FORTIS B FIX 2006 - BNP Paribas Investment Partners

FORTIS B FIX 2006 - BNP Paribas Investment Partners

FORTIS B FIX 2006 - BNP Paribas Investment Partners

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

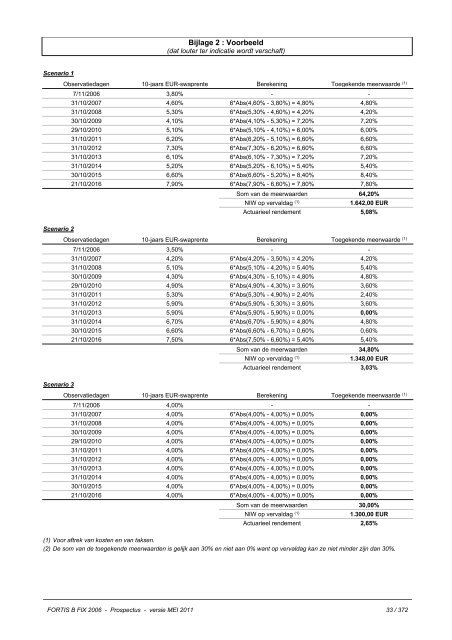

Bijlage 2 : Voorbeeld<br />

(dat louter ter indicatie wordt verschaft)<br />

Scenario 1<br />

Observatiedagen 10-jaars EUR-swaprente Berekening Toegekende meerwaarde (1)<br />

7/11/<strong>2006</strong> 3,80% - -<br />

31/10/2007 4,60% 6*Abs(4,60% - 3,80%) = 4,80% 4,80%<br />

31/10/2008 5,30% 6*Abs(5,30% - 4,60%) = 4,20% 4,20%<br />

30/10/2009 4,10% 6*Abs(4,10% - 5,30%) = 7,20% 7,20%<br />

29/10/2010 5,10% 6*Abs(5,10% - 4,10%) = 6,00% 6,00%<br />

31/10/2011 6,20% 6*Abs(6,20% - 5,10%) = 6,60% 6,60%<br />

31/10/2012 7,30% 6*Abs(7,30% - 6,20%) = 6,60% 6,60%<br />

31/10/2013 6,10% 6*Abs(6,10% - 7,30%) = 7,20% 7,20%<br />

31/10/2014 5,20% 6*Abs(5,20% - 6,10%) = 5,40% 5,40%<br />

30/10/2015 6,60% 6*Abs(6,60% - 5,20%) = 8,40% 8,40%<br />

21/10/2016 7,90% 6*Abs(7,90% - 6,60%) = 7,80% 7,80%<br />

Som van de meerwaarden 64,20%<br />

NIW op vervaldag (1)<br />

1.642,00 EUR<br />

Actuarieel rendement 5,08%<br />

Scenario 2<br />

Observatiedagen 10-jaars EUR-swaprente Berekening Toegekende meerwaarde (1)<br />

7/11/<strong>2006</strong> 3,50% - -<br />

31/10/2007 4,20% 6*Abs(4,20% - 3,50%) = 4,20% 4,20%<br />

31/10/2008 5,10% 6*Abs(5,10% - 4,20%) = 5,40% 5,40%<br />

30/10/2009 4,30% 6*Abs(4,30% - 5,10%) = 4,80% 4,80%<br />

29/10/2010 4,90% 6*Abs(4,90% - 4,30%) = 3,60% 3,60%<br />

31/10/2011 5,30% 6*Abs(5,30% - 4,90%) = 2,40% 2,40%<br />

31/10/2012 5,90% 6*Abs(5,90% - 5,30%) = 3,60% 3,60%<br />

31/10/2013 5,90% 6*Abs(5,90% - 5,90%) = 0,00% 0,00%<br />

31/10/2014 6,70% 6*Abs(6,70% - 5,90%) = 4,80% 4,80%<br />

30/10/2015 6,60% 6*Abs(6,60% - 6,70%) = 0,60% 0,60%<br />

21/10/2016 7,50% 6*Abs(7,50% - 6,60%) = 5,40% 5,40%<br />

Som van de meerwaarden 34,80%<br />

NIW op vervaldag (1)<br />

1.348,00 EUR<br />

Actuarieel rendement 3,03%<br />

Scenario 3<br />

Observatiedagen 10-jaars EUR-swaprente Berekening Toegekende meerwaarde (1)<br />

7/11/<strong>2006</strong> 4,00% - -<br />

31/10/2007 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

31/10/2008 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

30/10/2009 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

29/10/2010 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

31/10/2011 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

31/10/2012 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

31/10/2013 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

31/10/2014 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

30/10/2015 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

21/10/2016 4,00% 6*Abs(4,00% - 4,00%) = 0,00% 0,00%<br />

Som van de meerwaarden 30,00%<br />

NIW op vervaldag (1)<br />

1.300,00 EUR<br />

Actuarieel rendement 2,65%<br />

(1) Voor aftrek van kosten en van taksen.<br />

(2) De som van de toegekende meerwaarden is gelijk aan 30% en niet aan 0% want op vervaldag kan ze niet minder zijn dan 30%.<br />

<strong>FORTIS</strong> B <strong>FIX</strong> <strong>2006</strong> - Prospectus - versie MEI 2011 33 / 372