The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

164<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013<br />

Notes to the Company financial statements (continued)<br />

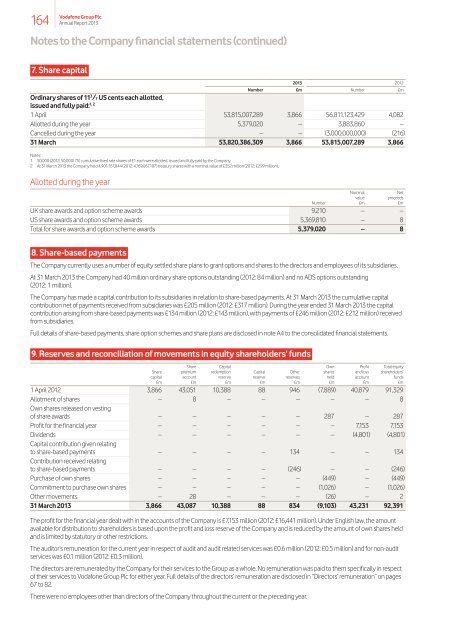

7. Share capital<br />

2013 2012<br />

Number £m Number £m<br />

Ordinary shares of 11 3 /7 US cents each allotted,<br />

1, 2<br />

issued and fully paid:<br />

1 April 53,815,007,289 3,866 56,811,123,429 4,082<br />

Allotted during the year 5,379,020 – 3,883,860 –<br />

Cancelled during the year – – (3,000,000,000) (216)<br />

31 March 53,820,386,309 3,866 53,815,007,289 3,866<br />

Notes:<br />

1 50,000 (2012: 50,000) 7% cumulative fixed rate shares of £1 each were allotted, issued and fully paid by the Company.<br />

2 At 31 March 2013 the Company held 4,901,767,844 (2012: 4,169,067,107) treasury shares with a nominal value of £352 million (2012: £299 million).<br />

Allotted during the year<br />

Nominal Net<br />

value proceeds<br />

Number £m £m<br />

UK share awards and option scheme awards 9,210 – –<br />

US share awards and option scheme awards 5,369,810 – 8<br />

Total for share awards and option scheme awards 5,379,020 – 8<br />

8. Share-based payments<br />

<strong>The</strong> Company currently uses a number of equity settled share plans to grant options and shares to the directors and employees of its subsidiaries.<br />

At 31 March 2013 the Company had 40 million ordinary share options outstanding (2012: 84 million) and no ADS options outstanding<br />

(2012: 1 million).<br />

<strong>The</strong> Company has made a capital contribution to its subsidiaries in relation to share-based payments. At 31 March 2013 the cumulative capital<br />

contribution net of payments received from subsidiaries was £205 million (2012: £317 million). During the year ended 31 March 2013 the capital<br />

contribution arising from share-based payments was £134 million (2012: £143 million), with payments of £246 million (2012: £212 million) received<br />

from subsidiaries.<br />

Full details of share-based payments, share option schemes and share plans are disclosed in note A4 to the consolidated financial statements.<br />

9. Reserves and reconciliation of movements in equity shareholders’ funds<br />

Share Capital Own Profit Total equity<br />

Share premium redemption Capital Other shares and loss shareholders’<br />

capital account reserve reserve reserves held account funds<br />

£m £m £m £m £m £m £m £m<br />

1 April 2012 3,866 43,051 10,388 88 946 (7,889) 40,879 91,329<br />

Allotment of shares – 8 – – – – – 8<br />

Own shares released on vesting<br />

of share awards – – – – – 287 – 287<br />

Profit for the financial year – – – – – – 7,153 7,153<br />

Dividends – – – – – – (4,801) (4,801)<br />

Capital contribution given relating<br />

to share-based payments – – – – 134 – – 134<br />

Contribution received relating<br />

to share-based payments – – – – (246) – – (246)<br />

Purchase of own shares – – – – – (449) – (449)<br />

Commitment to purchase own shares – – – – – (1,026) – (1,026)<br />

Other movements – 28 – – – (26) – 2<br />

31 March 2013 3,866 43,087 10,388 88 834 (9,103) 43,231 92,391<br />

<strong>The</strong> profit for the financial year dealt with in the accounts of the Company is £7,153 million (2012: £16,441 million). Under English law, the amount<br />

available for distribution to shareholders is based upon the profit and loss reserve of the Company and is reduced by the amount of own shares held<br />

and is limited by statutory or other restrictions.<br />

<strong>The</strong> auditor’s remuneration for the current year in respect of audit and audit related services was £0.6 million (2012: £0.5 million) and for non-audit<br />

services was £0.1 million (2012: £0.3 million).<br />

<strong>The</strong> directors are remunerated by the Company for their services to the Group as a whole. No remuneration was paid to them specifically in respect<br />

of their services to <strong>Vodafone</strong> Group Plc for either year. Full details of the directors’ remuneration are disclosed in “Directors’ remuneration” on pages<br />

67 to 82.<br />

<strong>The</strong>re were no employees other than directors of the Company throughout the current or the preceding year.