The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes to the consolidated financial statements (continued)<br />

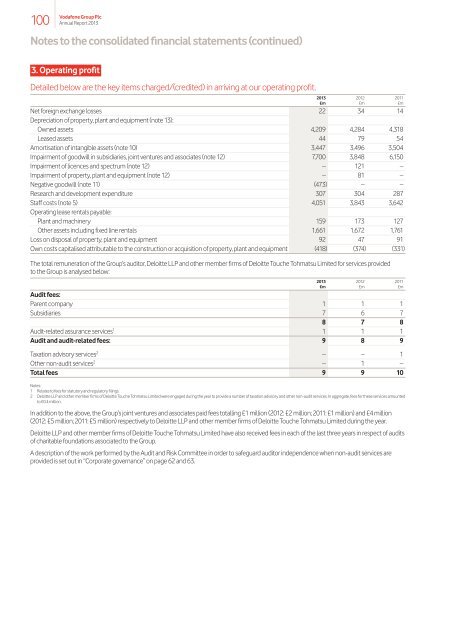

3. Operating profit<br />

Detailed below are the key items charged/(credited) in arriving at our operating profit.<br />

2013 2012 2011<br />

£m £m £m<br />

Net foreign exchange losses 22 34 14<br />

Depreciation of property, plant and equipment (note 13):<br />

Owned assets 4,209 4,284 4,318<br />

Leased assets 44 79 54<br />

Amortisation of intangible assets (note 10) 3,447 3,496 3,504<br />

Impairment of goodwill in subsidiaries, joint ventures and associates (note 12) 7,700 3,848 6,150<br />

Impairment of licences and spectrum (note 12) – 121 –<br />

Impairment of property, plant and equipment (note 12) – 81 –<br />

Negative goodwill (note 11) (473) – –<br />

Research and development expenditure 307 304 287<br />

Staff costs (note 5) 4,051 3,843 3,642<br />

Operating lease rentals payable:<br />

Plant and machinery 159 173 127<br />

Other assets including fixed line rentals 1,661 1,672 1,761<br />

Loss on disposal of property, plant and equipment 92 47 91<br />

Own costs capitalised attributable to the construction or acquisition of property, plant and equipment (418) (374) (331)<br />

<strong>The</strong> total remuneration of the Group’s auditor, Deloitte LLP and other member firms of Deloitte Touche Tohmatsu Limited for services provided<br />

to the Group is analysed below:<br />

2013 2012 2011<br />

£m £m £m<br />

Audit fees:<br />

Parent company 1 1 1<br />

Subsidiaries 7 6 7<br />

8 7 8<br />

Audit-related assurance services 1 1 1 1<br />

Audit and audit-related fees: 9 8 9<br />

Taxation advisory services 2 – – 1<br />

Other non-audit services 2 – 1 –<br />

Total fees 9 9 10<br />

Notes:<br />

1 Relates to fees for statutory and regulatory filings.<br />

2 Deloitte LLP and other member firms of Deloitte Touche Tohmatsu Limited were engaged during the year to provide a number of taxation advisory and other non‑audit services. In aggregate, fees for these services amounted<br />

to £0.4 million.<br />

In addition to the above, the Group’s joint ventures and associates paid fees totalling £1 million (2012: £2 million; 2011: £1 million) and £4 million<br />

(2012: £5 million; 2011: £5 million) respectively to Deloitte LLP and other member firms of Deloitte Touche Tohmatsu Limited during the year.<br />

Deloitte LLP and other member firms of Deloitte Touche Tohmatsu Limited have also received fees in each of the last three years in respect of audits<br />

of charitable foundations associated to the Group.<br />

A description of the work performed by the Audit and Risk Committee in order to safeguard auditor independence when non‑audit services are<br />

provided is set out in “Corporate governance” on page 62 and 63.