ARCHITECTURE

artofinequality_150917_web

artofinequality_150917_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.2.5<br />

Real Estate Finance & Investments: Risks and<br />

Opportunities<br />

3rd ed. (Philadelphia, PA: Linneman Associates, 2011 [2003]),<br />

498 pages, $135.00<br />

Peter Linneman, principal, Linneman Associates, former founding<br />

chair, UPenn Wharton, Real Estate Development Department;<br />

BA Economics, Ashland University 1973, MA Economics 1976;<br />

PhD Economics University of Chicago 1977.<br />

Assigned at: Columbia Business School, UPenn Wharton<br />

Read by Susanne Schindler<br />

Peter Linneman’s Real Estate Finance & Investments,<br />

in teaching the reader how to become a real estate<br />

developer, emphasizes the importance of judgment.<br />

Though it introduces techniques like modeling; key<br />

metrics like discounted cash flow and net present<br />

value; and legal structures, like bankruptcy and real<br />

estate investment trusts, these in themselves are not<br />

sufficient for success. A great developer learns by<br />

experience.<br />

The book addresses readers as if they were<br />

students unfamiliar with basic financial concepts<br />

like value and rates of return. The first two chapters<br />

describe real estate’s particular risks and opportunities<br />

and outline a typology of real estate properties.<br />

Chapters 3 through 7 teach lease and market analysis.<br />

After describing how to appraise particular developments<br />

and real estate companies, the book<br />

takes us on a tour of debt and equity instruments<br />

in chapters 11 through 18. Going on to consider decision<br />

making and cycles, it concludes in chapter<br />

21 with a discussion of ethics. Appendices provide a<br />

primer on finance fundamentals, case studies, exams,<br />

and a guide to Argus financial software.<br />

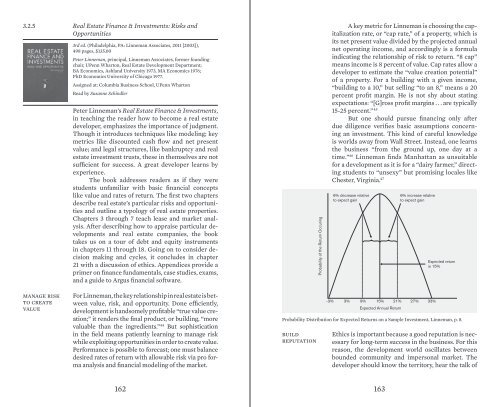

Probability of the Return Occuring<br />

A key metric for Linneman is choosing the capitalization<br />

rate, or “cap rate,” of a property, which is<br />

its net present value divided by the projected annual<br />

net operating income, and accordingly is a formula<br />

indicating the relationship of risk to return. “8 cap”<br />

means income is 8 percent of value. Cap rates allow a<br />

developer to estimate the “value creation potential”<br />

of a property. For a building with a given income,<br />

“building to a 10,” but selling “to an 8,” means a 20<br />

percent profit margin. He is not shy about stating<br />

expectations: “[G]ross profit margins . . . are typically<br />

15-25 percent.” 45<br />

But one should pursue financing only after<br />

due diligence verifies basic assumptions concerning<br />

an investment. This kind of careful knowledge<br />

is worlds away from Wall Street. Instead, one learns<br />

the business “from the ground up, one day at a<br />

time.” 46 Linneman finds Manhattan as unsuitable<br />

for a development as it is for a “dairy farmer,” directing<br />

students to “unsexy” but promising locales like<br />

Chester, Virginia. 47<br />

6% decrease relative<br />

to expect gain<br />

6% increase relative<br />

to expect gain<br />

Expected return<br />

is 15%<br />

manage risk<br />

to create<br />

value<br />

For Linneman, the key relationship in real estate is between<br />

value, risk, and opportunity. Done efficiently,<br />

development is handsomely profitable “true value creation;”<br />

it renders the final product, or building, “more<br />

valuable than the ingredients.” 44 But sophistication<br />

in the field means patiently learning to manage risk<br />

while exploiting opportunities in order to create value.<br />

Performance is possible to forecast; one must balance<br />

desired rates of return with allowable risk via pro forma<br />

analysis and financial modeling of the market.<br />

Probability Distribution for Expected Returns on a Sample Investment, Linneman, p. 8.<br />

build<br />

reputation<br />

-3% 3% 9% 15% 21% 27% 33%<br />

Expected Annual Return<br />

Ethics is important because a good reputation is necessary<br />

for long-term success in the business. For this<br />

reason, the development world oscillates between<br />

bounded community and impersonal market. The<br />

developer should know the territory, hear the talk of<br />

162 163