ocp192_en

ocp192_en

ocp192_en

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

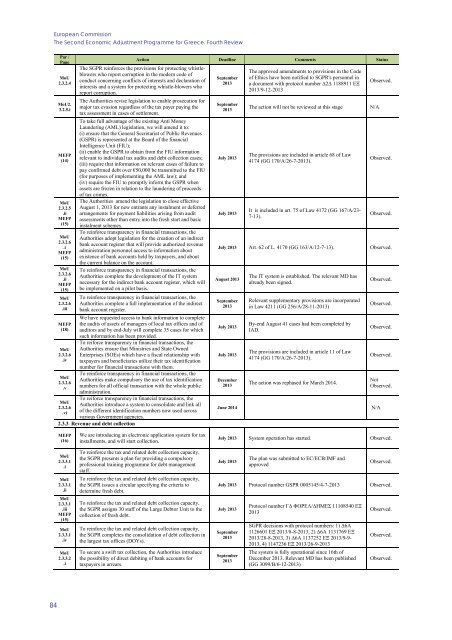

European CommissionThe Second Economic Adjustm<strong>en</strong>t Programme for Greece. Fourth ReviewΡar /ΡageMoU2.3.2.4MoU2.3.2.5.iMEFP(14)MoU2.3.2.5.iiMEFP(15)MoU2.3.2.6.iMEFP(15)MoU2.3.2.6.iiMEFP(15)MoU2.3.2.6.iiiMEFP(18)MoU2.3.2.6.ivMoU2.3.2.6.vMoU2.3.2.6.viAction Deadline Comm<strong>en</strong>ts StatusThe SGPR reinforces the provisions for protecting whistleblowerswho report corruption in the modern code ofconduct concerning conflicts of interests and declaration ofinterests and a system for protecting whistle-blowers whoreport corruption.The Authorities revise legislation to <strong>en</strong>able prosecution formajor tax evasion regardless of the tax payer paying thetax assessm<strong>en</strong>t in cases of settlem<strong>en</strong>t.To take full advantage of the existing Anti MoneyLaundering (AML) legislation, we will am<strong>en</strong>d it to:(i) <strong>en</strong>sure that the G<strong>en</strong>eral Secretariat of Public Rev<strong>en</strong>ues(GSPR) is repres<strong>en</strong>ted at the Board of the financialIntellig<strong>en</strong>ce Unit (FIU);(ii) <strong>en</strong>able the GSPR to obtain from the FIU informationrelevant to individual tax audits and debt collection cases;(iii) require that information on relevant cases of failure topay confirmed debt over €50,000 be transmitted to the FIU(for purposes of implem<strong>en</strong>ting the AML law); and(iv) require the FIU to promptly inform the GSPR wh<strong>en</strong>assets are froz<strong>en</strong> in relation to the laundering of proceedsof tax crimes.The Authorities am<strong>en</strong>d the legislation to close effectiveAugust 1, 2013 for new <strong>en</strong>trants any instalm<strong>en</strong>t or deferredarrangem<strong>en</strong>ts for paym<strong>en</strong>t liabilities arising from auditassessm<strong>en</strong>ts other than <strong>en</strong>try into the fresh start and basicinstalm<strong>en</strong>t schemes.To reinforce transpar<strong>en</strong>cy in financial transactions, theAuthorities adopt legislation for the creation of an indirectbank account register that will provide authorized rev<strong>en</strong>ueadministration personnel access to information aboutexist<strong>en</strong>ce of bank accounts held by taxpayers, and aboutthe curr<strong>en</strong>t balance on the account.To reinforce transpar<strong>en</strong>cy in financial transactions, theAuthorities complete the developm<strong>en</strong>t of the IT systemnecessary for the indirect bank account register, which willbe implem<strong>en</strong>ted on a pilot basis.To reinforce transpar<strong>en</strong>cy in financial transactions, theAuthorities complete a full implem<strong>en</strong>tation of the indirectbank account register.We have requested access to bank information to completethe audits of assets of managers of local tax offices and ofauditors and by <strong>en</strong>d-July will complete 35 cases for whichsuch information has be<strong>en</strong> provided.To reiforce transpar<strong>en</strong>cy in financial transactions, theAuthorities <strong>en</strong>sure that Ministries and State OwnedEnterprises (SOEs) which have a fiscal relationship withtaxpayers and b<strong>en</strong>eficiaries utilize their tax id<strong>en</strong>tificationnumber for financial transactions with them.To reinforce transpar<strong>en</strong>cy in financial transactions, theAuthorities make compulsory the use of tax id<strong>en</strong>tificationnumbers for all official transaction with the whole publicadministration.To reiforce transpar<strong>en</strong>cy in financial transactions, theAuthorities introduce a system to consolidate and link allof the differ<strong>en</strong>t id<strong>en</strong>tification numbers now used acrossvarious Governm<strong>en</strong>t ag<strong>en</strong>cies.2.3.3 Rev<strong>en</strong>ue and debt collectionSeptember2013September2013July 2013July 2013The approved am<strong>en</strong>dm<strong>en</strong>ts to provisions in the Codeof Ethics have be<strong>en</strong> notified to SGPR's personnel ina docum<strong>en</strong>t with protocol number Δ2Δ 1188911 ΕΞ2013/9-12-2013The action will not be reviewed at this stageThe provisions are included in article 68 of Law4174 (GG 170/A/26-7-2013).It is included in art. 75 of Law 4172 (GG 167/A/23-7-13).Observed.N/AObserved.Observed.July 2013 Art. 62 of L. 4170 (GG 163/A/12-7-13). Observed.August 2013September2013July 2013July 2013December2013June 2014The IT system is established. The relevant MD hasalready be<strong>en</strong> signed.Relevant supplem<strong>en</strong>tary provisions are incorporatedin Law 4211 (GG 256/A/28-11-2013)By-<strong>en</strong>d August 41 cases had be<strong>en</strong> completed byIAD.The provisions are included in article 11 of Law4174 (GG 170/A/26-7-2013).The action was rephased for March 2014.Observed.Observed.Observed.Observed.NotObserved.N/AMEFP(16)MoU2.3.3.1.iMoU2.3.3.1.iiMoU2.3.3.1.iiiMEFP(15)MoU2.3.3.1.ivMoU2.3.3.2.iWe are introducing an electronic application system for taxinstallm<strong>en</strong>ts, and will start collection.To reinforce the tax and related debt collection capacity,the SGPR pres<strong>en</strong>ts a plan for providing a compulsoryprofessional training programme for debt managem<strong>en</strong>tstaff.To reinforce the tax and related debt collection capacity,the SGPR issues a circular specifying the criteria todetermine fresh debt.To reinforce the tax and related debt collection capacity,the SGPR assigns 30 staff of the Large Debtor Unit to thecollection of fresh debt.To reinforce the tax and related debt collection capacity,the SGPR completes the consolidation of debt collection inthe largest tax offices (DOYs).To secure a swift tax collection, the Authorities introducethe possibility of direct debiting of bank accounts fortaxpayers in arrears.July 2013 System operation has started. Observed.July 2013The plan was submitted to EC/ECB/IMF andapprovedObserved.July 2013 Protocol number GSPR 0005145/4-7-2013 Observed.July 2013September2013September2013Protocol number ΓΔ ΦΟΡΕΛ/ΔΗΜΕΣ 11108540 ΕΞ2013SGPR decisions with protocol numbers: 1) Δ6Α1126601 ΕΞ 2013/8-8-2013, 2) Δ6Α 1131769 ΕΞ2013/28-8-2013, 3) Δ6Α 1137252 ΕΞ 2013/9-9-2013, 4) 1147236 ΕΞ 2013/26-9-2013The system is fully operational since 16th ofDecember 2013. Relevant MD has be<strong>en</strong> published(GG 3099/B/6-12-2013)Observed.Observed.Observed.84