The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview<br />

Business<br />

review Performance Governance Financials<br />

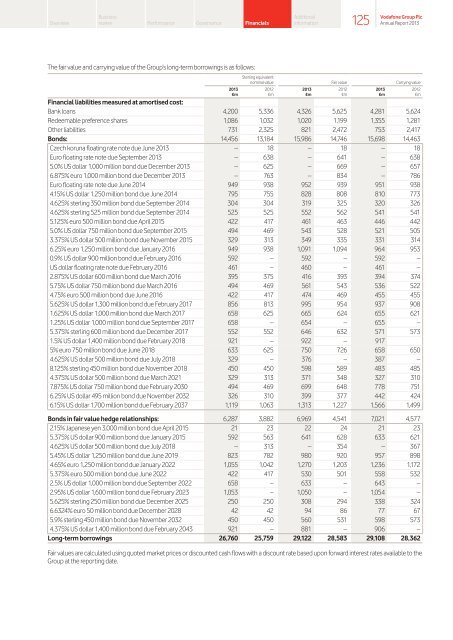

<strong>The</strong> fair value and carrying value of the Group’s long-term borrowings is as follows:<br />

Additional<br />

information<br />

125<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Sterling equivalent<br />

nominal value Fair value Carrying value<br />

2013 2012 2013 2012 2013 2012<br />

£m £m £m £m £m £m<br />

Financial liabilities measured at amortised cost:<br />

Bank loans 4,200 5,336 4,326 5,625 4,281 5,624<br />

Redeemable preference shares 1,086 1,032 1,020 1,199 1,355 1,281<br />

Other liabilities 731 2,325 821 2,472 753 2,417<br />

Bonds: 14,456 13,184 15,986 14,746 15,698 14,463<br />

Czech koruna floating rate note due June 2013 – 18 – 18 – 18<br />

Euro floating rate note due September 2013 – 638 – 641 – 638<br />

5.0% US dollar 1,000 million bond due December 2013 – 625 – 669 – 657<br />

6.875% euro 1,000 million bond due December 2013 – 763 – 834 – 786<br />

Euro floating rate note due June 2014 949 938 952 939 951 938<br />

4.15% US dollar 1,250 million bond due June 2014 795 755 828 808 810 773<br />

4.625% sterling 350 million bond due September 2014 304 304 319 325 320 326<br />

4.625% sterling 525 million bond due September 2014 525 525 552 562 541 541<br />

5.125% euro 500 million bond due April 2015 422 417 461 463 446 442<br />

5.0% US dollar 750 million bond due September 2015 494 469 543 528 521 505<br />

3.375% US dollar 500 million bond due November 2015 329 313 349 335 331 314<br />

6.25% euro 1,250 million bond due January 2016 949 938 1,091 1,094 964 953<br />

0.9% US dollar 900 million bond due February 2016 592 – 592 – 592 –<br />

US dollar floating rate note due February 2016 461 – 460 – 461 –<br />

2.875% US dollar 600 million bond due March 2016 395 375 416 393 394 374<br />

5.75% US dollar 750 million bond due March 2016 494 469 561 543 536 522<br />

4.75% euro 500 million bond due June 2016 422 417 474 469 455 455<br />

5.625% US dollar 1,300 million bond due February 2017 856 813 995 954 937 908<br />

1.625% US dollar 1,000 million bond due March 2017 658 625 665 624 655 621<br />

1.25% US dollar 1,000 million bond due September 2017 658 – 654 – 655 –<br />

5.375% sterling 600 million bond due December 2017 552 552 646 632 571 573<br />

1.5% US dollar 1,400 million bond due February 2018 921 – 922 – 917<br />

5% euro 750 million bond due June 2018 633 625 750 726 658 650<br />

4.625% US dollar 500 million bond due July 2018 329 – 376 – 387 –<br />

8.125% sterling 450 million bond due November 2018 450 450 598 589 483 485<br />

4.375% US dollar 500 million bond due March 2021 329 313 371 348 327 310<br />

7.875% US dollar 750 million bond due February 2030 494 469 699 648 778 751<br />

6.25% US dollar 495 million bond due November 2032 326 310 399 377 442 424<br />

6.15% US dollar 1,700 million bond due February 2037 1,119 1,063 1,313 1,227 1,566 1,499<br />

Bonds in fair value hedge relationships: 6,287 3,882 6,969 4,541 7,021 4,577<br />

2.15% Japanese yen 3,000 million bond due April 2015 21 23 22 24 21 23<br />

5.375% US dollar 900 million bond due January 2015 592 563 641 628 633 621<br />

4.625% US dollar 500 million bond due July 2018 – 313 – 354 – 367<br />

5.45% US dollar 1,250 million bond due June 2019 823 782 980 920 957 898<br />

4.65% euro 1,250 million bond due January 2022 1,055 1,042 1,270 1,203 1,236 1,172<br />

5.375% euro 500 million bond due June 2022 422 417 530 501 558 532<br />

2.5% US dollar 1,000 million bond due September 2022 658 – 633 – 643 –<br />

2.95% US dollar 1,600 million bond due February 2023 1,053 – 1,050 – 1,054 –<br />

5.625% sterling 250 million bond due December 2025 250 250 308 294 338 324<br />

6.6324% euro 50 million bond due December 2028 42 42 94 86 77 67<br />

5.9% sterling 450 million bond due November 2032 450 450 560 531 598 573<br />

4.375% US dollar 1,400 million bond due February 2043 921 – 881 – 906 –<br />

Long-term borrowings 26,760 25,759 29,122 28,583 29,108 28,362<br />

Fair values are calculated using quoted market prices or discounted cash flows with a discount rate based upon forward interest rates available to the<br />

Group at the reporting date.