The way ahead? - Vodafone

The way ahead? - Vodafone

The way ahead? - Vodafone

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview<br />

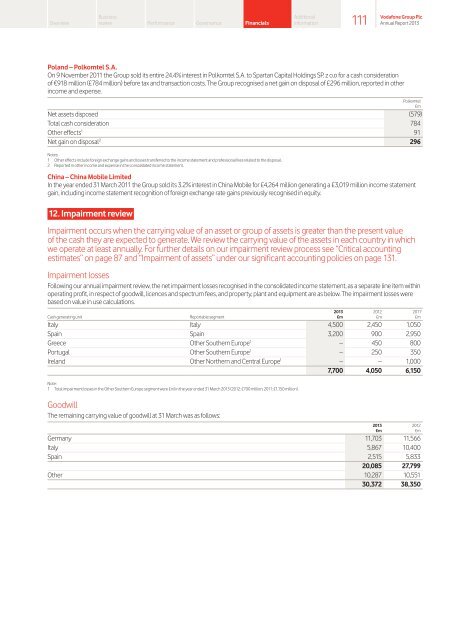

Poland – Polkomtel S.A.<br />

On 9 November 2011 the Group sold its entire 24.4% interest in Polkomtel S.A. to Spartan Capital Holdings SP. z o.o for a cash consideration<br />

of €918 million (£784 million) before tax and transaction costs. <strong>The</strong> Group recognised a net gain on disposal of £296 million, reported in other<br />

income and expense.<br />

Polkomtel<br />

£m<br />

Net assets disposed (579)<br />

Total cash consideration 784<br />

Other effects 1 91<br />

Net gain on disposal 2 296<br />

Notes:<br />

1 Other effects include foreign exchange gains and losses transferred to the income statement and professional fees related to the disposal.<br />

2 Reported in other income and expense in the consolidated income statement.<br />

China – China Mobile Limited<br />

In the year ended 31 March 2011 the Group sold its 3.2% interest in China Mobile for £4,264 million generating a £3,019 million income statement<br />

gain, including income statement recognition of foreign exchange rate gains previously recognised in equity.<br />

12. Impairment review<br />

Business<br />

review Performance Governance Financials<br />

Impairment occurs when the carrying value of an asset or group of assets is greater than the present value<br />

of the cash they are expected to generate. We review the carrying value of the assets in each country in which<br />

we operate at least annually. For further details on our impairment review process see “Critical accounting<br />

estimates” on page 87 and “Impairment of assets” under our significant accounting policies on page 131.<br />

Impairment losses<br />

Following our annual impairment review, the net impairment losses recognised in the consolidated income statement, as a separate line item within<br />

operating profit, in respect of goodwill, licences and spectrum fees, and property, plant and equipment are as below. <strong>The</strong> impairment losses were<br />

based on value in use calculations.<br />

2013 2012 2011 1<br />

Cash generating unit Reportable segment £m £m £m<br />

Italy Italy 4,500 2,450 1,050<br />

Spain Spain 3,200 900 2,950<br />

Greece Other Southern Europe 1 – 450 800<br />

Portugal Other Southern Europe 1 – 250 350<br />

Ireland Other Northern and Central Europe 1 – – 1,000<br />

7,700 4,050 6,150<br />

Note:<br />

1 Total impairment losses in the Other Southern Europe segment were £nil in the year ended 31 March 2013 (2012: £700 million; 2011: £1,150 million).<br />

Goodwill<br />

<strong>The</strong> remaining carrying value of goodwill at 31 March was as follows:<br />

Additional<br />

information<br />

2013 2012<br />

£m £m<br />

Germany 11,703 11,566<br />

Italy 5,867 10,400<br />

Spain 2,515 5,833<br />

20,085 27,799<br />

Other 10,287 10,551<br />

30,372 38,350<br />

111<br />

<strong>Vodafone</strong> Group Plc<br />

Annual Report 2013