The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

114<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes to the consolidated financial statements (continued)<br />

12. Impairment review (continued)<br />

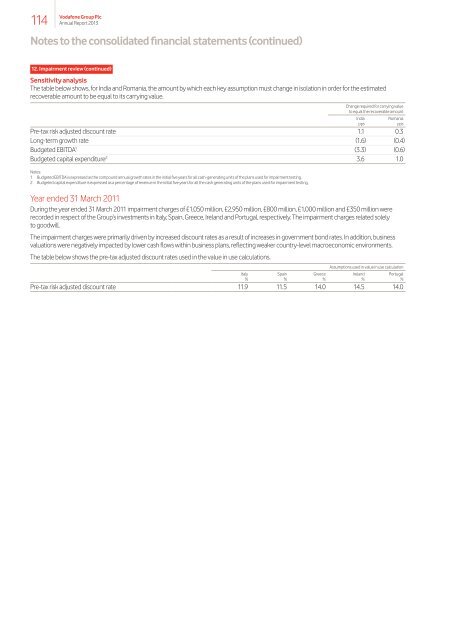

Sensitivity analysis<br />

<strong>The</strong> table below shows, for India and Romania, the amount by which each key assumption must change in isolation in order for the estimated<br />

recoverable amount to be equal to its carrying value.<br />

Change required for carrying value<br />

to equal the recoverable amount<br />

India Romania<br />

pps pps<br />

Pre‑tax risk adjusted discount rate 1.1 0.3<br />

Long-term growth rate (1.6) (0.4)<br />

Budgeted EBITDA 1 (3.3) (0.6)<br />

Budgeted capital expenditure 2 3.6 1.0<br />

Notes:<br />

1 Budgeted EBITDA is expressed as the compound annual growth rates in the initial five years for all cash‑generating units of the plans used for impairment testing.<br />

2 Budgeted capital expenditure is expressed as a percentage of revenue in the initial five years for all the cash generating units of the plans used for impairment testing.<br />

Year ended 31 March 2011<br />

During the year ended 31 March 2011 impairment charges of £1,050 million, £2,950 million, £800 million, £1,000 million and £350 million were<br />

recorded in respect of the Group’s investments in Italy, Spain, Greece, Ireland and Portugal, respectively. <strong>The</strong> impairment charges related solely<br />

to goodwill.<br />

<strong>The</strong> impairment charges were primarily driven by increased discount rates as a result of increases in government bond rates. In addition, business<br />

valuations were negatively impacted by lower cash flows within business plans, reflecting weaker country‑level macroeconomic environments.<br />

<strong>The</strong> table below shows the pre‑tax adjusted discount rates used in the value in use calculations.<br />

Assumptions used in value in use calculation<br />

Italy Spain Greece Ireland Portugal<br />

% % % % %<br />

Pre‑tax risk adjusted discount rate 11.9 11.5 14.0 14.5 14.0