Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100 / FINANCIAL STATEMENTS AND NOTES<br />

notes to the Financial Statements<br />

For the 53 weeks ended 29 April <strong>2012</strong><br />

27. Financial Instruments Continued<br />

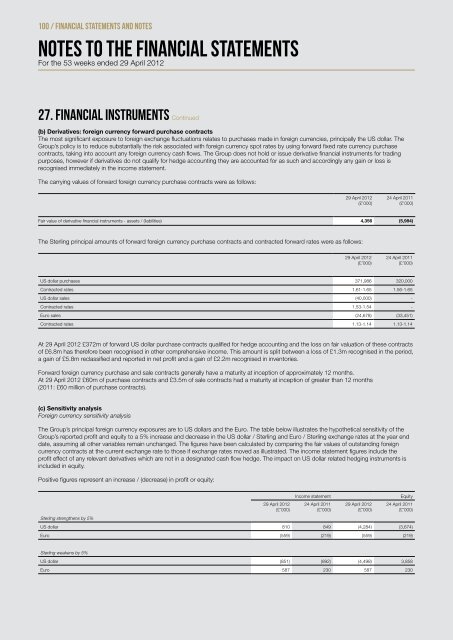

(b) Derivatives: foreign currency forward purchase contracts<br />

The most significant exposure to foreign exchange fluctuations relates to purchases made in foreign currencies, principally the US dollar. The<br />

Group’s policy is to reduce substantially the risk associated with foreign currency spot rates by using forward fixed rate currency purchase<br />

contracts, taking into account any foreign currency cash flows. The Group does not hold or issue derivative financial instruments for trading<br />

purposes, however if derivatives do not qualify for hedge accounting they are accounted for as such and accordingly any gain or loss is<br />

recognised immediately in the income statement.<br />

The carrying values of forward foreign currency purchase contracts were as follows:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Fair value of derivative financial instruments - assets / (liabilities) 4,356 (5,984)<br />

The Sterling principal amounts of forward foreign currency purchase contracts and contracted forward rates were as follows:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

US dollar purchases 371,986 320,000<br />

Contracted rates 1.61-1.65 1.56-1.65<br />

US dollar sales (40,000) -<br />

Contracted rates 1.53-1.54 -<br />

Euro sales (24,678) (33,451)<br />

Contracted rates 1.13-1.14 1.13-1.14<br />

At 29 April <strong>2012</strong> £372m of forward US dollar purchase contracts qualified for hedge accounting and the loss on fair valuation of these contracts<br />

of £6.8m has therefore been recognised in other comprehensive income. This amount is split between a loss of £1.3m recognised in the period,<br />

a gain of £5.8m reclassified and reported in net profit and a gain of £2.2m recognised in inventories.<br />

Forward foreign currency purchase and sale contracts generally have a maturity at inception of approximately 12 months.<br />

At 29 April <strong>2012</strong> £60m of purchase contracts and £3.5m of sale contracts had a maturity at inception of greater than 12 months<br />

(2011: £60 million of purchase contracts).<br />

(c) Sensitivity analysis<br />

Foreign currency sensitivity analysis<br />

The Group’s principal foreign currency exposures are to US dollars and the Euro. The table below illustrates the hypothetical sensitivity of the<br />

Group’s reported profit and equity to a 5% increase and decrease in the US dollar / Sterling and Euro / Sterling exchange rates at the year end<br />

date, assuming all other variables remain unchanged. The figures have been calculated by comparing the fair values of outstanding foreign<br />

currency contracts at the current exchange rate to those if exchange rates moved as illustrated. The income statement figures include the<br />

profit effect of any relevant derivatives which are not in a designated cash flow hedge. The impact on US dollar related hedging instruments is<br />

included in equity.<br />

Positive figures represent an increase / (decrease) in profit or equity:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

Income statement Equity<br />

24 April 2011<br />

(£’000)<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Sterling strengthens by 5%<br />

US dollar 810 849 (4,284) (3,674)<br />

Euro (559) (2<strong>19</strong>) (559) (2<strong>19</strong>)<br />

Sterling weakens by 5%<br />

US dollar (851) (892) (4,498) 3,858<br />

Euro 587 230 587 230

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)