The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview<br />

Business<br />

review Performance Governance Financials<br />

11. Acquisitions and disposals<br />

Additional<br />

information<br />

109<br />

We made a number of business acquisitions during the year, the two largest being Cable & Wireless Worldwide<br />

plc and TelstraClear Limited. See below for further details of the net assets acquired and the goodwill arising.<br />

<strong>The</strong> note also provides details of our disposals of our interests in SFR and Polkomtel in the prior year.<br />

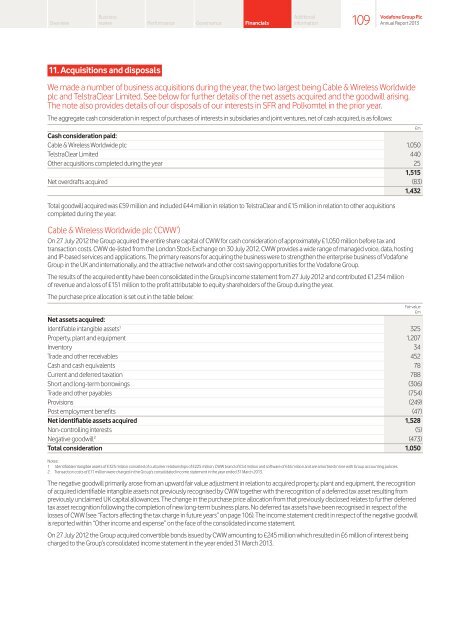

<strong>The</strong> aggregate cash consideration in respect of purchases of interests in subsidiaries and joint ventures, net of cash acquired, is as follows:<br />

Cash consideration paid:<br />

Cable & Wireless Worldwide plc 1,050<br />

TelstraClear Limited 440<br />

Other acquisitions completed during the year 25<br />

1,515<br />

Net overdrafts acquired (83)<br />

1,432<br />

Total goodwill acquired was £59 million and included £44 million in relation to TelstraClear and £15 million in relation to other acquisitions<br />

completed during the year.<br />

Cable & Wireless Worldwide plc (‘CWW’)<br />

On 27 July 2012 the Group acquired the entire share capital of CWW for cash consideration of approximately £1,050 million before tax and<br />

transaction costs. CWW de‑listed from the London Stock Exchange on 30 July 2012. CWW provides a wide range of managed voice, data, hosting<br />

and IP‑based services and applications. <strong>The</strong> primary reasons for acquiring the business were to strengthen the enterprise business of <strong>Vodafone</strong><br />

Group in the UK and internationally, and the attractive network and other cost saving opportunities for the <strong>Vodafone</strong> Group.<br />

<strong>The</strong> results of the acquired entity have been consolidated in the Group’s income statement from 27 July 2012 and contributed £1,234 million<br />

of revenue and a loss of £151 million to the profit attributable to equity shareholders of the Group during the year.<br />

<strong>The</strong> purchase price allocation is set out in the table below:<br />

Net assets acquired:<br />

Identifiable intangible assets 1 325<br />

Property, plant and equipment 1,207<br />

Inventory 34<br />

Trade and other receivables 452<br />

Cash and cash equivalents 78<br />

Current and deferred taxation 788<br />

Short and long-term borrowings (306)<br />

Trade and other payables (754)<br />

Provisions (249)<br />

Post employment benefits (47)<br />

Net identifiable assets acquired 1,528<br />

Non-controlling interests (5)<br />

Negative goodwill 2 (473)<br />

Total consideration 1,050<br />

Notes:<br />

1 Identifiable intangible assets of £325 million consisted of customer relationships of £225 million, CWW brand of £54 million and software of £46 million and are amortised in line with Group accounting policies.<br />

2 Transaction costs of £11 million were charged in the Group’s consolidated income statement in the year ended 31 March 2013.<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

<strong>The</strong> negative goodwill primarily arose from an upward fair value adjustment in relation to acquired property, plant and equipment, the recognition<br />

of acquired identifiable intangible assets not previously recognised by CWW together with the recognition of a deferred tax asset resulting from<br />

previously unclaimed UK capital allowances. <strong>The</strong> change in the purchase price allocation from that previously disclosed relates to further deferred<br />

tax asset recognition following the completion of new long‑term business plans. No deferred tax assets have been recognised in respect of the<br />

losses of CWW (see “Factors affecting the tax charge in future years” on page 106). <strong>The</strong> income statement credit in respect of the negative goodwill<br />

is reported within “Other income and expense” on the face of the consolidated income statement.<br />

On 27 July 2012 the Group acquired convertible bonds issued by CWW amounting to £245 million which resulted in £6 million of interest being<br />

charged to the Group’s consolidated income statement in the year ended 31 March 2013.<br />

£m<br />

Fair value<br />

£m