The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview<br />

Business<br />

review Performance Governance Financials<br />

Additional<br />

information<br />

Financial risk management<br />

<strong>The</strong> Group’s treasury function provides a centralised service to the Group for funding, foreign exchange, interest rate management and counterparty<br />

risk management.<br />

Treasury operations are conducted within a framework of policies and guidelines authorised and reviewed by the Board, most recently on 27 March<br />

2012. A treasury risk committee comprising of the Group’s Chief Financial Officer, Group General Counsel and Company Secretary, Group Treasury<br />

Director and Director of Financial Reporting meets three times a year to review treasury activities and its members receive management information<br />

relating to treasury activities on a quarterly basis. <strong>The</strong> Group’s accounting function, which does not report to the Group Treasury Director, provides<br />

regular update reports of treasury activity to the Board. <strong>The</strong> Group’s internal auditor reviews the internal control environment regularly.<br />

<strong>The</strong> Group uses a number of derivative instruments for currency and interest rate risk management purposes only that are transacted by specialist<br />

treasury personnel. <strong>The</strong> Group mitigates banking sector credit risk by the use of collateral support agreements.<br />

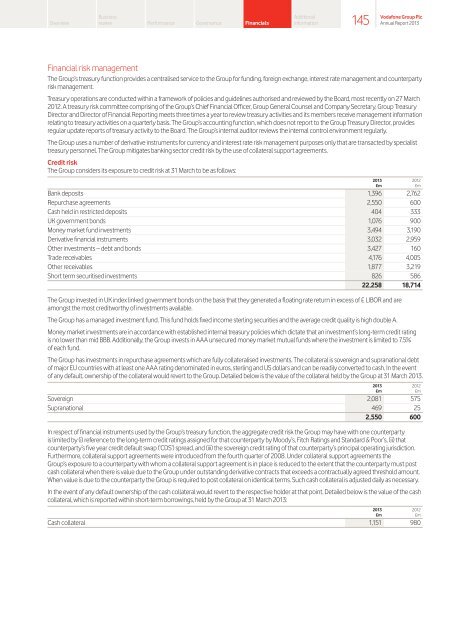

Credit risk<br />

<strong>The</strong> Group considers its exposure to credit risk at 31 March to be as follows:<br />

2013 2012<br />

£m £m<br />

Bank deposits 1,396 2,762<br />

Repurchase agreements 2,550 600<br />

Cash held in restricted deposits 404 333<br />

UK government bonds 1,076 900<br />

Money market fund investments 3,494 3,190<br />

Derivative financial instruments 3,032 2,959<br />

Other investments – debt and bonds 3,427 160<br />

Trade receivables 4,176 4,005<br />

Other receivables 1,877 3,219<br />

Short term securitised investments 826 586<br />

22,258 18,714<br />

<strong>The</strong> Group invested in UK index linked government bonds on the basis that they generated a floating rate return in excess of £ LIBOR and are<br />

amongst the most creditworthy of investments available.<br />

<strong>The</strong> Group has a managed investment fund. This fund holds fixed income sterling securities and the average credit quality is high double A.<br />

Money market investments are in accordance with established internal treasury policies which dictate that an investment’s long-term credit rating<br />

is no lower than mid BBB. Additionally, the Group invests in AAA unsecured money market mutual funds where the investment is limited to 7.5%<br />

of each fund.<br />

<strong>The</strong> Group has investments in repurchase agreements which are fully collateralised investments. <strong>The</strong> collateral is sovereign and supranational debt<br />

of major EU countries with at least one AAA rating denominated in euros, sterling and US dollars and can be readily converted to cash. In the event<br />

of any default, ownership of the collateral would revert to the Group. Detailed below is the value of the collateral held by the Group at 31 March 2013.<br />

2013 2012<br />

£m £m<br />

Sovereign 2,081 575<br />

Supranational 469 25<br />

2,550 600<br />

In respect of financial instruments used by the Group’s treasury function, the aggregate credit risk the Group may have with one counterparty<br />

is limited by (i) reference to the long-term credit ratings assigned for that counterparty by Moody’s, Fitch Ratings and Standard & Poor’s, (ii) that<br />

counterparty’s five year credit default swap (‘CDS’) spread, and (iii) the sovereign credit rating of that counterparty’s principal operating jurisdiction.<br />

Furthermore, collateral support agreements were introduced from the fourth quarter of 2008. Under collateral support agreements the<br />

Group’s exposure to a counterparty with whom a collateral support agreement is in place is reduced to the extent that the counterparty must post<br />

cash collateral when there is value due to the Group under outstanding derivative contracts that exceeds a contractually agreed threshold amount.<br />

When value is due to the counterparty the Group is required to post collateral on identical terms. Such cash collateral is adjusted daily as necessary.<br />

In the event of any default ownership of the cash collateral would revert to the respective holder at that point. Detailed below is the value of the cash<br />

collateral, which is reported within short-term borrowings, held by the Group at 31 March 2013:<br />

2013 2012<br />

£m £m<br />

Cash collateral 1,151 980<br />

145<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013