Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

90 / FINANCIAL STATEMENTS AND NOTES<br />

notes to the Financial Statements<br />

For the 53 weeks ended 29 April <strong>2012</strong><br />

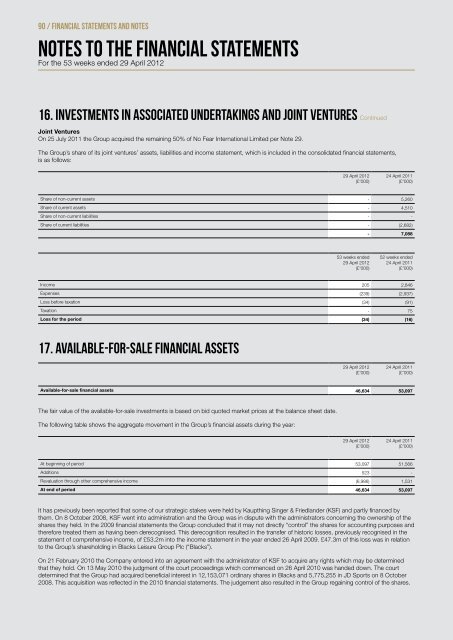

16. Investments in associated undertakings and joint ventures Continued<br />

Joint Ventures<br />

On 25 <strong>July</strong> 2011 the Group acquired the remaining 50% of No Fear <strong>International</strong> Limited per Note 29.<br />

The Group’s share of its joint ventures’ assets, liabilities and income statement, which is included in the consolidated financial statements,<br />

is as follows:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Share of non-current assets - 5,260<br />

Share of current assets - 4,510<br />

Share of non-current liabilities - -<br />

Share of current liabilities - (2,682)<br />

- 7,088<br />

53 weeks ended<br />

29 April <strong>2012</strong><br />

(£’000)<br />

52 weeks ended<br />

24 April 2011<br />

(£’000)<br />

Income 205 2,846<br />

Expenses (239) (2,937)<br />

Loss before taxation (34) (91)<br />

Taxation - 75<br />

Loss for the period (34) (16)<br />

17. Available-for-sale financial assets<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

Available-for-sale financial assets 46,634 53,097<br />

The fair value of the available-for-sale investments is based on bid quoted market prices at the balance sheet date.<br />

The following table shows the aggregate movement in the Group’s financial assets during the year:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

24 April 2011<br />

(£’000)<br />

At beginning of period 53,097 51,566<br />

Additions 523 -<br />

Revaluation through other comprehensive income (6,986) 1,531<br />

At end of period 46,634 53,097<br />

It has previously been reported that some of our strategic stakes were held by Kaupthing Singer & Friedlander (KSF) and partly financed by<br />

them. On 8 October 2008, KSF went into administration and the Group was in dispute with the administrators concerning the ownership of the<br />

shares they held. In the 2009 financial statements the Group concluded that it may not directly “control” the shares for accounting purposes and<br />

therefore treated them as having been derecognised. This derecognition resulted in the transfer of historic losses, previously recognised in the<br />

statement of comprehensive income, of £53.2m into the income statement in the year ended 26 April 2009. £47.3m of this loss was in relation<br />

to the Group’s shareholding in Blacks Leisure Group Plc (“Blacks”).<br />

On 21 February 2010 the Company entered into an agreement with the administrator of KSF to acquire any rights which may be determined<br />

that they hold. On 13 May 2010 the judgment of the court proceedings which commenced on 26 April 2010 was handed down. The court<br />

determined that the Group had acquired beneficial interest in 12,153,071 ordinary shares in Blacks and 5,775,255 in JD <strong>Sports</strong> on 8 October<br />

2008. This acquisition was reflected in the 2010 financial statements. The judgement also resulted in the Group regaining control of the shares.

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)