The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

124<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes to the consolidated financial statements (continued)<br />

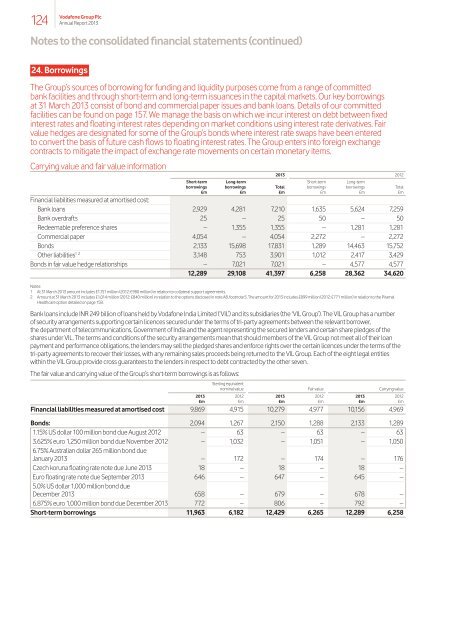

24. Borrowings<br />

<strong>The</strong> Group’s sources of borrowing for funding and liquidity purposes come from a range of committed<br />

bank facilities and through short-term and long-term issuances in the capital markets. Our key borrowings<br />

at 31 March 2013 consist of bond and commercial paper issues and bank loans. Details of our committed<br />

facilities can be found on page 157. We manage the basis on which we incur interest on debt between fixed<br />

interest rates and floating interest rates depending on market conditions using interest rate derivatives. Fair<br />

value hedges are designated for some of the Group’s bonds where interest rate swaps have been entered<br />

to convert the basis of future cash flows to floating interest rates. <strong>The</strong> Group enters into foreign exchange<br />

contracts to mitigate the impact of exchange rate movements on certain monetary items.<br />

Carrying value and fair value information<br />

2013 2012<br />

Short-term Long-term Short-term Long-term<br />

borrowings borrowings Total borrowings borrowings Total<br />

£m £m £m £m £m £m<br />

Financial liabilities measured at amortised cost:<br />

Bank loans 2,929 4,281 7,210 1,635 5,624 7,259<br />

Bank overdrafts 25 – 25 50 – 50<br />

Redeemable preference shares – 1,355 1,355 – 1,281 1,281<br />

Commercial paper 4,054 – 4,054 2,272 – 2,272<br />

Bonds 2,133 15,698 17,831 1,289 14,463 15,752<br />

Other liabilities 1 2 3,148 753 3,901 1,012 2,417 3,429<br />

Bonds in fair value hedge relationships – 7,021 7,021 – 4,577 4,577<br />

12,289 29,108 41,397 6,258 28,362 34,620<br />

Notes:<br />

1 At 31 March 2013 amount includes £1,151 million (2012: £980 million) in relation to collateral support agreements.<br />

2 Amount at 31 March 2013 includes £1,014 million (2012: £840 million) in relation to the options disclosed in note A8, footnote 5. <strong>The</strong> amount for 2013 includes £899 million (2012: £771 million) in relation to the Piramal<br />

Healthcare option detailed on page 158.<br />

Bank loans include INR 249 billion of loans held by <strong>Vodafone</strong> India Limited (‘VIL’) and its subsidiaries (the ‘VIL Group’). <strong>The</strong> VIL Group has a number<br />

of security arrangements supporting certain licences secured under the terms of tri-party agreements between the relevant borrower,<br />

the department of telecommunications, Government of India and the agent representing the secured lenders and certain share pledges of the<br />

shares under VIL. <strong>The</strong> terms and conditions of the security arrangements mean that should members of the VIL Group not meet all of their loan<br />

payment and performance obligations, the lenders may sell the pledged shares and enforce rights over the certain licences under the terms of the<br />

tri-party agreements to recover their losses, with any remaining sales proceeds being returned to the VIL Group. Each of the eight legal entities<br />

within the VIL Group provide cross guarantees to the lenders in respect to debt contracted by the other seven.<br />

<strong>The</strong> fair value and carrying value of the Group’s short-term borrowings is as follows:<br />

Sterling equivalent<br />

nominal value<br />

Fair value<br />

Carrying value<br />

2013 2012 2013 2012 2013 2012<br />

£m £m £m £m £m £m<br />

Financial liabilities measured at amortised cost 9,869 4,915 10,279 4,977 10,156 4,969<br />

Bonds: 2,094 1,267 2,150 1,288 2,133 1,289<br />

1.15% US dollar 100 million bond due August 2012 – 63 – 63 – 63<br />

3.625% euro 1,250 million bond due November 2012 – 1,032 – 1,051 – 1,050<br />

6.75% Australian dollar 265 million bond due<br />

January 2013 – 172 – 174 – 176<br />

Czech koruna floating rate note due June 2013 18 – 18 – 18 –<br />

Euro floating rate note due September 2013 646 – 647 – 645 –<br />

5.0% US dollar 1,000 million bond due<br />

December 2013 658 – 679 – 678 –<br />

6.875% euro 1,000 million bond due December 2013 772 – 806 – 792 –<br />

Short-term borrowings 11,963 6,182 12,429 6,265 12,289 6,258