The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview<br />

Business<br />

review Performance Governance Financials<br />

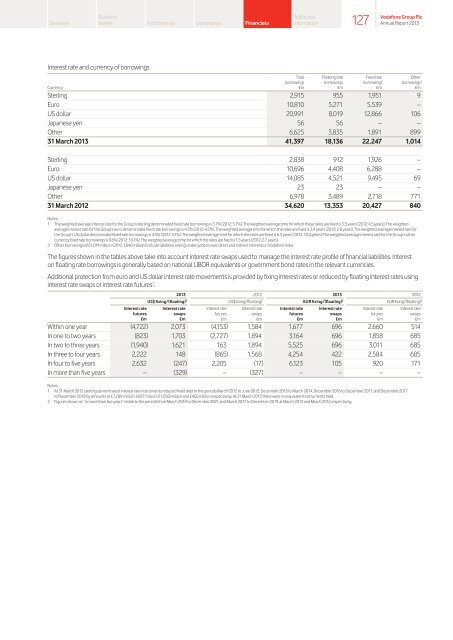

Interest rate and currency of borrowings<br />

Additional<br />

information<br />

Total Floating rate Fixed rate Other<br />

borrowings borrowings borrowings 1 borrowings 2<br />

Currency £m £m £m £m<br />

Sterling 2,915 955 1,951 9<br />

Euro 10,810 5,271 5,539 –<br />

US dollar 20,991 8,019 12,866 106<br />

Japanese yen 56 56 – –<br />

Other 6,625 3,835 1,891 899<br />

31 March 2013 41,397 18,136 22,247 1,014<br />

Sterling 2,838 912 1,926 –<br />

Euro 10,696 4,408 6,288 –<br />

US dollar 14,085 4,521 9,495 69<br />

Japanese yen 23 23 – –<br />

Other 6,978 3,489 2,718 771<br />

31 March 2012 34,620 13,353 20,427 840<br />

Notes:<br />

1 <strong>The</strong> weighted average interest rate for the Group’s sterling denominated fixed rate borrowings is 5.7% (2012: 5.7%). <strong>The</strong> weighted average time for which these rates are fixed is 3.5 years (2012: 4.5 years). <strong>The</strong> weighted<br />

average interest rate for the Group’s euro denominated fixed rate borrowings is 4.3% (2012: 4.2%). <strong>The</strong> weighted average time for which the rates are fixed is 2.4 years (2012: 2.8 years). <strong>The</strong> weighted average interest rate for<br />

the Group’s US dollar denominated fixed rate borrowings is 4.3% (2012: 5.1%). <strong>The</strong> weighted average time for which the rates are fixed is 6.3 years (2012: 10.0 years). <strong>The</strong> weighted average interest rate for the Group’s other<br />

currency fixed rate borrowings is 9.6% (2012: 10.1%). <strong>The</strong> weighted average time for which the rates are fixed is 1.5 years (2012: 2.7 years).<br />

2 Other borrowings of £1,014 million (2012: £840 million) include liabilities arising under options over direct and indirect interests in <strong>Vodafone</strong> India.<br />

<strong>The</strong> figures shown in the tables above take into account interest rate swaps used to manage the interest rate profile of financial liabilities. Interest<br />

on floating rate borrowings is generally based on national LIBOR equivalents or government bond rates in the relevant currencies.<br />

Additional protection from euro and US dollar interest rate movements is provided by fixing interest rates or reduced by floating interest rates using<br />

interest rate swaps or interest rate futures 1 .<br />

2013 2012 2013 2012<br />

US$ fixing/(floating) 2 US$ fixing/(floating) 2 EUR fixing/(floating) 2 EUR fixing/(floating) 2<br />

Interest rate Interest rate<br />

Interest rate Interest rate<br />

Interest rate Interest rate<br />

Interest rate Interest rate<br />

futures<br />

swaps<br />

futures<br />

swaps<br />

futures<br />

swaps<br />

futures<br />

swaps<br />

£m £m £m £m £m £m £m £m<br />

Within one year (4,722) 2,073 (4,153) 1,584 1,677 696 2,660 514<br />

In one to two years (823) 1,703 (2,727) 1,894 3,164 696 1,858 685<br />

In two to three years (1,940) 1,621 163 1,894 5,525 696 3,011 685<br />

In three to four years 2,222 148 (865) 1,568 4,254 422 2,584 685<br />

In four to five years 2,632 (247) 2,205 (17) 6,123 105 920 171<br />

In more than five years – (329) – (327) – – – –<br />

127<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes:<br />

1 At 31 March 2012 sterling denominated interest rate instruments reduced fixed debt in the periods March 2012 to June 2012, December 2013 to March 2014, December 2016 to December 2017, and December 2017<br />

to December 2018 by amounts of £7,289 million, £667 million, £1,050 million and £450 million respectively. At 31 March 2013 there were no equivalent instruments held.<br />

2 Figures shown as “in more than five years” relate to the periods from March 2018 to December 2021 and March 2017 to December 2019, at March 2013 and March 2012 respectively.