The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

128<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes to the consolidated financial statements (continued)<br />

24. Borrowings (continued)<br />

Borrowing facilities<br />

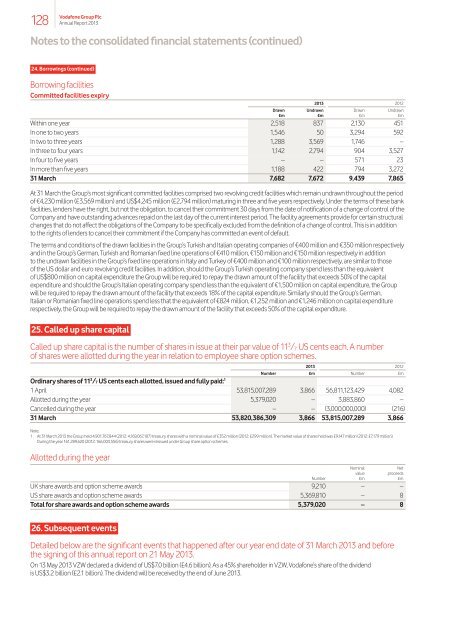

Committed facilities expiry<br />

2013 2012<br />

Drawn Undrawn Drawn Undrawn<br />

£m £m £m £m<br />

Within one year 2,518 837 2,130 451<br />

In one to two years 1,546 50 3,294 592<br />

In two to three years 1,288 3,569 1,746 –<br />

In three to four years 1,142 2,794 904 3,527<br />

In four to five years – – 571 23<br />

In more than five years 1,188 422 794 3,272<br />

31 March 7,682 7,672 9,439 7,865<br />

At 31 March the Group’s most significant committed facilities comprised two revolving credit facilities which remain undrawn throughout the period<br />

of €4,230 million (£3,569 million) and US$4,245 million (£2,794 million) maturing in three and five years respectively. Under the terms of these bank<br />

facilities, lenders have the right, but not the obligation, to cancel their commitment 30 days from the date of notification of a change of control of the<br />

Company and have outstanding advances repaid on the last day of the current interest period. <strong>The</strong> facility agreements provide for certain structural<br />

changes that do not affect the obligations of the Company to be specifically excluded from the definition of a change of control. This is in addition<br />

to the rights of lenders to cancel their commitment if the Company has committed an event of default.<br />

<strong>The</strong> terms and conditions of the drawn facilities in the Group’s Turkish and Italian operating companies of €400 million and €350 million respectively<br />

and in the Group’s German, Turkish and Romanian fixed line operations of €410 million, €150 million and €150 million respectively in addition<br />

to the undrawn facilities in the Group’s fixed line operations in Italy and Turkey of €400 million and €100 million respectively, are similar to those<br />

of the US dollar and euro revolving credit facilities. In addition, should the Group’s Turkish operating company spend less than the equivalent<br />

of US$800 million on capital expenditure the Group will be required to repay the drawn amount of the facility that exceeds 50% of the capital<br />

expenditure and should the Group’s Italian operating company spend less than the equivalent of €1,500 million on capital expenditure, the Group<br />

will be required to repay the drawn amount of the facility that exceeds 18% of the capital expenditure. Similarly should the Group’s German,<br />

Italian or Romanian fixed line operations spend less that the equivalent of €824 million, €1,252 million and €1,246 million on capital expenditure<br />

respectively, the Group will be required to repay the drawn amount of the facility that exceeds 50% of the capital expenditure.<br />

25. Called up share capital<br />

Called up share capital is the number of shares in issue at their par value of 11 3 /7 US cents each. A number<br />

of shares were allotted during the year in relation to employee share option schemes.<br />

2013 2012<br />

Number £m Number £m<br />

Ordinary shares of 11 3 /7 US cents each allotted, issued and fully paid: 1<br />

1 April 53,815,007,289 3,866 56,811,123,429 4,082<br />

Allotted during the year 5,379,020 – 3,883,860 –<br />

Cancelled during the year – – (3,000,000,000) (216)<br />

31 March 53,820,386,309 3,866 53,815,007,289 3,866<br />

Note:<br />

1 At 31 March 2013 the Group held 4,901,767,844 (2012: 4,169,067,107) treasury shares with a nominal value of £352 million (2012: £299 million). <strong>The</strong> market value of shares held was £9,147 million (2012: £7,179 million).<br />

During the year 161,289,620 (2012: 166,003,556) treasury shares were reissued under Group share option schemes.<br />

Allotted during the year<br />

Nominal Net<br />

value proceeds<br />

Number £m £m<br />

UK share awards and option scheme awards 9,210 – –<br />

US share awards and option scheme awards 5,369,810 – 8<br />

Total for share awards and option scheme awards 5,379,020 – 8<br />

26. Subsequent events<br />

Detailed below are the significant events that happened after our year end date of 31 March 2013 and before<br />

the signing of this annual report on 21 May 2013.<br />

On 13 May 2013 VZW declared a dividend of US$7.0 billion (£4.6 billion). As a 45% shareholder in VZW, <strong>Vodafone</strong>’s share of the dividend<br />

is US$3.2 billion (£2.1 billion). <strong>The</strong> dividend will be received by the end of June 2013.