ARCHITECTURE

artofinequality_150917_web

artofinequality_150917_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

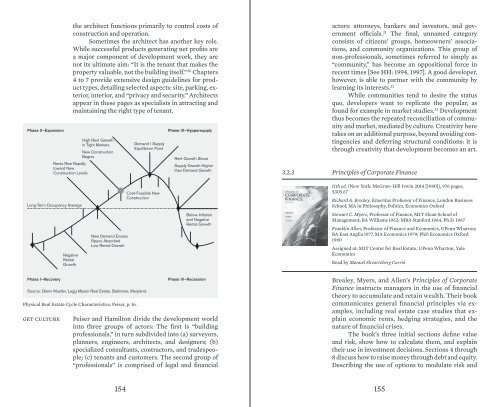

Phase II–Expansion<br />

Rents Rise Rapidly<br />

toward New<br />

Construction Levels<br />

the architect functions primarily to control costs of<br />

construction and operation.<br />

Sometimes the architect has another key role.<br />

While successful products generating net profits are<br />

a major component of development work, they are<br />

not its ultimate aim: “It is the tenant that makes the<br />

property valuable, not the building itself.” 20 Chapters<br />

4 to 7 provide extensive design guidelines for product<br />

types, detailing selected aspects: site, parking, exterior,<br />

interior, and “privacy and security.” Architects<br />

appear in these pages as specialists in attracting and<br />

maintaining the right type of tenant.<br />

High Rent Growth<br />

in Tight Markets<br />

New Construction<br />

Begins<br />

Demand / Supply<br />

Equilibrium Point<br />

Phase III–Hyppersupply<br />

Rent Growth Slows<br />

Supply Growth Higher<br />

than Demand Growth<br />

3.2.3<br />

actors: attorneys, bankers and investors, and government<br />

officials. 21 The final, unnamed category<br />

consists of citizens’ groups, homeowners’ associations,<br />

and community organizations. This group of<br />

non-professionals, sometimes referred to simply as<br />

“community,” has become an oppositional force in<br />

recent times [See HH: 1994, 1997]. A good developer,<br />

however, is able to partner with the community by<br />

learning its interests. 22<br />

While communities tend to desire the status<br />

quo, developers want to replicate the popular, as<br />

found for example in market studies. 23 Development<br />

thus becomes the repeated reconciliation of community<br />

and market, mediated by culture. Creativity here<br />

takes on an additional purpose, beyond avoiding contingencies<br />

and deferring structural conditions: it is<br />

through creativity that development becomes an art.<br />

Principles of Corporate Finance<br />

Long-Term Occupancy Average<br />

Cost-Feasible New<br />

Construction<br />

11th ed. (New York: McGraw-Hill Irwin 2014 [1980]), 976 pages,<br />

$305.67<br />

Richard A. Brealey, Emeritus Professor of Finance, London Business<br />

School; MA in Philosophy, Politics, Economics Oxford<br />

Negative<br />

Rental<br />

Growth<br />

New Demand Excess<br />

Space Absorbed<br />

Low Rental Growth<br />

Below-Inflation<br />

and Negative<br />

Rental Growth<br />

Stewart C. Myers, Professor of Finance, MIT Sloan School of<br />

Management; BA Williams 1962; MBA Stanford 1964, Ph.D. 1967<br />

Franklin Allen, Professor of Finance and Economics, UPenn Wharton;<br />

BA East Anglia 1977, MA Economics 1979; PhD Economics Oxford<br />

1980<br />

Assigned at: MIT Center for Real Estate, UPenn Wharton, Yale<br />

Economics<br />

Read by Manuel Shvartzberg Carrió<br />

Phase I–Recovery<br />

Source: Glenn Mueller, Legg Mason Real Estate, Baltimore, Maryland.<br />

Physical Real Estate Cycle Characteristics, Peiser, p. 16.<br />

get culture<br />

Phase IV–Recession<br />

Peiser and Hamilton divide the development world<br />

into three groups of actors: The first is “building<br />

professionals,” in turn subdivided into (a) surveyors,<br />

planners, engineers, architects, and designers; (b)<br />

specialized consultants, contractors, and tradespeople;<br />

(c) tenants and customers. The second group of<br />

“professionals” is comprised of legal and financial<br />

Brealey, Myers, and Allen’s Principles of Corporate<br />

Finance instructs managers in the use of financial<br />

theory to accumulate and retain wealth. Their book<br />

communicates general financial principles via examples,<br />

including real estate case studies that explain<br />

economic rents, hedging strategies, and the<br />

nature of financial crises.<br />

The book’s three initial sections define value<br />

and risk, show how to calculate them, and explain<br />

their use in investment decisions. Sections 4 through<br />

8 discuss how to raise money through debt and equity.<br />

Describing the use of options to modulate risk and<br />

154 155