The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview<br />

Business<br />

review Performance Governance Financials<br />

VIHBV has not received any formal demand for taxation following the Finance Act 2012, but it did receive a letter on 3 January 2013 reminding<br />

it of the tax demand raised prior to the Indian Supreme Court judgment and purporting to update the interest element of that demand in a total<br />

amount of INR 142 billion (£1.6 billion). <strong>The</strong> separate proceedings taken against VIHBV to seek to treat it as an agent of HTIL in respect of its alleged<br />

tax on the same transaction, as well as penalties of up to 100% of the assessed withholding tax for the alleged failure to have withheld such taxes,<br />

remain pending despite the issue having been ruled upon by the Indian Supreme Court. Should a further demand for taxation be received by VIHBV<br />

or any member of the Group as a result of the new retrospective legislation, the Group believes it is probable that it will be able to make a successful<br />

claim under the BIT. Although this would not result in any outflow of economic benefit from the Group, it could take several years for VIHBV<br />

to recover any deposit required by an Indian Court as a condition for any stay of enforcement of a tax demand pending the outcome of VIHBV’s BIT<br />

claim. However, VIHBV expects that it would be able to recover any such deposit. VIHBV is exploring with the Indian Government whether<br />

a mechanism exists under Indian law which would allow the parties to explore the possibility of a negotiated resolution of this dispute, but there<br />

is no certainty that such a mechanism exists or that a resolution acceptable to both VIHBV and the Indian Government could be reached.<br />

<strong>The</strong> Group did not carry a provision for this litigation or in respect of the retrospective legislation at 31 March 2013 or at previous reporting dates.<br />

Indian regulatory cases<br />

Litigation remains pending in the Telecommunications Dispute Settlement Appellate Tribunal (‘TDSAT’), High Courts and the Supreme Court<br />

in relation to a number of significant regulatory issues including mobile termination rates (‘MTRs’), spectrum and licence fees, licence extension and<br />

3G intra-circle roaming (‘ICR’).<br />

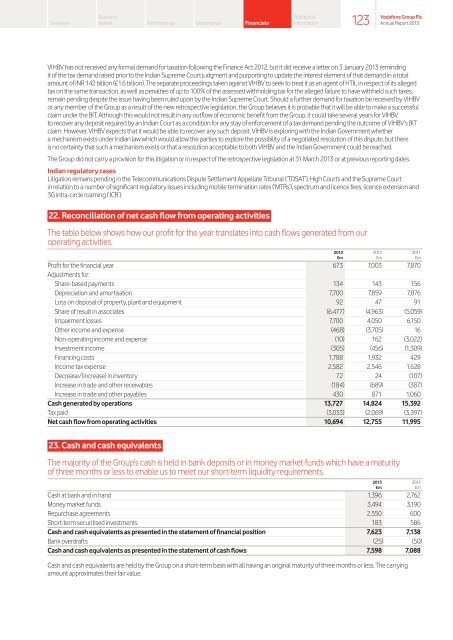

22. Reconciliation of net cash flow from operating activities<br />

<strong>The</strong> table below shows how our profit for the year translates into cash flows generated from our<br />

operating activities.<br />

2013 2012 2011<br />

£m £m £m<br />

Profit for the financial year 673 7,003 7,870<br />

Adjustments for:<br />

Share-based payments 134 143 156<br />

Depreciation and amortisation 7,700 7,859 7,876<br />

Loss on disposal of property, plant and equipment 92 47 91<br />

Share of result in associates (6,477) (4,963) (5,059)<br />

Impairment losses 7,700 4,050 6,150<br />

Other income and expense (468) (3,705) 16<br />

Non-operating income and expense (10) 162 (3,022)<br />

Investment income (305) (456) (1,309)<br />

Financing costs 1,788 1,932 429<br />

Income tax expense 2,582 2,546 1,628<br />

Decrease/(increase) in inventory 72 24 (107)<br />

Increase in trade and other receivables (184) (689) (387)<br />

Increase in trade and other payables 430 871 1,060<br />

Cash generated by operations 13,727 14,824 15,392<br />

Tax paid (3,033) (2,069) (3,397)<br />

Net cash flow from operating activities 10,694 12,755 11,995<br />

23. Cash and cash equivalents<br />

Additional<br />

information<br />

123<br />

<strong>The</strong> majority of the Group’s cash is held in bank deposits or in money market funds which have a maturity<br />

of three months or less to enable us to meet our short-term liquidity requirements.<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

2013 2012<br />

£m £m<br />

Cash at bank and in hand 1,396 2,762<br />

Money market funds 3,494 3,190<br />

Repurchase agreements 2,550 600<br />

Short-term securitised investments 183 586<br />

Cash and cash equivalents as presented in the statement of financial position 7,623 7,138<br />

Bank overdrafts (25) (50)<br />

Cash and cash equivalents as presented in the statement of cash flows 7,598 7,088<br />

Cash and cash equivalents are held by the Group on a short-term basis with all having an original maturity of three months or less. <strong>The</strong> carrying<br />

amount approximates their fair value.