The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

94<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

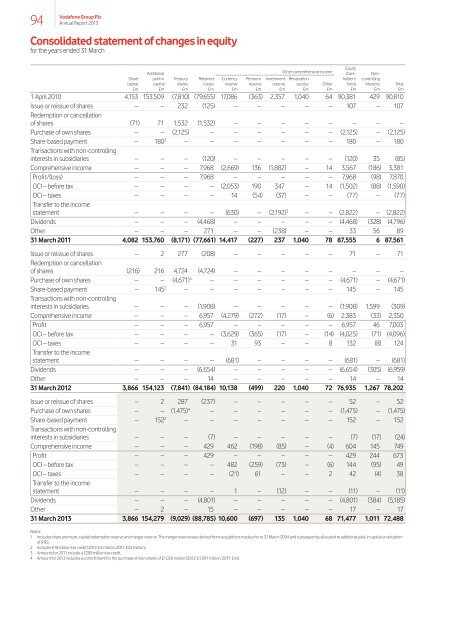

Consolidated statement of changes in equity<br />

for the years ended 31 March<br />

Other comprehensive income<br />

Additional share‑ Non‑<br />

Share paid‑in Treasury Retained Currency Pensions Investment Revaluation holders’ controlling<br />

capital capital 1 shares losses reserve reserve reserve surplus Other funds interests Total<br />

£m £m £m £m £m £m £m £m £m £m £m £m<br />

1 April 2010 4,153 153,509 (7,810) (79,655) 17,086 (363) 2,357 1,040 64 90,381 429 90,810<br />

Issue or reissue of shares – – 232 (125) – – – – – 107 – 107<br />

Redemption or cancellation<br />

of shares (71) 71 1,532 (1,532) – – – – – – – –<br />

Purchase of own shares – – (2,125) – – – – – – (2,125) – (2,125)<br />

Share-based payment – 180 2 – – – – – – – 180 – 180<br />

Transactions with non-controlling<br />

interests in subsidiaries – – – (120) – – – – – (120) 35 (85)<br />

Comprehensive income – – – 7,968 (2,669) 136 (1,882) – 14 3,567 (186) 3,381<br />

Profit/(loss) – – – 7,968 – – – – – 7,968 (98) 7,870<br />

OCI – before tax – – – – (2,053) 190 347 – 14 (1,502) (88) (1,590)<br />

OCI – taxes – – – – 14 (54) (37) – – (77) – (77)<br />

Transfer to the income<br />

statement – – – – (630) – (2,192) 3 – – (2,822) – (2,822)<br />

Dividends – – – (4,468) – – – – – (4,468) (328) (4,796)<br />

Other – – – 271 – – (238) – – 33 56 89<br />

31 March 2011 4,082 153,760 (8,171) (77,661) 14,417 (227) 237 1,040 78 87,555 6 87,561<br />

Issue or reissue of shares – 2 277 (208) – – – – – 71 – 71<br />

Redemption or cancellation<br />

of shares (216) 216 4,724 (4,724) – – – – – – – –<br />

Purchase of own shares – – (4,671) 4 – – – – – – (4,671) – (4,671)<br />

Share-based payment – 145 2 – – – – – – – 145 – 145<br />

Transactions with non-controlling<br />

interests in subsidiaries – – – (1,908) – – – – – (1,908) 1,599 (309)<br />

Comprehensive income – – – 6,957 (4,279) (272) (17) – (6) 2,383 (33) 2,350<br />

Profit – – – 6,957 – – – – – 6,957 46 7,003<br />

OCI – before tax – – – – (3,629) (365) (17) – (14) (4,025) (71) (4,096)<br />

OCI – taxes – – – – 31 93 – – 8 132 (8) 124<br />

Transfer to the income<br />

statement – – – – (681) – – – – (681) – (681)<br />

Dividends – – – (6,654) – – – – – (6,654) (305) (6,959)<br />

Other – – – 14 – – – – – 14 – 14<br />

31 March 2012 3,866 154,123 (7,841) (84,184) 10,138 (499) 220 1,040 72 76,935 1,267 78,202<br />

Issue or reissue of shares – 2 287 (237) – – – – – 52 – 52<br />

Purchase of own shares – – (1,475) 4 – – – – – – (1,475) – (1,475)<br />

Share-based payment – 152 2 – – – – – – – 152 – 152<br />

Transactions with non-controlling<br />

interests in subsidiaries – – – (7) – – – – – (7) (17) (24)<br />

Comprehensive income – – – 429 462 (198) (85) – (4) 604 145 749<br />

Profit – – – 429 – – – – – 429 244 673<br />

OCI – before tax – – – – 482 (259) (73) – (6) 144 (95) 49<br />

OCI – taxes – – – – (21) 61 – – 2 42 (4) 38<br />

Transfer to the income<br />

statement – – – – 1 – (12) – – (11) – (11)<br />

Dividends – – – (4,801) – – – – – (4,801) (384) (5,185)<br />

Other – 2 – 15 – – – – – 17 – 17<br />

31 March 2013 3,866 154,279 (9,029) (88,785) 10,600 (697) 135 1,040 68 71,477 1,011 72,488<br />

Notes:<br />

1 Includes share premium, capital redemption reserve and merger reserve. <strong>The</strong> merger reserve was derived from acquisitions made prior to 31 March 2004 and subsequently allocated to additional paid‑in capital on adoption<br />

of IFRS.<br />

2 Includes £18 million tax credit (2012: £2 million; 2011: £24 million).<br />

3 Amounts for 2011 include a £208 million tax credit.<br />

4 Amount for 2013 includes a commitment for the purchase of own shares of £1,026 million (2012: £1,091 million; 2011: £nil).<br />

Equity