The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview<br />

Business<br />

review Performance Governance Financials<br />

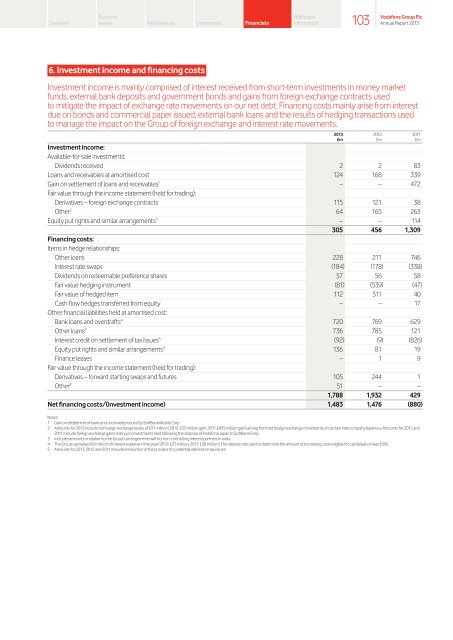

6. Investment income and financing costs<br />

Additional<br />

information<br />

103<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Investment income is mainly comprised of interest received from short‑term investments in money market<br />

funds, external bank deposits and government bonds and gains from foreign exchange contracts used<br />

to mitigate the impact of exchange rate movements on our net debt. Financing costs mainly arise from interest<br />

due on bonds and commercial paper issued, external bank loans and the results of hedging transactions used<br />

to manage the impact on the Group of foreign exchange and interest rate movements.<br />

2013 2012 2011<br />

£m £m £m<br />

Investment income:<br />

Available-for-sale investments:<br />

Dividends received 2 2 83<br />

Loans and receivables at amortised cost 124 168 339<br />

Gain on settlement of loans and receivables 1 – – 472<br />

Fair value through the income statement (held for trading):<br />

Derivatives – foreign exchange contracts 115 121 38<br />

Other 2 64 165 263<br />

Equity put rights and similar arrangements 3 – – 114<br />

305 456 1,309<br />

Financing costs:<br />

Items in hedge relationships:<br />

Other loans 228 211 746<br />

Interest rate swaps (184) (178) (338)<br />

Dividends on redeemable preference shares 57 56 58<br />

Fair value hedging instrument (81) (539) (47)<br />

Fair value of hedged item 112 511 40<br />

Cash flow hedges transferred from equity – – 17<br />

Other financial liabilities held at amortised cost:<br />

Bank loans and overdrafts 4 720 769 629<br />

Other loans 2 736 785 121<br />

Interest credit on settlement of tax issues 5 (92) (9) (826)<br />

Equity put rights and similar arrangements 3 136 81 19<br />

Finance leases – 1 9<br />

Fair value through the income statement (held for trading):<br />

Derivatives – forward starting swaps and futures 105 244 1<br />

Other 2 51 – –<br />

1,788 1,932 429<br />

Net financing costs/(investment income) 1,483 1,476 (880)<br />

Notes:<br />

1 Gain on settlement of loans and receivables issued by SoftBank Mobile Corp.<br />

2 Amounts for 2013 include net foreign exchange losses of £91 million (2012: £55 million gain; 2011 £405 million gain) arising from net foreign exchange movements on certain intercompany balances. Amounts for 2012 and<br />

2011 include foreign exchange gains arising on investments held following the disposal of <strong>Vodafone</strong> Japan to SoftBank Corp.<br />

3 Includes amounts in relation to the Group’s arrangements with its non‑controlling interest partners in India.<br />

4 <strong>The</strong> Group capitalised £8 million of interest expense in the year (2012: £25 million; 2011: £38 million). <strong>The</strong> interest rate used to determine the amount of borrowing costs eligible for capitalisation was 5.6%.<br />

5 Amounts for 2013, 2012 and 2011 include a reduction of the provision for potential interest on tax issues.