The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

144<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes to the consolidated financial statements (continued)<br />

A5. Post employment benefits (continued)<br />

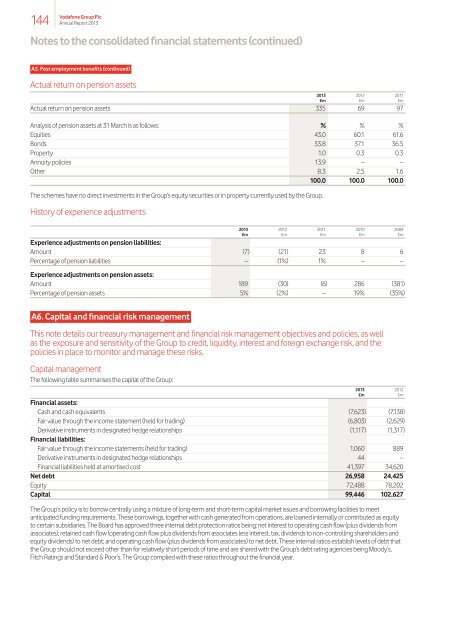

Actual return on pension assets<br />

2013 2012 2011<br />

£m £m £m<br />

Actual return on pension assets 335 69 97<br />

Analysis of pension assets at 31 March is as follows: % % %<br />

Equities 43.0 60.1 61.6<br />

Bonds 33.8 37.1 36.5<br />

Property 1.0 0.3 0.3<br />

Annuity policies 13.9 – –<br />

Other 8.3 2.5 1.6<br />

100.0 100.0 100.0<br />

<strong>The</strong> schemes have no direct investments in the Group’s equity securities or in property currently used by the Group.<br />

History of experience adjustments<br />

2013 2012 2011 2010 2009<br />

£m £m £m £m £m<br />

Experience adjustments on pension liabilities:<br />

Amount (7) (21) 23 8 6<br />

Percentage of pension liabilities – (1%) 1% – –<br />

Experience adjustments on pension assets:<br />

Amount 189 (30) (6) 286 (381)<br />

Percentage of pension assets 5% (2%) – 19% (35%)<br />

A6. Capital and financial risk management<br />

This note details our treasury management and financial risk management objectives and policies, as well<br />

as the exposure and sensitivity of the Group to credit, liquidity, interest and foreign exchange risk, and the<br />

policies in place to monitor and manage these risks.<br />

Capital management<br />

<strong>The</strong> following table summarises the capital of the Group:<br />

2013 2012<br />

£m £m<br />

Financial assets:<br />

Cash and cash equivalents (7,623) (7,138)<br />

Fair value through the income statement (held for trading) (6,803) (2,629)<br />

Derivative instruments in designated hedge relationships (1,117) (1,317)<br />

Financial liabilities:<br />

Fair value through the income statements (held for trading) 1,060 889<br />

Derivative instruments in designated hedge relationships 44 –<br />

Financial liabilities held at amortised cost 41,397 34,620<br />

Net debt 26,958 24,425<br />

Equity 72,488 78,202<br />

Capital 99,446 102,627<br />

<strong>The</strong> Group’s policy is to borrow centrally using a mixture of long-term and short-term capital market issues and borrowing facilities to meet<br />

anticipated funding requirements. <strong>The</strong>se borrowings, together with cash generated from operations, are loaned internally or contributed as equity<br />

to certain subsidiaries. <strong>The</strong> Board has approved three internal debt protection ratios being: net interest to operating cash flow (plus dividends from<br />

associates); retained cash flow (operating cash flow plus dividends from associates less interest, tax, dividends to non-controlling shareholders and<br />

equity dividends) to net debt; and operating cash flow (plus dividends from associates) to net debt. <strong>The</strong>se internal ratios establish levels of debt that<br />

the Group should not exceed other than for relatively short periods of time and are shared with the Group’s debt rating agencies being Moody’s,<br />

Fitch Ratings and Standard & Poor’s. <strong>The</strong> Group complied with these ratios throughout the financial year.