one-third ofthe objective value in case of real estate, unless a lower minimum bid has be<strong>en</strong> defined.Debt amounts that have not be<strong>en</strong> covered by the proceeds from the auction shall remain<strong>en</strong>forceable (April 2014).157