TDC Group Annual Report 2011(6,4MB) - TDC Annual Report 2011

TDC Group Annual Report 2011(6,4MB) - TDC Annual Report 2011

TDC Group Annual Report 2011(6,4MB) - TDC Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Performance in <strong>2011</strong><br />

Revenue<br />

<strong>2011</strong> was characterised by pressure across most product<br />

lines, especially in the residential mobile market, where the<br />

price war continued. Compared with 2010, revenue declined<br />

by 1.2%.<br />

Landline telephony<br />

Despite the continuing migration from landline telephony to<br />

mobile only, Consumer managed to reduce its line loss<br />

through improved intake of, and migration to, HomeDuo<br />

and HomeTrio. Besides churn reduction, Consumer’s multiplay<br />

strategy opens up growth opportunities and offers<br />

scope for a unique brand position.<br />

The continued market size decline resulted in a revenue<br />

decrease of 14.7% compared with 2010.<br />

Mobility services<br />

The mobile market is saturated and the intense price<br />

competition continued in <strong>2011</strong>, which drove down the total<br />

market value within mobility services. Combined with the<br />

impact from MTR (both SMS and voice) and roaming<br />

regulation, this led to a 5.9% decrease in blended ARPU<br />

including IC, and a revenue decline of 3.7% compared with<br />

2010.<br />

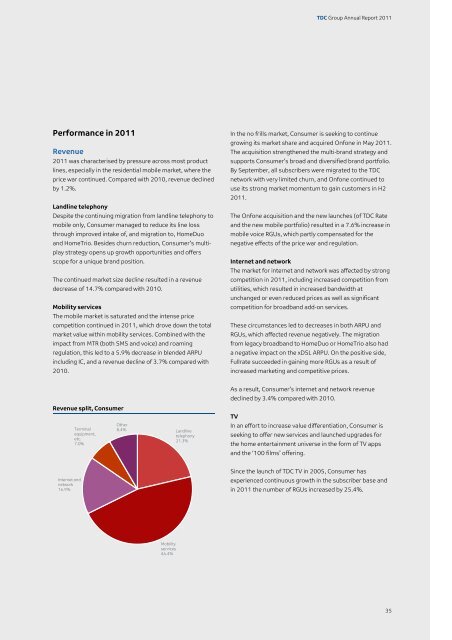

Revenue split, Consumer<br />

Internet and<br />

network<br />

16.9%<br />

Terminal<br />

equipment,<br />

etc.<br />

7.0%<br />

Other<br />

8.4%<br />

Mobility<br />

services<br />

46.4%<br />

Landline<br />

telephony<br />

21.3%<br />

<strong>TDC</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

In the no frills market, Consumer is seeking to continue<br />

growing its market share and acquired Onfone in May <strong>2011</strong>.<br />

The acquisition strengthened the multi-brand strategy and<br />

supports Consumer’s broad and diversified brand portfolio.<br />

By September, all subscribers were migrated to the <strong>TDC</strong><br />

network with very limited churn, and Onfone continued to<br />

use its strong market momentum to gain customers in H2<br />

<strong>2011</strong>.<br />

The Onfone acquisition and the new launches (of <strong>TDC</strong> Rate<br />

and the new mobile portfolio) resulted in a 7.6% increase in<br />

mobile voice RGUs, which partly compensated for the<br />

negative effects of the price war and regulation.<br />

Internet and network<br />

The market for internet and network was affected by strong<br />

competition in <strong>2011</strong>, including increased competition from<br />

utilities, which resulted in increased bandwidth at<br />

unchanged or even reduced prices as well as significant<br />

competition for broadband add-on services.<br />

These circumstances led to decreases in both ARPU and<br />

RGUs, which affected revenue negatively. The migration<br />

from legacy broadband to HomeDuo or HomeTrio also had<br />

a negative impact on the xDSL ARPU. On the positive side,<br />

Fullrate succeeded in gaining more RGUs as a result of<br />

increased marketing and competitive prices.<br />

As a result, Consumer’s internet and network revenue<br />

declined by 3.4% compared with 2010.<br />

TV<br />

In an effort to increase value differentiation, Consumer is<br />

seeking to offer new services and launched upgrades for<br />

the home entertainment universe in the form of TV apps<br />

and the ‘100 films’ offering.<br />

Since the launch of <strong>TDC</strong> TV in 2005, Consumer has<br />

experienced continuous growth in the subscriber base and<br />

in <strong>2011</strong> the number of RGUs increased by 25.4%.<br />

35