The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview<br />

Business<br />

review Performance Governance Financials<br />

Commentary on the consolidated statement of changes in equity<br />

<strong>The</strong> consolidated statement of changes in equity<br />

shows the movements in equity shareholders’ funds<br />

and non‑controlling interests. Equity shareholders<br />

funds decreased by ‑7.1% to £71.5 billion as the<br />

profit for the year was more than offset by the<br />

purchase of our own shares under the share buyback<br />

programmes and equity dividends paid.<br />

Further details on the major movements in the year are set out below:<br />

Acquisition of non-controlling interest<br />

We did not acquire any significant non‑controlling interests in the<br />

current year. In the year ended 31 March 2012 we acquired an additional<br />

stake in <strong>Vodafone</strong> India.<br />

Purchase of own shares<br />

We acquired 894 million of our own shares at a cost of £1.5 billion in the<br />

year. <strong>The</strong>se arose from the two share buyback programmes that were<br />

in place.<br />

a We initiated a £4.0 billion share buyback programme following<br />

the disposal of our entire 44% interest in SFR to Vivendi on 16 June<br />

2011. Under this programme, which was completed in August 2012,<br />

we purchased a total of 2,330,039,575 shares at an average price per<br />

share, including transaction costs, of 171.67 pence.<br />

a Following the receipt of a US$3.8 billion (£2.4 billion) income<br />

dividend from VZW in December 2012, we initiated a £1.5 billion<br />

share buyback programme. <strong>The</strong> Group placed irrevocable purchase<br />

instructions with a third party to enable shares to be repurchased<br />

on our behalf when we may otherwise have been prohibited from<br />

buying in the market.<br />

<strong>The</strong> aggregate number of shares and the amount of consideration paid<br />

by the Company in relation to the £1.5 billion buyback programme<br />

at 20 May 2013 was 406 million and £0.7 billion respectively.<br />

<strong>The</strong> maximum value of shares that may yet be purchased under the<br />

programme at 20 May 2013 is £0.8 billion.<br />

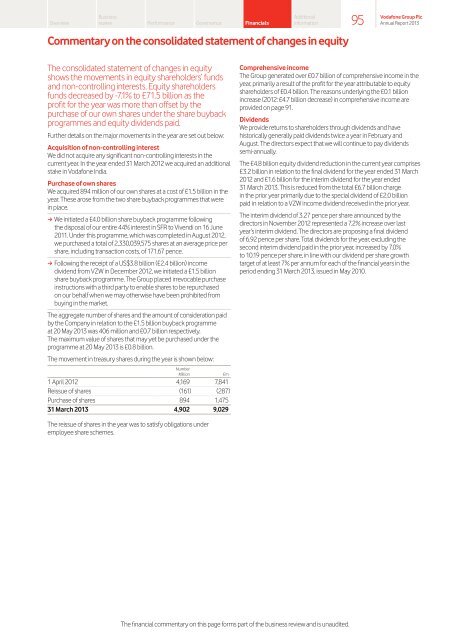

<strong>The</strong> movement in treasury shares during the year is shown below:<br />

Number<br />

Million £m<br />

1 April 2012 4,169 7,841<br />

Reissue of shares (161) (287)<br />

Purchase of shares 894 1,475<br />

31 March 2013 4,902 9,029<br />

<strong>The</strong> reissue of shares in the year was to satisfy obligations under<br />

employee share schemes.<br />

Additional<br />

information<br />

Comprehensive income<br />

<strong>The</strong> Group generated over £0.7 billion of comprehensive income in the<br />

year, primarily a result of the profit for the year attributable to equity<br />

shareholders of £0.4 billion. <strong>The</strong> reasons underlying the £0.1 billion<br />

increase (2012: £4.7 billion decrease) in comprehensive income are<br />

provided on page 91.<br />

Dividends<br />

We provide returns to shareholders through dividends and have<br />

historically generally paid dividends twice a year in February and<br />

August. <strong>The</strong> directors expect that we will continue to pay dividends<br />

semi‑annually.<br />

<strong>The</strong> £4.8 billion equity dividend reduction in the current year comprises<br />

£3.2 billion in relation to the final dividend for the year ended 31 March<br />

2012 and £1.6 billion for the interim dividend for the year ended<br />

31 March 2013. This is reduced from the total £6.7 billion charge<br />

in the prior year primarily due to the special dividend of £2.0 billion<br />

paid in relation to a VZW income dividend received in the prior year.<br />

<strong>The</strong> interim dividend of 3.27 pence per share announced by the<br />

directors in November 2012 represented a 7.2% increase over last<br />

year’s interim dividend. <strong>The</strong> directors are proposing a final dividend<br />

of 6.92 pence per share. Total dividends for the year, excluding the<br />

second interim dividend paid in the prior year, increased by 7.0%<br />

to 10.19 pence per share, in line with our dividend per share growth<br />

target of at least 7% per annum for each of the financial years in the<br />

period ending 31 March 2013, issued in May 2010.<br />

<strong>The</strong> financial commentary on this page forms part of the business review and is unaudited.<br />

95<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013