The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes to the consolidated financial statements (continued)<br />

7. Taxation (continued)<br />

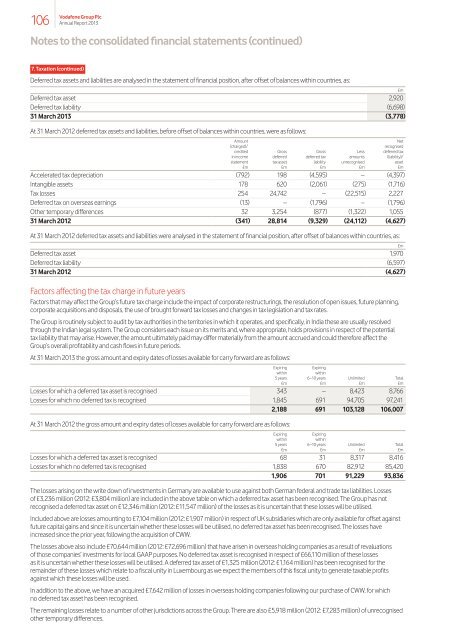

Deferred tax assets and liabilities are analysed in the statement of financial position, after offset of balances within countries, as:<br />

£m<br />

Deferred tax asset 2,920<br />

Deferred tax liability (6,698)<br />

31 March 2013 (3,778)<br />

At 31 March 2012 deferred tax assets and liabilities, before offset of balances within countries, were as follows:<br />

Amount Net<br />

(charged)/ recognised<br />

credited Gross Gross Less deferred tax<br />

in income deferred deferred tax amounts (liability)/<br />

statement tax asset liability unrecognised asset<br />

£m £m £m £m £m<br />

Accelerated tax depreciation (792) 198 (4,595) – (4,397)<br />

Intangible assets 178 620 (2,061) (275) (1,716)<br />

Tax losses 254 24,742 – (22,515) 2,227<br />

Deferred tax on overseas earnings (13) – (1,796) – (1,796)<br />

Other temporary differences 32 3,254 (877) (1,322) 1,055<br />

31 March 2012 (341) 28,814 (9,329) (24,112) (4,627)<br />

At 31 March 2012 deferred tax assets and liabilities were analysed in the statement of financial position, after offset of balances within countries, as:<br />

£m<br />

Deferred tax asset 1,970<br />

Deferred tax liability (6,597)<br />

31 March 2012 (4,627)<br />

Factors affecting the tax charge in future years<br />

Factors that may affect the Group’s future tax charge include the impact of corporate restructurings, the resolution of open issues, future planning,<br />

corporate acquisitions and disposals, the use of brought forward tax losses and changes in tax legislation and tax rates.<br />

<strong>The</strong> Group is routinely subject to audit by tax authorities in the territories in which it operates, and specifically, in India these are usually resolved<br />

through the Indian legal system. <strong>The</strong> Group considers each issue on its merits and, where appropriate, holds provisions in respect of the potential<br />

tax liability that may arise. However, the amount ultimately paid may differ materially from the amount accrued and could therefore affect the<br />

Group’s overall profitability and cash flows in future periods.<br />

At 31 March 2013 the gross amount and expiry dates of losses available for carry forward are as follows:<br />

Expiring Expiring<br />

within within<br />

5 years 6–10 years Unlimited Total<br />

£m £m £m £m<br />

Losses for which a deferred tax asset is recognised 343 – 8,423 8,766<br />

Losses for which no deferred tax is recognised 1,845 691 94,705 97,241<br />

2,188 691 103,128 106,007<br />

At 31 March 2012 the gross amount and expiry dates of losses available for carry forward are as follows:<br />

Expiring Expiring<br />

within within<br />

5 years 6–10 years Unlimited Total<br />

£m £m £m £m<br />

Losses for which a deferred tax asset is recognised 68 31 8,317 8,416<br />

Losses for which no deferred tax is recognised 1,838 670 82,912 85,420<br />

1,906 701 91,229 93,836<br />

<strong>The</strong> losses arising on the write down of investments in Germany are available to use against both German federal and trade tax liabilities. Losses<br />

of £3,236 million (2012: £3,804 million) are included in the above table on which a deferred tax asset has been recognised. <strong>The</strong> Group has not<br />

recognised a deferred tax asset on £12,346 million (2012: £11,547 million) of the losses as it is uncertain that these losses will be utilised.<br />

Included above are losses amounting to £7,104 million (2012: £1,907 million) in respect of UK subsidiaries which are only available for offset against<br />

future capital gains and since it is uncertain whether these losses will be utilised, no deferred tax asset has been recognised. <strong>The</strong> losses have<br />

increased since the prior year, following the acquisition of CWW.<br />

<strong>The</strong> losses above also include £70,644 million (2012: £72,696 million) that have arisen in overseas holding companies as a result of revaluations<br />

of those companies’ investments for local GAAP purposes. No deferred tax asset is recognised in respect of £66,110 million of these losses<br />

as it is uncertain whether these losses will be utilised. A deferred tax asset of £1,325 million (2012: £1,164 million) has been recognised for the<br />

remainder of these losses which relate to a fiscal unity in Luxembourg as we expect the members of this fiscal unity to generate taxable profits<br />

against which these losses will be used.<br />

In addition to the above, we have an acquired £7,642 million of losses in overseas holding companies following our purchase of CWW, for which<br />

no deferred tax asset has been recognised.<br />

<strong>The</strong> remaining losses relate to a number of other jurisdictions across the Group. <strong>The</strong>re are also £5,918 million (2012: £7,283 million) of unrecognised<br />

other temporary differences.