ARCHITECTURE

artofinequality_150917_web

artofinequality_150917_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

value<br />

shareholders<br />

exploit<br />

inefficiencies<br />

think of<br />

real estate<br />

as an asset<br />

value, the text goes on to explore the implications<br />

of contracts and global conditions for risk management.<br />

Sections 9 and 10 cover the diagnosis, planning,<br />

and restructuring of corporations. The typical<br />

chapter begins with an overview; features examples,<br />

articles from financial publications, and guidance on<br />

how to use Excel spreadsheets; and concludes with<br />

problem sets and brief case studies.<br />

This book upholds shareholder value as the key to<br />

corporate finance. Corporations serve as agents of<br />

the shareholder, who could be an individual, firm,<br />

or mutual fund. The task of the corporation is to<br />

maximize share values. 24 Value maximization is an<br />

ahistorical human drive, the expression of innate<br />

competitiveness. 25<br />

Competitive advantages ensure economic rents, or<br />

“profits that more than cover the cost of capital.” 26<br />

According to the efficient markets hypothesis, transparency<br />

and freedom from regulation will, in the<br />

long run, eliminate economic rents by encouraging<br />

competitive equilibrium. Given this dynamic, financial<br />

management works to increase value by maximizing<br />

more or less temporary competitive advantages<br />

using mathematical techniques. Tacit in this<br />

formulation, yet clear in the examples, is the fact that<br />

to the degree that it is scarce and unique, land also<br />

earns economic rents. Property in the form of land<br />

can bring opportunities for leveraging asymmetrical<br />

access (i.e. unavailable to non-owners). For example,<br />

in deciding whether to open a department store on a<br />

parcel of land, an investor is making “two bets—one<br />

on real estate prices and another on the firm’s ability<br />

to run a successful department store.” Depending on<br />

real estate projections, the owner may be better off<br />

either renting out the real estate or selling the land<br />

and renting it back for the store. 27<br />

In Brealey, Myers, and Allen’s text, real estate, while<br />

a tangible commodity linked to a plot of land, appears<br />

as one of many kinds of assets. It is thus described relationally:<br />

like gold and oil, it has extensive markets<br />

and is easy to price. Like banks and utilities, it has high<br />

abandonment value—used properties are easy to sell. 28<br />

distribute<br />

ownership<br />

and risk with<br />

securities<br />

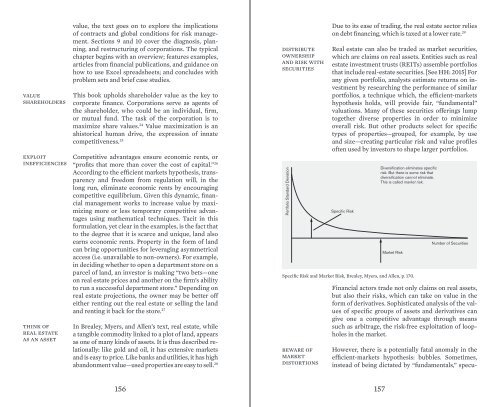

Portfolio Standard Deviation<br />

Due to its ease of trading, the real estate sector relies<br />

on debt financing, which is taxed at a lower rate. 29<br />

Real estate can also be traded as market securities,<br />

which are claims on real assets. Entities such as real<br />

estate investment trusts (REITs) assemble portfolios<br />

that include real-estate securities. [See HH: 2015] For<br />

any given portfolio, analysts estimate returns on investment<br />

by researching the performance of similar<br />

portfolios, a technique which, the efficient-markets<br />

hypothesis holds, will provide fair, “fundamental”<br />

valuations. Many of these securities offerings lump<br />

together diverse properties in order to minimize<br />

overall risk. But other products select for specific<br />

types of properties—grouped, for example, by use<br />

and size—creating particular risk and value profiles<br />

often used by investors to shape larger portfolios.<br />

Specific Risk and Market Risk, Brealey, Myers, and Allen, p. 170.<br />

beware of<br />

market<br />

distortions<br />

Specific Risk<br />

Diversification eliminates specific<br />

risk. But there is some risk that<br />

diversification cannot eliminate.<br />

This is called market risk.<br />

Market Risk<br />

Number of Securities<br />

Financial actors trade not only claims on real assets,<br />

but also their risks, which can take on value in the<br />

form of derivatives. Sophisticated analysis of the values<br />

of specific groups of assets and derivatives can<br />

give one a competitive advantage through means<br />

such as arbitrage, the risk-free exploitation of loopholes<br />

in the market.<br />

However, there is a potentially fatal anomaly in the<br />

efficient-markets hypothesis: bubbles. Sometimes,<br />

instead of being dictated by “fundamentals,” specu-<br />

156 157