The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview<br />

Business<br />

review Performance Governance Financials<br />

Commentary on the consolidated statement of cash flows<br />

<strong>The</strong> consolidated statement of cash flows shows the<br />

cash flows from operating, investing and financing<br />

activities for the year. Cash and cash equivalents<br />

at the end of the financial year increased 7.2%<br />

to £7.6 billion. We have maintained a robust liquidity<br />

position throughout the year enabling us to service<br />

shareholder returns, debt and expansion through<br />

capital investment. This position has been achieved<br />

through cash generated from operations, dividends<br />

from associates, and borrowings through shortterm<br />

and long-term debt issued through the capital<br />

markets. We expect these to be our key sources<br />

of liquidity for the foreseeable future. We also<br />

have access to the committed facilities detailed<br />

on page 157.<br />

Our liquidity and working capital may be affected by a material decrease<br />

in cash flow due to a number of factors as outlined in “Principal risk<br />

factors and uncertainties” on pages 46 to 49. We do not use non‑<br />

consolidated special purpose entities as a source of liquidity or for other<br />

financing purposes.<br />

Purchase of interest in subsidiaries and joint ventures,<br />

net of cash acquired<br />

During the year we acquired CWW and TelstraClear for cash<br />

consideration of £1.1 billion and £0.4 billion respectively. Further details<br />

on the assets and liabilities acquired are outlined in note 11.<br />

Purchase of intangible assets<br />

<strong>The</strong> purchase of intangible assets was primarily in relation to spectrum.<br />

We acquired spectrum in the UK, the Netherlands, Romania, Egypt and<br />

India, totalling £2.5 billion during the year.<br />

Disposal of interests in associates and joint ventures<br />

In the prior year we disposed of our 44% interest in SFR and our 24.4%<br />

interest in Polkomtel for proceeds of £6.8 billion and £0.8 billion<br />

respectively. <strong>The</strong>re were no significant disposals in the current year.<br />

Disposal of investments<br />

In April 2012 we received the remaining consideration of £1.5 billion<br />

from the disposal of our interests in SoftBank Mobile Corp.<br />

Purchase of investments<br />

<strong>The</strong> Group purchases short-term investments as part of its treasury<br />

strategy. See note 16.<br />

Dividends received from associates<br />

Dividends received from associates increased by 20.0% to £4.8 billion,<br />

primarily due to dividends received from VZW. <strong>The</strong> Group received<br />

an income dividend of £2.4 billion (2012: £2.9 billion) and also tax<br />

distributions totalling £2.4 billion (2012: £1.0 billion) during the year.<br />

Proceeds from issues of long-term debt<br />

<strong>The</strong> Group issued bonds, under its US shelf programme,<br />

in September 2012 and February 2013 of US$2.0 billion (£1.2 billion)<br />

and US$6.0 billion (£3.9 billion) respectively.<br />

Purchase of treasury shares<br />

During the year the Group completed the £4.0 billion share<br />

buyback programme announced in 2011 and also initiated<br />

a £1.5 billion programme on receipt of the income dividend from<br />

VZW in December 2012.<br />

Equity dividends paid<br />

Equity dividends paid during the year decreased by ‑27.7%, primarily<br />

due to the payment of a special dividend in the prior year. <strong>The</strong> special<br />

dividend was paid following the receipt of an income dividend from VZW.<br />

Other transactions with non-controlling shareholders<br />

in subsidiaries<br />

In the year ended 31 March 2012 we acquired an additional stake<br />

in <strong>Vodafone</strong> India.<br />

Additional<br />

information<br />

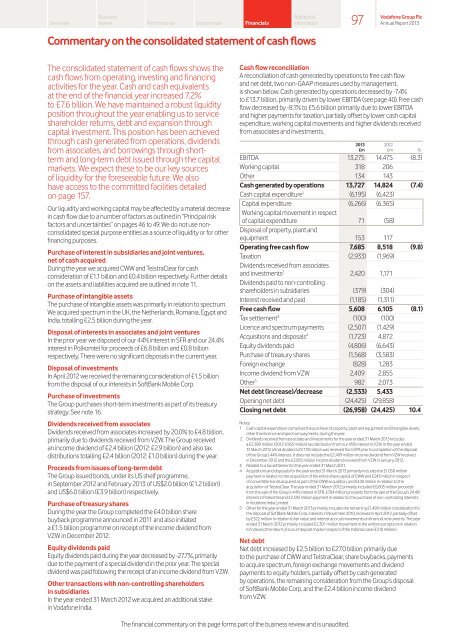

Cash flow reconciliation<br />

A reconciliation of cash generated by operations to free cash flow<br />

and net debt, two non-GAAP measures used by management,<br />

is shown below. Cash generated by operations decreased by ‑7.4%<br />

to £13.7 billion, primarily driven by lower EBITDA (see page 40). Free cash<br />

flow decreased by ‑8.1% to £5.6 billion primarily due to lower EBITDA<br />

and higher payments for taxation, partially offset by lower cash capital<br />

expenditure, working capital movements and higher dividends received<br />

from associates and investments.<br />

2013 2012<br />

£m £m %<br />

EBITDA 13,275 14,475 (8.3)<br />

Working capital 318 206<br />

Other 134 143<br />

Cash generated by operations 13,727 14,824 (7.4)<br />

Cash capital expenditure 1 (6,195) (6,423)<br />

Capital expenditure (6,266) (6,365)<br />

Working capital movement in respect<br />

of capital expenditure 71 (58)<br />

Disposal of property, plant and<br />

equipment 153 117<br />

Operating free cash flow 7,685 8,518 (9.8)<br />

Taxation (2,933) (1,969)<br />

Dividends received from associates<br />

and investments 2 2,420 1,171<br />

Dividends paid to non-controlling<br />

shareholders in subsidiaries (379) (304)<br />

Interest received and paid (1,185) (1,311)<br />

Free cash flow 5,608 6,105 (8.1)<br />

Tax settlement 3 (100) (100)<br />

Licence and spectrum payments (2,507) (1,429)<br />

Acquisitions and disposals 4 (1,723) 4,872<br />

Equity dividends paid (4,806) (6,643)<br />

Purchase of treasury shares (1,568) (3,583)<br />

Foreign exchange (828) 1,283<br />

Income dividend from VZW 2,409 2,855<br />

Other 5 982 2,073<br />

Net debt (increase)/decrease (2,533) 5,433<br />

Opening net debt (24,425) (29,858)<br />

Closing net debt (26,958) (24,425) 10.4<br />

Notes:<br />

1 Cash capital expenditure comprises the purchase of property, plant and equipment and intangible assets,<br />

other than licence and spectrum payments, during the year.<br />

2 Dividends received from associates and investments for the year ended 31 March 2013 includes<br />

a £2,389 million (2012: £965 million) tax distribution from our 45% interest in VZW. In the year ended<br />

31 March 2012 a final dividend of £178 million was received from SFR prior to completion of the disposal<br />

of the Group’s 44% interest . It does not include the £2,409 million income dividend from VZW received<br />

in December 2012 and the £2,855 million income dividend received from VZW in January 2012.<br />

3 Related to a tax settlement in the year ended 31 March 2011.<br />

4 Acquisitions and disposals for the year ended 31 March 2013 primarily includes the £1,050 million<br />

payment in relation to the acquisition of the entire share capital of CWW and £243 million in respect<br />

of convertible bonds acquired as part of the CWW acquisition, and £440 million in relation to the<br />

acquisition of TelstraClear. <strong>The</strong> year ended 31 March 2012 primarily included £6,805 million proceeds<br />

from the sale of the Group’s 44% interest in SFR, £784 million proceeds from the sale of the Group’s 24.4%<br />

interest in Polkomtel and £2,592 million payment in relation to the purchase of non‑controlling interests<br />

in <strong>Vodafone</strong> India Limited.<br />

5 Other for the year ended 31 March 2013 primarily includes the remaining £1,499 million consideration for<br />

the disposal of SoftBank Mobile Corp. interests in November 2010, received in April 2012, partially offset<br />

by £322 million in relation to fair value and interest accrual movements on financial instruments. <strong>The</strong> year<br />

ended 31 March 2012 primarily included £2,301 million movement in the written put options in relation<br />

to India and the return of a court deposit made in respect of the India tax case (£310 million).<br />

Net debt<br />

Net debt increased by £2.5 billion to £27.0 billion primarily due<br />

to the purchase of CWW and TelstraClear, share buybacks, payments<br />

to acquire spectrum, foreign exchange movements and dividend<br />

payments to equity holders, partially offset by cash generated<br />

by operations, the remaining consideration from the Group’s disposal<br />

of SoftBank Mobile Corp. and the £2.4 billion income dividend<br />

from VZW.<br />

<strong>The</strong> financial commentary on this page forms part of the business review and is unaudited.<br />

97<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013