TDC Group Annual Report 2011(6,4MB) - TDC Annual Report 2011

TDC Group Annual Report 2011(6,4MB) - TDC Annual Report 2011

TDC Group Annual Report 2011(6,4MB) - TDC Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Gross profit<br />

Despite the <strong>TDC</strong> <strong>Group</strong>’s revenue increase, gross profit<br />

decreased by 1.3% to DKK 19,172m.<br />

• The decline was driven mainly by a shift in product mix.<br />

Growth in areas with relatively low margins such as the<br />

TV business, Nordic and especially terminal equipment<br />

were more than offset by decreased activity in highmargin<br />

areas such as landline voice and landline<br />

broadband.<br />

The gross profit margin decreased from 74.2% to 72.9%<br />

despite being positively affected by the fact that only a<br />

minor part of the regulation had a gross profit effect.<br />

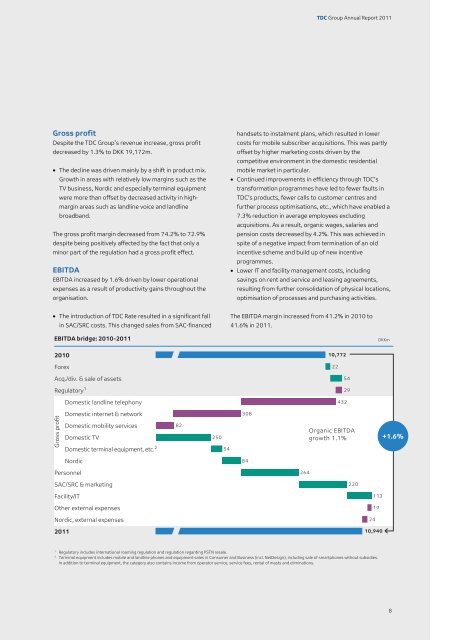

EBITDA<br />

EBITDA increased by 1.6% driven by lower operational<br />

expenses as a result of productivity gains throughout the<br />

organisation.<br />

• The introduction of <strong>TDC</strong> Rate resulted in a significant fall<br />

in SAC/SRC costs. This changed sales from SAC-financed<br />

<strong>TDC</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

handsets to instalment plans, which resulted in lower<br />

costs for mobile subscriber acquisitions. This was partly<br />

offset by higher marketing costs driven by the<br />

competitive environment in the domestic residential<br />

mobile market in particular.<br />

• Continued improvements in efficiency through <strong>TDC</strong>’s<br />

transformation programmes have led to fewer faults in<br />

<strong>TDC</strong>’s products, fewer calls to customer centres and<br />

further process optimisations, etc., which have enabled a<br />

7.3% reduction in average employees excluding<br />

acquisitions. As a result, organic wages, salaries and<br />

pension costs decreased by 4.2%. This was achieved in<br />

spite of a negative impact from termination of an old<br />

incentive scheme and build up of new incentive<br />

programmes.<br />

• Lower IT and facility management costs, including<br />

savings on rent and service and leasing agreements,<br />

resulting from further consolidation of physical locations,<br />

optimisation of processes and purchasing activities.<br />

The EBITDA margin increased from 41.2% in 2010 to<br />

41.6% in <strong>2011</strong>.<br />

8