The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview<br />

Business<br />

review Performance Governance Financials<br />

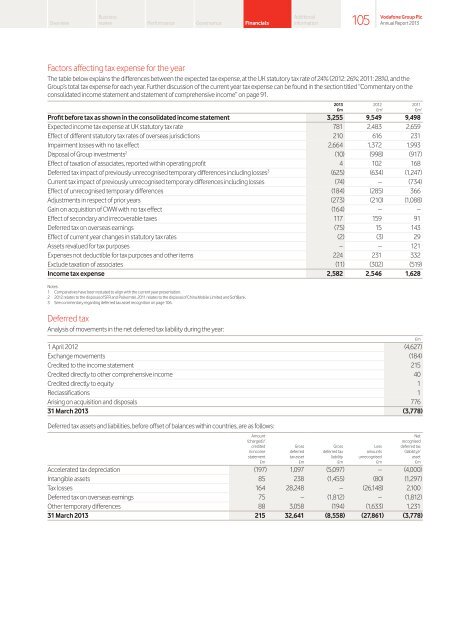

Factors affecting tax expense for the year<br />

<strong>The</strong> table below explains the differences between the expected tax expense, at the UK statutory tax rate of 24% (2012: 26%; 2011: 28%), and the<br />

Group’s total tax expense for each year. Further discussion of the current year tax expense can be found in the section titled “Commentary on the<br />

consolidated income statement and statement of comprehensive income” on page 91.<br />

2013 2012 2011<br />

£m £m 1 £m 1<br />

Profit before tax as shown in the consolidated income statement 3,255 9,549 9,498<br />

Expected income tax expense at UK statutory tax rate 781 2,483 2,659<br />

Effect of different statutory tax rates of overseas jurisdictions 210 616 231<br />

Impairment losses with no tax effect 2,664 1,372 1,993<br />

Disposal of Group investments 2 (10) (998) (917)<br />

Effect of taxation of associates, reported within operating profit 4 102 168<br />

Deferred tax impact of previously unrecognised temporary differences including losses 3 (625) (634) (1,247)<br />

Current tax impact of previously unrecognised temporary differences including losses (74) – (734)<br />

Effect of unrecognised temporary differences (184) (285) 366<br />

Adjustments in respect of prior years (273) (210) (1,088)<br />

Gain on acquisition of CWW with no tax effect (164) – –<br />

Effect of secondary and irrecoverable taxes 117 159 91<br />

Deferred tax on overseas earnings (75) 15 143<br />

Effect of current year changes in statutory tax rates (2) (3) 29<br />

Assets revalued for tax purposes – – 121<br />

Expenses not deductible for tax purposes and other items 224 231 332<br />

Exclude taxation of associates (11) (302) (519)<br />

Income tax expense 2,582 2,546 1,628<br />

Notes:<br />

1 Comparatives have been restated to align with the current year presentation.<br />

2 2012 relates to the disposal of SFR and Polkomtel. 2011 relates to the disposal of China Mobile Limited and SoftBank.<br />

3 See commentary regarding deferred tax asset recognition on page 106.<br />

Deferred tax<br />

Analysis of movements in the net deferred tax liability during the year:<br />

£m<br />

1 April 2012 (4,627)<br />

Exchange movements (184)<br />

Credited to the income statement 215<br />

Credited directly to other comprehensive income 40<br />

Credited directly to equity 1<br />

Reclassifications 1<br />

Arising on acquisition and disposals 776<br />

31 March 2013 (3,778)<br />

Deferred tax assets and liabilities, before offset of balances within countries, are as follows:<br />

Additional<br />

information<br />

105<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Amount Net<br />

(charged)/ recognised<br />

credited Gross Gross Less deferred tax<br />

in income deferred deferred tax amounts (liability)/<br />

statement tax asset liability unrecognised asset<br />

£m £m £m £m £m<br />

Accelerated tax depreciation (197) 1,097 (5,097) – (4,000)<br />

Intangible assets 85 238 (1,455) (80) (1,297)<br />

Tax losses 164 28,248 – (26,148) 2,100<br />

Deferred tax on overseas earnings 75 – (1,812) – (1,812)<br />

Other temporary differences 88 3,058 (194) (1,633) 1,231<br />

31 March 2013 215 32,641 (8,558) (27,861) (3,778)