Organizational Strategy - Sustainable Development - L'Oréal

Organizational Strategy - Sustainable Development - L'Oréal

Organizational Strategy - Sustainable Development - L'Oréal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

7 L’OréaL - GrI DaTa SHEETS 2011<br />

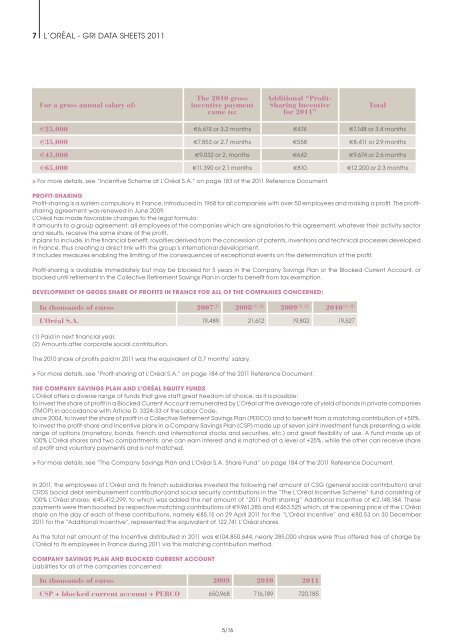

For a gross annual salary of:<br />

> For more details, see “Incentive Scheme at L’Oréal S.a.” on page 183 of the 2011 reference Document.<br />

PROFIT-SHARING<br />

Profit-sharing is a system compulsory in France, introduced in 1968 for all companies with over 50 employees and making a profit. The profitsharing<br />

agreement was renewed in June 2009.<br />

L’Oréal has made favorable changes to the legal formula:<br />

It amounts to a group agreement: all employees of the companies which are signatories to this agreement, whatever their activity sector<br />

and results, receive the same share of the profit,<br />

It plans to include, in the financial benefit, royalties derived from the concession of patents, inventions and technical processes developed<br />

in France, thus creating a direct link with the group’s international development,<br />

It includes measures enabling the limiting of the consequences of exceptional events on the determination of the profit.<br />

Profit-sharing is available immediately but may be blocked for 5 years in the Company Savings Plan or the Blocked Current account, or<br />

blocked until retirement in the Collective retirement Savings Plan in order to benefit from tax exemption.<br />

DEVELOPMENT OF GROSS SHARE OF PROFITS IN FRANCE FOR ALL OF THE COMPANIES CONCERNED:<br />

(1) Paid in next financial year.<br />

(2) amounts after corporate social contribution.<br />

The 2010 share of profits paid in 2011 was the equivalent of 0.7 months’ salary.<br />

> For more details, see “Profit-sharing at L’Oréal S.a.” on page 184 of the 2011 reference Document.<br />

THE COMPANY SAVINGS PLAN AND L’ORÉAL EQUITY FUNDS<br />

L’Oréal offers a diverse range of funds that give staff great freedom of choice, as it is possible:<br />

to invest the share of profit in a Blocked Current account remunerated by L’Oréal at the average rate of yield of bonds in private companies<br />

(TMOP) in accordance with article D. 3324-33 of the Labor Code,<br />

since 2004, to invest the share of profit in a Collective retirement Savings Plan (PErCO) and to benefit from a matching contribution of +50%,<br />

to invest the profit-share and Incentive plans in a Company Savings Plan (CSP) made up of seven joint investment funds presenting a wide<br />

range of options (monetary, bonds, French and international stocks and securities, etc.) and great flexibility of use. a fund made up of<br />

100% L’Oréal shares and two compartments: one can earn interest and is matched at a level of +25%, while the other can receive share<br />

of profit and voluntary payments and is not matched.<br />

> For more details, see “The Company Savings Plan and L’Oréal S.a. Share Fund” on page 184 of the 2011 reference Document.<br />

In 2011, the employees of L’Oréal and its French subsidiaries invested the following net amount of CSG (general social contribution) and<br />

CrDS (social debt reimbursement contribution)and social security contributions in the “The L’Oréal Incentive Scheme” fund consisting of<br />

100% L’Oréal shares: €45,412,299, to which was added the net amount of “2011 Profit-sharing” additional Incentive of €2,148,184. These<br />

payments were then boosted by respective matching contributions of €9,961,285 and €463,525 which, at the opening price of the L’Oréal<br />

share on the day of each of these contributions, namely €85.15 on 29 april 2011 for the “L’Oréal Incentive” and €80.53 on 30 December<br />

2011 for the “additional Incentive”, represented the equivalent of 122,741 L’Oréal shares.<br />

as the total net amount of the Incentive distributed in 2011 was €104,850,644, nearly 285,000 shares were thus offered free of charge by<br />

L’Oréal to its employees in France during 2011 via this matching contribution method.<br />

COMPANY SAVINGS PLAN AND BLOCKED CURRENT ACCOUNT<br />

Liabilities for all of the companies concerned:<br />

The 2010 gross<br />

incentive payment<br />

came to:<br />

5/16<br />

Additional “Profit-<br />

Sharing Incentive<br />

for 2011”<br />

e25,000 e6,674 or 3,2 months e474 e7,148 or 3.4 months<br />

e35,000 e7,853 or 2,7 months e558 e8,411 or 2.9 months<br />

e45,000 e9,032 or 2, months e642 e9,674 or 2.6 months<br />

e65,000 e11,390 or 2,1 months e810 e12,200 or 2.3 months<br />

In thousands of euros 2007 (1) 2008 (1) (2) 2009 (1) (2) (1) (2) 2010<br />

L’Oréal S.A. 19,489 21,612 19,802 19,527<br />

In thousands of euros 2009 2010 2011<br />

CSP + blocked current account + PERCO 650,968 716,189 720,185<br />

Total