- Page 2 and 3:

C06508165: Documento fuente son 23

- Page 4 and 5:

ULTRA SECRETO (b)(3)NatSecAct NOFOR

- Page 6 and 7:

APROBADO PARA DIVULGACION: 02-MAR-2

- Page 8 and 9:

APROBADO PARA DIVULGACION: 02-MAR-2

- Page 10 and 11:

APROBADO PARA DIVULGACION: 02-MAR-2

- Page 12 and 13:

C06508166: Documento fuente es 26 p

- Page 14 and 15:

APROBADO PARA DIVULGACION: 03-MAR-2

- Page 16 and 17:

APROBADO PARA DIVULGACION: 03-MAR-2

- Page 18 and 19:

C06508166 ULTRA SECRETO (b)(3)NatSe

- Page 20 and 21:

APROBADO PARA DIVULGACION: 03-MAR-2

- Page 22 and 23:

C06508166 ULTRA SECRETO (b)(3)NatSe

- Page 24 and 25:

APROBADO PARA DIVULGACION: 03-MAR-2

- Page 26 and 27:

APROBADO PARA DIVULGACION: 03-MAR-2

- Page 28 and 29:

APROBADO PARA DIVULGACION: 03-MAR-2

- Page 30 and 31:

C06508166 (b)(1) (b)(3) NatSecAct U

- Page 32 and 33:

C05508262 APROBADO PARA DIVULGACION

- Page 34 and 35:

C05508262 APROBADO PARA DIVULGACION

- Page 36 and 37:

C05508262 APROBADO PARA DIVULGACION

- Page 38 and 39:

Juicios clave C05508262 Informació

- Page 40 and 41:

C05508262 APROBADO PARA DIVULGACION

- Page 42 and 43:

C05508262 APROBADO PARA DIVULGACION

- Page 44 and 45:

C05508262 APROBADO PARA DIVULGACION

- Page 46 and 47:

C05508262 APROBADO PARA DIVULGACION

- Page 48 and 49:

C05508262 APROBADO PARA DIVULGACION

- Page 50 and 51:

C05508262 APROBADO PARA DIVULGACION

- Page 52 and 53:

C05508262 Evolución de la Extrema

- Page 54 and 55:

APROBADO PARA DIVULGACION: 02-MAR-2

- Page 56 and 57:

APROBADO PARA DIVULGACION: 02-MAR-2

- Page 58 and 59:

C05508262 APROBADO PARA DIVULGACION

- Page 60 and 61:

C05508262 APROBADO PARA DIVULGACION

- Page 62 and 63:

C05508262 (b)(1) (b)(3) NatSecAct (

- Page 64 and 65:

C05508262 APROBADO PARA DIVULGACION

- Page 66 and 67:

C05508262 APROBADO PARA DIVULGACION

- Page 68 and 69:

C05508262 APROBADO PARA DIVULGACION

- Page 70 and 71:

C05508262 APROBADO PARA DIVULGACION

- Page 72 and 73:

C05508262 APROBADO PARA DIVULGACION

- Page 74 and 75:

C05508262 APROBADO PARA DIVULGACION

- Page 76 and 77:

C05508262 APROBADO PARA DIVULGACION

- Page 78 and 79:

C05508262 APROBADO PARA DIVULGACION

- Page 80 and 81:

C05508262 15 APROBADO PARA DIVULGAC

- Page 82 and 83:

C05508262 APROBADO PARA DIVULGACION

- Page 84 and 85:

C05508262 APROBADO PARA DIVULGACION

- Page 86 and 87:

C06509067 APROBADO PARA DIVULGACION

- Page 88 and 89:

C06509067 APROBADO PARA DIVULGACION

- Page 90 and 91:

C06509067 APROBADO PARA DIVULGACION

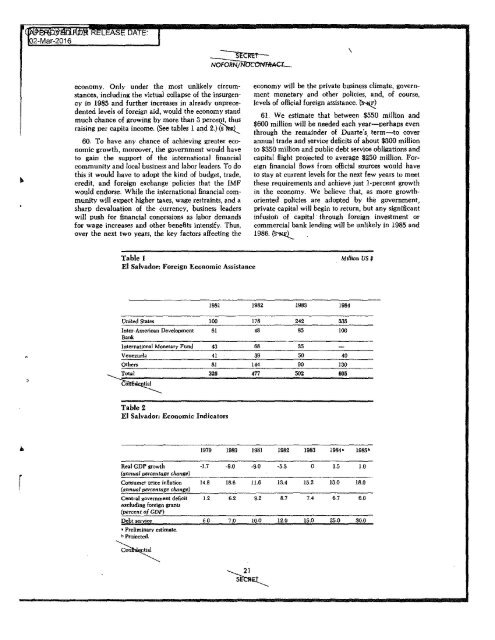

- Page 92 and 93: C05434109 El salvador: Perspectivas

- Page 94 and 95: C06509067 APROBADO PARA DIVULGACION

- Page 96 and 97: C05434109 NIE 83.1-85 EL SALVADOR:

- Page 98 and 99: C05434109 APROBADO PARA DIVULGACION

- Page 100 and 101: C05434109 APROBADO PARA DIVULGACION

- Page 102 and 103: C05434109 APROBADO PARA DIVULGACION

- Page 104 and 105: C05434109 APROBADO PARA DIVULGACION

- Page 106 and 107: C05434109 APROBADO PARA DIVULGACION

- Page 108 and 109: C05434109 APROBADO PARA DIVULGACION

- Page 110 and 111: Otros factores que afectan la estab

- Page 112 and 113: Implicaciones para los Estados Unid

- Page 114 and 115: Antecedentes 1. Durante sus primero

- Page 116 and 117: 6. Como la violenta y antidemocrát

- Page 118 and 119: derecha que han formado la mayoría

- Page 120 and 121: El panorama para las elecciones de

- Page 122 and 123: Cualquier reducción de los 24 miem

- Page 124 and 125: MEJORAS A LA FUERZA ARMADA SALVADOR

- Page 126 and 127: área de la guerrilla y con un mejo

- Page 128 and 129: 64 La decreciente fortuna de los gu

- Page 130 and 131: muertes de los grupos derechistas e

- Page 132 and 133: ha señalado que sobresalen las emb

- Page 134 and 135: Fiebre revolucionaria y evolución

- Page 136 and 137: 43. Habría, por ende, una gran opo

- Page 138 and 139: Relaciones Civil-Militares 48. Quiz

- Page 140 and 141: 54. Al menos un par de líderes gue

- Page 144 and 145: Implicaciones para los Estados Unid

- Page 146 and 147: pág. 73

- Page 148 and 149: pág. 74

- Page 150 and 151: pág. 75

- Page 152 and 153: C05434109: Todos los registros busc

- Page 154 and 155: ANNEXO B Indicadores Clave Varios d

- Page 156 and 157: Clase obrera, campesinos, y otros g

- Page 158 and 159: AVISO DE DIFUSIÓN 1. El presente d

- Page 160 and 161: pág. 80

- Page 162 and 163: C05594352: Todos los registros busc

- Page 164 and 165: EN BREVE Américas - Oscar Arias: c

- Page 166 and 167: C06508160: documento de origen es d

- Page 168 and 169: INDICACIONES DE INESTABILIDAD POLÍ

- Page 170 and 171: - La rebelión de enero por el Coro

- Page 172 and 173: C06508148: documento de origen es d

- Page 174 and 175: DIARIO DE INTELIGENCIA NACIONAL (CA

- Page 176 and 177: EL SALVADOR: Las ganancias de contr

- Page 178 and 179: C06508159: documento de origen es d

- Page 180 and 181: DIARIO DE INTELIGENCIA NACIONAL VIE

- Page 182 and 183: Análisis especial EL SALVADOR: Se

- Page 184 and 185: Los tres agentes son conservadores

- Page 186 and 187: C06508162: documento de origen es d

- Page 188 and 189: DIARIO DE INTELIGENCIA NACIONAL Vie

- Page 190 and 191: EL SALVADOR: Situación Militar Los

- Page 192 and 193:

Diario de Inteligencia Nacional Lun

- Page 194 and 195:

EL Salvador: incremento de la presi

- Page 196 and 197:

C06508153 el documento de origen es

- Page 198 and 199:

Diario de Inteligencia Nacional. Lu

- Page 200 and 201:

Análisis especial. El Salvador: Po

- Page 202 and 203:

eforzado viejos temores de que se h

- Page 204 and 205:

El líder de la extrema derecha D´

- Page 206 and 207:

Diario de inteligencia Nacional Lun

- Page 208 and 209:

EL SALVADOR: facilidad de las tensi

- Page 210 and 211:

C06508147: el documento de origen e

- Page 212 and 213:

Diario de Inteligencia Nacional. S

- Page 214 and 215:

EL SALVADOR: moderadores en un Gobi

- Page 216 and 217:

D’Aubuisson ve oportunidades en d

- Page 218 and 219:

La Política Civil. La presión fre

- Page 220 and 221:

C06508161: el documento de origen e

- Page 222 and 223:

Diario de Inteligencia Nacional Sá

- Page 224 and 225:

El SALVADOR: Los preparativos para

- Page 226 and 227:

C06508155: Documento de origen es d

- Page 228 and 229:

Diario de Inteligencia Nacional Sá

- Page 230 and 231:

EL SALVADOR: Nueva lucha por el Pod

- Page 232 and 233:

C06508149: Documento de origen es d

- Page 234 and 235:

Diario de Inteligencia Nacional Sá

- Page 236 and 237:

EL SALVADOR: Las Revueltas Comandan

- Page 238 and 239:

C0658152: Documento de origen es de

- Page 240 and 241:

Diario de la Inteligencia Nacional

- Page 242 and 243:

EL SALVADOR: Acontecimientos Polít

- Page 244 and 245:

Diario de inteligencia Nacional Jue

- Page 246 and 247:

El Salvador: Maniobras de alto nive

- Page 248 and 249:

La fuente del documento son 15 pagi

- Page 250 and 251:

Diario de inteligencia Nacional Mi

- Page 252 and 253:

El Salvador: Estatus de la disputa

- Page 254 and 255:

La fuente del documento son 18 pagi

- Page 256 and 257:

Diario de inteligencia Nacional Mi

- Page 258 and 259:

Análisis Especial El Salvador: El

- Page 260 and 261:

Las nuevas unidades sin embargo, ha

- Page 262 and 263:

Para evitar que la guerrilla haga m

- Page 264 and 265:

La fuente del documento son 26 pagi

- Page 266 and 267:

Diario de inteligencia Nacional Mi

- Page 268 and 269:

El Salvador Militares intensificand

- Page 270 and 271:

Panorama militar a corto plazo para

- Page 272 and 273:

Aviso de advertencia Fuentes sensib

- Page 274 and 275:

SNIE 83.1.2.83 PERSPECTIVAS MILITAR

- Page 276 and 277:

ESTA ESTIMACIÓN ES EMITIDA POR EL

- Page 278 and 279:

CONTENIDO NOTA DE ALCANCE JUICIOS C

- Page 280 and 281:

NOTA DE ALCANCE La estimación de e

- Page 282 and 283:

PÁGINA EN BLANCO 141

- Page 284 and 285:

JUICIOS CLAVE Nosotros creemos que

- Page 286 and 287:

Cuba y Nicaragua son probablemente

- Page 288 and 289:

actitud dentro del cuerpo tendrán

- Page 290 and 291:

alguna resolución de los problemas

- Page 292 and 293:

DISCUSIÓN 1. El estancamiento mili

- Page 294 and 295:

Organización 6. El FMLN consiste e

- Page 296 and 297:

148

- Page 298 and 299:

DEBILIDADES 13. La gran debilidad d

- Page 300 and 301:

Demostrar la habilidad de su lucha,

- Page 302 and 303:

28. La presencia de Estados Unidos

- Page 304 and 305:

Problemas tácticos y logísticos.

- Page 306 and 307:

44. Un sistema de educación milita

- Page 308 and 309:

51. Los coroneles que dirigen geogr

- Page 310 and 311:

155

- Page 312 and 313:

57. El impacto de la organización

- Page 314 and 315:

Perspectivas de colapso militar 63.

- Page 316 and 317:

70. Las políticas de los cuerpos o

- Page 318 and 319:

76. Grupos de exterminio de la dere

- Page 320 and 321:

160

- Page 322 and 323:

161

- Page 324 and 325:

162

- Page 326 and 327:

163

- Page 328 and 329:

164

- Page 330 and 331:

AGENCIA CENTRAL DE INTELIGENCIA Dir

- Page 332 and 333:

El ejército salvadoreño: Un compo

- Page 334 and 335:

Aviso de Advertencia Fuentes de int

- Page 336 and 337:

El ejército salvadoreño: Un compo

- Page 338 and 339:

Nota de Alcance En este trabajo se

- Page 340 and 341:

Las sentencias clave Información d

- Page 342 and 343:

Mejora de la planificación estrat

- Page 344 and 345:

El desarrollo militar continuará s

- Page 346 and 347:

C05356748: Todos los registros y la

- Page 348 and 349:

174

- Page 350 and 351:

175

- Page 352 and 353:

El ejército salvadoreño: Un compo

- Page 354 and 355:

Página en blanco 177

- Page 356 and 357:

178

- Page 358 and 359:

Página en blanco 179

- Page 360 and 361:

180

- Page 362 and 363:

Anuncio de Difusión. 1. Este docum

- Page 364 and 365:

El Establecimiento de la Defensa (t

- Page 366 and 367:

elaciones con los países vecinos p

- Page 368 and 369:

En cooperación con los estados uni

- Page 370 and 371:

Muchos de los programas de mejora m

- Page 372 and 373:

Que refleja los déficit presupuest

- Page 374 and 375:

El ministro de Defensa Vides ha ani

- Page 376 and 377:

Los plazos de entrega sustanciales

- Page 378 and 379:

Aunque la influencia de Estados Uni

- Page 380 and 381:

C05356748: Todos los registros fuer

- Page 382 and 383:

Apéndice Desarrollo de la fuerza c

- Page 384 and 385:

El crecimiento de las fuerzas armag

- Page 386 and 387:

fuerzas de seguridad pública que c

- Page 388 and 389:

El gobierno promete establecer un c

- Page 390 and 391:

Liderazgo El tamaño y la distribuc

- Page 392 and 393:

Preparación. Problemas de ausentis

- Page 394 and 395:

Equipo Militar El Salvador ha renov

- Page 396 and 397:

Comunicación Las comunicaciones mi

- Page 398 and 399:

envío de municiones 5.56mm a final

- Page 400 and 401:

La lucha. Aunque la capital está p

- Page 402 and 403:

En la estela de una serie de victor

- Page 404 and 405:

202

- Page 406 and 407:

Estrategias y Tácticas. El Salvado

- Page 408 and 409:

con gran aclamación en junio de 19

- Page 410 and 411:

Con sólo unos 12 helicópteros ope

- Page 412 and 413:

206

- Page 414 and 415:

CABLE DE INFORMACIÓN DE INTELIGENC

- Page 416 and 417:

Aviso. Una mayor difusión y uso de

- Page 418 and 419:

SECRETO/ USO INTERNO DE LA CIA UNIC

- Page 420 and 421:

Según este acuerdo, la Junta del E

- Page 422 and 423:

(TACHADO) AVISO: reporte clase: SEC

- Page 424 and 425:

Clasificado por: Sin especificar. D

- Page 426 and 427:

… influenciado por el Partido ARE

- Page 428 and 429:

…hubieran apoyado el intento de G

- Page 430 and 431:

Clasificado por: Sin especificar. M

- Page 432 and 433:

… que el Presidente había sido c

- Page 434 and 435:

Clasificado por: Sin especificar. D

- Page 436 and 437:

… Comandante del Primer destacame

- Page 438 and 439:

Clasificado por: Sin especificar. D

- Page 440 and 441:

Texto: 1. (Tachado) El comandante d

- Page 442 and 443:

(Tachado) (Tachado) Advertencia: Re

- Page 444 and 445:

Clasificado por: Sin especificar. D

- Page 446 and 447:

(TACHADO) (TACHADO) Advertencia: Re

- Page 448 and 449:

Clasificado por: Sin especificar. M

- Page 450 and 451:

CABLE DE INFORMACIÓN DE INTELIGENC

- Page 452 and 453:

Aviso Una mayor difusión y uso de

- Page 454 and 455:

SECRETARIA CIA/ SOLO PARA USO INTER

- Page 456 and 457:

SECRETARIA CIA/ SOLO PARA USO INTER

- Page 458 and 459:

SECRETARIA CIA/ SOLO PARA USO INTER

- Page 460 and 461:

SECRETARIA CIA/ SOLO PARA USO INTER

- Page 462 and 463:

SECRETARIA CIA/ SOLO PARA USO INTER

- Page 464 and 465:

Advertencia: Reporte de clase secre

- Page 466 and 467:

SECRETOSPECAT -NOFORN-NOCONTRACT-OR

- Page 468 and 469:

DM1 Comandante Coronel Benjamín (R

- Page 470 and 471:

Clasificación: Sin especificar Der

- Page 472 and 473:

También incluye una denuncia de la

- Page 474 and 475:

SECRETARIA CIA/ SOLO PARA USO INTER

- Page 476 and 477:

Fuentes de inteligencia y métodos

- Page 478 and 479:

Clasificación: Sin especificar Mot

- Page 480 and 481:

…(S//OC//NF) describió a Vides c

- Page 482 and 483:

Clasificación: Sin especificar Der

- Page 484 and 485:

…sería extremadamente difícil r

- Page 486 and 487:

(TACHADO) (TACHADO) (TACHADO) AVISO

- Page 488 and 489:

Clasificación: Sin especificar Der

- Page 490 and 491:

(Tachado) (Tachado) (Tachado) Adver

- Page 492 and 493:

(PAGINA EN BLANCO) 246

- Page 494 and 495:

Clasificado por: Sin especificar De

- Page 496 and 497:

2. Respecto a las capacidades de fu

- Page 498 and 499:

(Tachado) Advertencia: Reporte de c

- Page 500 and 501:

Aprobado para desclasificación Fec

- Page 502 and 503:

TEMA - REACCION INICIAL DE LOS OFIC

- Page 504 and 505:

….se ha desarrollado la falta de

- Page 506 and 507:

1/2 10 de octubre de 1984 253

- Page 508 and 509:

2/2 COMENTARIO: El reciente progres

- Page 510 and 511:

1/3 TEMA - ESTRATEGIA INSURGENTE PA

- Page 512 and 513:

2. El FMLN continúa experimentando

- Page 514 and 515:

3/3 257

- Page 516 and 517:

1/2 TEMA - FALTA DE APOYO DEL ALTO

- Page 518 and 519:

2/2 ….la responsabilidad de vigil

- Page 520 and 521:

1/3 TEMA - RENUIÓN DE COMANDANTES

- Page 522 and 523:

2/3 3. Sobre la carta presentada al

- Page 524 and 525:

3/3 262

- Page 526 and 527:

1/3 TEMA: COOPERACIÓN MILITAR EN E

- Page 528 and 529:

2/3 …batallones de la armada hond

- Page 530 and 531:

3/3 …..pondrá las fuerzas de con

- Page 532 and 533:

1/2 TEMA: VALORACIÓN DEL COMANDANT

- Page 534 and 535:

2/2 3. Según Ochoa, los únicos of

- Page 536 and 537:

1/2 TEMA: REACCIÓN NEGATIVA DE OFI

- Page 538 and 539:

2/2 …notificarían oportunamente

- Page 540 and 541:

1/3 TEMA: PLAN DE LA COMANDANCIA DE

- Page 542 and 543:

2/3 ….y a Ochoa como autoridad mi

- Page 544 and 545:

3/3 I. Desarrollar acciones de rela

- Page 546 and 547:

1/2 TEMA: PLANES DE LOS MIEMBROS DE

- Page 548 and 549:

2/2 …Asociación. Los representan

- Page 550 and 551:

1/3 TEMA: PLANES DEL COMANDANTE DE

- Page 552 and 553:

2/3 ….la jurisdicción del Corone

- Page 554 and 555:

3 de 3 277

- Page 556 and 557:

Clasificados por: Sin especificar D

- Page 558 and 559:

3. 4. EL 22 DE ENERO PASTORA SE REU

- Page 560 and 561:

ADVERTENCIA: REPORTE CLASE SECRETA

- Page 562 and 563:

Clasificados por: Sin especificar D

- Page 564 and 565:

CLAROS. LA NOCHE DEL 28 DE DICIEMBR

- Page 566 and 567:

LAS PORCIONES CONTIENEN CLASIFICACI

- Page 568 and 569:

Clasificados por: Sin especificar D

- Page 570 and 571:

MILITARMENTE PERO POLÍTICO. BLANDO

- Page 572 and 573:

TEMA: POSICIÓN DEL TENIENTE GENERA

- Page 574 and 575:

EL CESE AL FUEGO OFRECIDO POR LA IN

- Page 576 and 577:

288 ‣ NNNN ‣ NNDD

- Page 578 and 579:

TEMA: EL DESEO INMINENTE DEL PRESID

- Page 580 and 581:

EL 1 DE ENERO, MUCHOS COMO EL CORON

- Page 582 and 583:

TEMA: PROBABLE REASIGNACIÓN DEL TE

- Page 584 and 585:

ADVERTENCIA: REPORTE SECRETO—NOTI

- Page 586 and 587:

TEMA: PROPUESTA DE CAMBIO DE PERSON

- Page 588 and 589:

COMENTARIO: EL TIEMPO EXACTO DE EST

- Page 590 and 591:

TEMA: PROSPECTOS PARA UNIRSE A LAS

- Page 592 and 593:

POSICIÓN DE BLOQUEO EN EL LADO HON

- Page 594 and 595:

PORCIONES LLEVAN CLASIFICACIONES Y

- Page 596 and 597:

SECRET//ORCON/NOFORN Clasificado po

- Page 598 and 599:

MARIA (14-09N, 89-01W) A SAN FERNAN

- Page 600 and 601:

C06504110 Secreto/NC/CIA/ Clasifica

- Page 602 and 603:

C06504105 Secreto/CIA USO INTERNO/

- Page 604 and 605:

C06504105 Secreto/CIA/Uso interno C

- Page 606 and 607:

C06504105 Secreto/CIA USO INTERNO/

- Page 608 and 609:

C06504105 Secreto/CIA USO INTERNO/

- Page 610 and 611:

C06503877 Secreto/CIA/Uso interno C

- Page 612 and 613:

C06503877 Secreto/CIA/Uso interno 1

- Page 614 and 615:

C06503877 Secreto/CIA/Uso interno Q

- Page 616 and 617:

C06503877 Secreto/CIA/Uso interno E

- Page 618 and 619:

C06504073 Secreto/CIA/Uso interno C

- Page 620 and 621:

C06504073 Secreto/CIA/Uso interno 4

- Page 622 and 623:

C05194512 Secreto Información de c

- Page 624 and 625:

C05194512 SECRETO Noticia de advert

- Page 626 and 627:

C06504070 Secreto/CIA/Uso interno C

- Page 628 and 629:

C06504070 Secreto/CIA/Uso interno D

- Page 630 and 631:

C06504113 Secreto/CIA/Uso interno C

- Page 632 and 633:

C06504113 Secreto/CIA/Uso interno _

- Page 634 and 635:

C06503882 Secreto/CIA/Uso interno C

- Page 636 and 637:

C06503882 Secreto/ CIA/USO INTERNO/

- Page 638 and 639:

C06503882 Secreto/ CIA/USO INTERNO/

- Page 640 and 641:

C05216895 Secreto Eugenio VIDES CAS

- Page 642 and 643:

C05216895 Problemas militares EL tr

- Page 644 and 645:

C05216895 Problemas políticos Vide

- Page 646 and 647:

C05216895 SECRETO Vides Casanova si

- Page 648 and 649:

C05216895 SECRETO Callado y muy ami

- Page 650 and 651:

C06508154 CONFIDENCIAL José Guille