- Page 1:

Proceedings e report 90

- Page 4 and 5:

ECOS 2012 : the 25 th International

- Page 7 and 8:

Advisory Committee (Track Organizer

- Page 10 and 11:

The 25 th ECOS Conference 1987-2012

- Page 12 and 13:

VOLUME VI CONTENT VI. 1 CARBON CAPT

- Page 14 and 15:

-----------------------------------

- Page 16 and 17:

» Personal transportation energy c

- Page 18 and 19:

» Excess enthalpies of second gene

- Page 20 and 21:

VOLUME IV IV . 1 - FLUID DYNAMICS A

- Page 22 and 23:

» Exergy analysis and genetic algo

- Page 24 and 25:

» Optimal lighting control strateg

- Page 26 and 27:

» Stability and limit cycles in an

- Page 28 and 29:

PROCEEDINGS OF ECOS 2012 - THE 25 T

- Page 30 and 31:

Fig. 2. The exergy destruction of M

- Page 32 and 33:

ineffectiveness of the catalyst, in

- Page 34 and 35:

[ P EXmth EX SNG] ESR F where EXm

- Page 36 and 37:

Fuel inputkW 728221 203771 237719 3

- Page 38 and 39:

Not only at desined Rc (the ratio o

- Page 40 and 41:

4. DISCUSSION The graphic exergy an

- Page 42 and 43:

Figure 9(a) illustrates the energy

- Page 44 and 45:

Engineering Technical Conferences &

- Page 46 and 47:

generally there are four kinds of m

- Page 48 and 49:

However, even under the off-design

- Page 50 and 51:

Fig. 3. 600MW supercritical coal-fi

- Page 52 and 53:

CO2 rich loading(molCO2/molMEA) 0.4

- Page 54 and 55:

Net efficiency (%) 40.28 30.29 26.4

- Page 56 and 57:

Fig. 11. Schematic diagram of heat

- Page 58 and 59:

28.67%. In addition, through heat i

- Page 60 and 61:

Applied Thermal Engineering 2010;30

- Page 62 and 63:

Abstract: PROCEEDINGS OF ECOS 2012

- Page 64 and 65:

Fig. 1. Solution diagram of „four

- Page 66 and 67:

K ~ K 1 eK 1a p K 1a iK mK

- Page 68 and 69:

Oxygen recovery rate, % 105 95 85 7

- Page 70 and 71:

Calculated optimal compressor press

- Page 72 and 73:

PROCEEDINGS OF ECOS 2012 - THE 25 T

- Page 74 and 75:

The net amount of the flue gas leav

- Page 76 and 77:

Figure 3. Idea for lignite drying b

- Page 78 and 79:

Energy efficiency, % 34,00 33,00 32

- Page 80 and 81:

points efficiency increase related

- Page 82 and 83:

Figure A1b. Thermoflex flow sheet o

- Page 84 and 85:

Figure A3a. Thermoflex flow sheet o

- Page 86 and 87:

Figure A4. Thermoflex flow sheet of

- Page 88 and 89:

Abstract: PROCEEDINGS OF ECOS 2012

- Page 90 and 91:

2.1. Life Cycle Assessment 2.1.1. G

- Page 92 and 93:

these factors. A sensitivity analys

- Page 94 and 95:

methane slip contributes to 13% of

- Page 96 and 97:

As can be seen in Fig. 5 the impact

- Page 98 and 99:

References [1] Eurobserv’er, The

- Page 100 and 101:

PROCEEDINGS OF ECOS 2012 - THE 25 T

- Page 102 and 103:

in which CO2 is separated from H2,

- Page 104 and 105:

dimensions of water droplets and wa

- Page 106 and 107:

Temperature (°C) 8 7 6 5 4 3 2 1 0

- Page 108 and 109:

4. Conclusions In the present paper

- Page 110 and 111:

Abstract: PROCEEDINGS OF ECOS 2012

- Page 112 and 113:

penalty, but without separate captu

- Page 114 and 115:

0.5 - 0.7 kg/kg, resulting typicall

- Page 116 and 117:

3.3 - Utilising waste heat All exis

- Page 118 and 119:

4.5 - Suomusjärvi olivine deposits

- Page 120 and 121:

material will change from a few % t

- Page 122 and 123:

Fig. 5 Schematic diagram of the PFB

- Page 124 and 125:

8. Combined SO2 capture and CO2 min

- Page 126 and 127:

Fig. 10 Carbonate- (left) and sulph

- Page 128 and 129:

[13] Ekdahl, E., Idman, H. Statemen

- Page 130 and 131:

Abstract: PROCEEDINGS OF ECOS 2012

- Page 132 and 133:

HEAT Fig. 1. Scheme and main reacti

- Page 134:

(raw) materials pre-heating and AS

- Page 137 and 138:

Fig 3- Aspen Plus® model 110

- Page 139 and 140:

Table 4. Elemental and XRD analysis

- Page 141 and 142:

the ÅA CSM route. The content of M

- Page 143 and 144:

Abstract: PROCEEDINGS OF ECOS 2012

- Page 145 and 146:

moisture - 0,2237 ash - 0,0876 LHV

- Page 147 and 148:

2.2 CFB plant For the current momen

- Page 149 and 150:

The CO2 emission factor which indic

- Page 151 and 152:

The CO2 emission factor calculated

- Page 153 and 154:

Appendix A Fig A.1. Simulation mode

- Page 155 and 156:

(b) Fig. A.2. Simulation model of C

- Page 157 and 158:

Table A.1. Calculated parameters at

- Page 159 and 160:

References [1] Pfaff I., Oexmann J.

- Page 161 and 162:

with a CC installation could be avo

- Page 163 and 164:

2.3. Basic CHP plant indices. The b

- Page 165 and 166:

3. Off-design calculations The main

- Page 167 and 168:

Fig. 6. CHP plant efficiency Fig. 7

- Page 169 and 170:

amount of steam delivered to the he

- Page 171 and 172:

[5] Lukowicz H., Mroncz M.: Analysi

- Page 173 and 174:

water removal is feasible by coolin

- Page 175 and 176:

Figure 2. Sketch of the suggested P

- Page 177 and 178:

a b Figure 5. a) Exergy balance of

- Page 179 and 180:

The basis of comparison of each met

- Page 181 and 182:

Figure 7a. Impact of S/CATR on PCU

- Page 183 and 184:

However, more energy duty is requir

- Page 185 and 186:

Abstract: PROCEEDINGS OF ECOS 2012

- Page 187 and 188:

3.1. JACOBIAN-ASPEN Interface ASPEN

- Page 189 and 190:

Fig. 3. Triple Pressure Bottoming S

- Page 191 and 192:

As seen from Table 1, the mass flow

- Page 193 and 194:

4. Conclusion Fig. 5. Partial Emiss

- Page 195 and 196:

[19] Yantovski E., Shokotov M., Sho

- Page 197 and 198:

investigation and the developing of

- Page 199 and 200:

University of L’Aquila and German

- Page 201 and 202:

hydrogen combustion technology at d

- Page 203 and 204:

eversibility of a pre-treated synth

- Page 205 and 206:

Fig. 1. TG curves collected for spe

- Page 207 and 208:

(see Fig 5). Carbon dioxide uptake

- Page 209 and 210:

period is reduced to the first 15 c

- Page 211 and 212:

CO2 capture capacity up to 150 th c

- Page 213 and 214:

the way for biogas utilisation is t

- Page 215 and 216:

projectand is described in the foll

- Page 217 and 218:

4. Pilot plant tests In order to de

- Page 219 and 220:

Concerning the absorption reaction,

- Page 221 and 222:

with Regeneration (AwR), consists i

- Page 223 and 224:

[25] Aspen Plus 2004.1. Cambridge,

- Page 225 and 226:

systems for fuel drying waste strea

- Page 227 and 228:

heated in a heat exchanger placed i

- Page 229 and 230:

Fig. 2. Lower heating value of fuel

- Page 231 and 232:

Acknowledgements The results presen

- Page 233 and 234:

large amount of CO2 [1,5-7]. APCr a

- Page 235 and 236:

N 1 i ( x x i n 1 m ) 2.3. Carbon

- Page 237 and 238:

DTA analysis of the untreated APCrs

- Page 239 and 240:

Table 4. Relative Error (%) of the

- Page 241 and 242:

CaO HCl CaCl H O 193kJ / mol (

- Page 243 and 244:

[1] M. Fernández Bertos, S.J.R. Si

- Page 245 and 246:

Abstract: PROCEEDINGS OF ECOS 2012

- Page 247 and 248:

2. Process development 2.1. Backgro

- Page 249 and 250:

to dissolve the chloride salts prec

- Page 251 and 252:

The remaining 25% (5 ml/min) of the

- Page 253 and 254: Table 6. Experimental conversions o

- Page 255 and 256: p p 1 1. 5 p H 1 1. 5 2O p mi

- Page 257 and 258: Calculating from the Aspen Plus mod

- Page 259 and 260: [11] Mattila, H.-P., Experimental s

- Page 261 and 262: Mg2SiO4(s) + 2CO2(g) →2MgCO3(s) +

- Page 263 and 264: (Mg/Fe) of the mineral rock, Mg-sil

- Page 265 and 266: Figure 2. Effect of Mg/Fe ratio of

- Page 267 and 268: Figure 4 shows that an increase in

- Page 269 and 270: Figure 5. Process flow diagram of M

- Page 271 and 272: 2. Only cold utility is needed belo

- Page 273 and 274: extraction process at 400 °C (~ 62

- Page 275 and 276: Table A2. Extraction equations and

- Page 277 and 278: [13] Teir S, Kuusik R, Fogelholm CJ

- Page 279 and 280: In the area of coal technologies al

- Page 281 and 282: Tabel 1. Characteristics quantities

- Page 283 and 284: N m eT 4a ~ T cp T4a 1 ( K

- Page 285 and 286: Auxiliary power rate of ASU, % 40 4

- Page 287 and 288: [8] Buhre B.J.P., Elliott L.K., She

- Page 289 and 290: 1.1 - Cement Manufacturing The ceme

- Page 291 and 292: 2. Numerical model The purpose of t

- Page 293 and 294: -0.309x15.77x2 2.085x3 240x4 12.53x

- Page 295 and 296: Table 4 - Results of the optimizati

- Page 297 and 298: PROCEEDINGS OF ECOS 2012 - THE 25 T

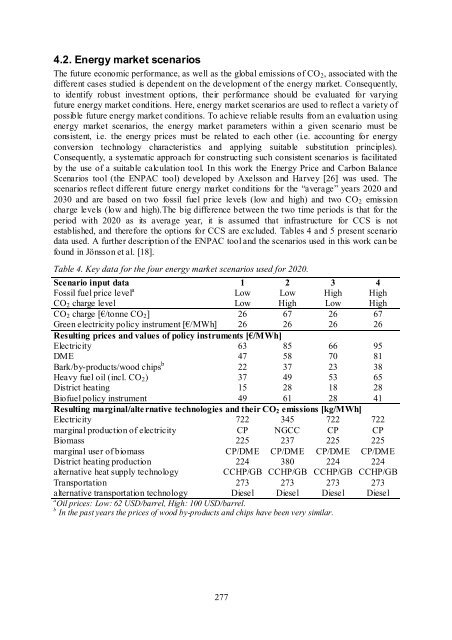

- Page 299 and 300: 1. Define the studied system (in th

- Page 301 and 302: cycle) or a lignin extraction plant

- Page 303: limiting factor for the maximum siz

- Page 307 and 308: Global CO 2 emissions [ktonnes/yr]

- Page 309 and 310: for biofuels and the investment cos

- Page 311 and 312: The possibility to capture CO2 from

- Page 313 and 314: [17] Berglin N, Andersson L. Proces

- Page 315 and 316: Therefore NL Agency (an agency of t

- Page 317 and 318: 2.2.2. Pinch analysis Pinch analysi

- Page 319 and 320: 3. Case study 3.1. Plant and proces

- Page 321 and 322: Te 1000 mp era 900 tur 800 e [°C 7

- Page 323 and 324: Application of the approach led to

- Page 325 and 326: The advantage of dynamic models is

- Page 327 and 328: e equal at both time intervals and

- Page 329 and 330: 2.5. Selecting the number of TSs Se

- Page 331 and 332: A) Time Slices for solar thermal en

- Page 333 and 334: The first step of procedure is to p

- Page 335 and 336: cTSs demand TS solar TSs 0 2 4 6 8

- Page 337 and 338: In the presented paper a framework

- Page 339 and 340: [5] Erdil E, Ilkan M, Egelioglu F.

- Page 341 and 342: PROCEEDINGS OF ECOS 2012 - THE 25 T

- Page 343 and 344: district energy network simulation

- Page 345 and 346: were decreased by 10°C.All scenari

- Page 347 and 348: Site 3 Heat sources Heat load Site

- Page 349 and 350: 3.2.2. Input data and assumptions A

- Page 351 and 352: Fig.7 shows the operation forecast

- Page 353 and 354: [13] TERMIS Operation User Guide, 7

- Page 355 and 356:

Polygeneration is a term used to de

- Page 357 and 358:

The increase in energy utilization

- Page 359 and 360:

are available for an entire year, 8

- Page 361 and 362:

6. Extensions to core methodology 6

- Page 363 and 364:

thermal storage and possible suppor

- Page 365 and 366:

laterites. Ore Geology Reviews, v.

- Page 367 and 368:

Abstract: PROCEEDINGS OF ECOS 2012

- Page 369 and 370:

gasification [15], hybrid biomass g

- Page 371 and 372:

the second reactor. In this unit, s

- Page 373 and 374:

The variables effect was evaluated

- Page 375 and 376:

atio, as well as the shift-syngas f

- Page 377 and 378:

Fig. 4. Effect of operating tempera

- Page 379 and 380:

SDG has slight effect on the syngas

- Page 381:

[26.] Castle WF. Air separation and