The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

142<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes to the consolidated financial statements (continued)<br />

A5. Post employment benefits<br />

We operate a number of defined benefit and defined contribution pension plans for our employees.<br />

<strong>The</strong> Group’s largest defined benefit schemes are in the UK.<br />

Background<br />

At 31 March 2013 the Group operated a number of pension plans for the benefit of its employees throughout the world, with varying rights and<br />

obligations depending on the conditions and practices in the countries concerned. <strong>The</strong> Group’s pension plans are provided through both defined<br />

benefit and defined contribution arrangements. Defined benefit schemes provide benefits based on the employees’ length of pensionable service<br />

and their final pensionable salary or other criteria. Defined contribution schemes offer employees individual funds that are converted into benefits<br />

at the time of retirement.<br />

<strong>The</strong> Group operates defined benefit schemes in Germany, Ghana, Ireland, Italy, India, the UK and the US. Defined contribution pension schemes are<br />

currently provided in Australia, Egypt, Germany, Greece, Hungary, Ireland, Italy, Malta, the Netherlands, New Zealand, Portugal, South Africa, Spain,<br />

the UK and the US. <strong>The</strong> Group’s principal defined benefit pension schemes in the UK, being the <strong>Vodafone</strong> Group Plc Pension Scheme (‘<strong>Vodafone</strong><br />

UK plan’) and the Cable & Wireless Worldwide Retirement Plan (‘CWWRP’), are closed to new entrants and additionally the <strong>Vodafone</strong> UK plan has<br />

been closed to future accrual for existing members since 31 March 2010.<br />

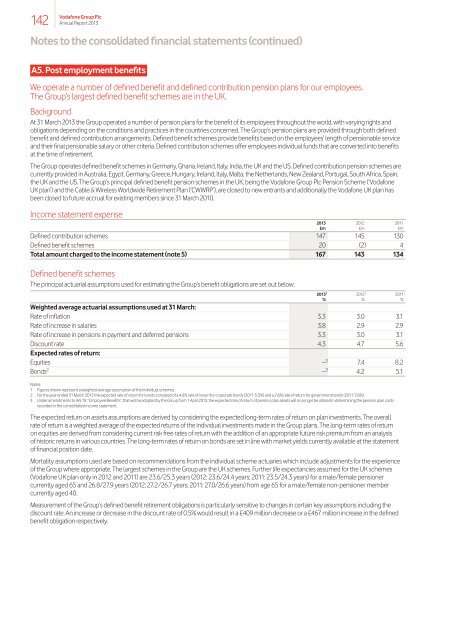

Income statement expense<br />

2013 2012 2011<br />

£m £m £m<br />

Defined contribution schemes 147 145 130<br />

Defined benefit schemes 20 (2) 4<br />

Total amount charged to the income statement (note 5) 167 143 134<br />

Defined benefit schemes<br />

<strong>The</strong> principal actuarial assumptions used for estimating the Group’s benefit obligations are set out below:<br />

2013 1 2012 1 2011 1<br />

% % %<br />

Weighted average actuarial assumptions used at 31 March:<br />

Rate of inflation 3.3 3.0 3.1<br />

Rate of increase in salaries 3.8 2.9 2.9<br />

Rate of increase in pensions in payment and deferred pensions 3.3 3.0 3.1<br />

Discount rate 4.3 4.7 5.6<br />

Expected rates of return:<br />

Equities – 3 7.4 8.2<br />

Bonds 2 – 3 4.2 5.1<br />

Notes:<br />

1 Figures shown represent a weighted average assumption of the individual schemes.<br />

2 For the year ended 31 March 2012 the expected rate of return for bonds consisted of a 4.6% rate of return for corporate bonds (2011: 5.3%) and a 2.6% rate of return for government bonds (2011: 3.6%).<br />

3 Under amendments to IAS 19, “Employee Benefits”, that will be adopted by the Group from 1 April 2013, the expected rate of return of pension plan assets will no longer be utilised in determining the pension plan costs<br />

recorded in the consolidated income statement.<br />

<strong>The</strong> expected return on assets assumptions are derived by considering the expected long-term rates of return on plan investments. <strong>The</strong> overall<br />

rate of return is a weighted average of the expected returns of the individual investments made in the Group plans. <strong>The</strong> long-term rates of return<br />

on equities are derived from considering current risk free rates of return with the addition of an appropriate future risk premium from an analysis<br />

of historic returns in various countries. <strong>The</strong> long-term rates of return on bonds are set in line with market yields currently available at the statement<br />

of financial position date.<br />

Mortality assumptions used are based on recommendations from the individual scheme actuaries which include adjustments for the experience<br />

of the Group where appropriate. <strong>The</strong> largest schemes in the Group are the UK schemes. Further life expectancies assumed for the UK schemes<br />

(<strong>Vodafone</strong> UK plan only in 2012 and 2011) are 23.6/25.3 years (2012: 23.6/24.4 years; 2011: 23.5/24.3 years) for a male/female pensioner<br />

currently aged 65 and 26.8/27.9 years (2012: 27.2/26.7 years; 2011: 27.0/26.6 years) from age 65 for a male/female non-pensioner member<br />

currently aged 40.<br />

Measurement of the Group’s defined benefit retirement obligations is particularly sensitive to changes in certain key assumptions including the<br />

discount rate. An increase or decrease in the discount rate of 0.5% would result in a £409 million decrease or a £467 million increase in the defined<br />

benefit obligation respectively.