Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

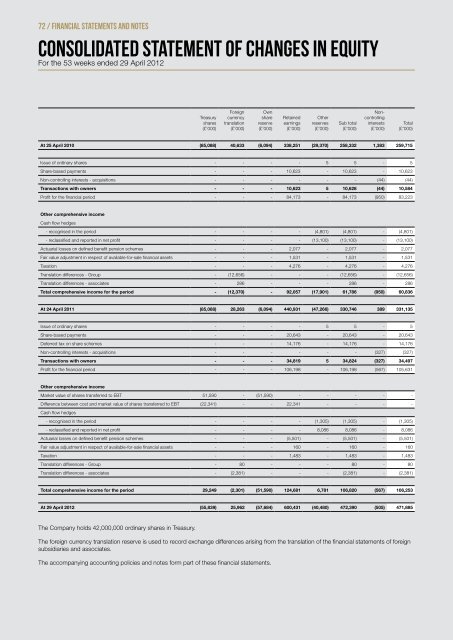

72 / FINANCIAL STATEMENTS AND NOTES<br />

consolidated statement of changes in equity<br />

For the 53 weeks ended 29 April <strong>2012</strong><br />

Treasury<br />

shares<br />

(£’000)<br />

Foreign<br />

currency<br />

translation<br />

(£’000)<br />

Own<br />

share<br />

reserve<br />

(£’000)<br />

Retained<br />

earnings<br />

(£’000)<br />

Other<br />

reserves<br />

(£’000)<br />

Sub total<br />

(£’000)<br />

Noncontrolling<br />

interests<br />

(£’000)<br />

At 25 April 2010 (85,088) 40,633 (6,094) 338,251 (29,370) 258,332 1,383 259,715<br />

Issue of ordinary shares - - - - 5 5 - 5<br />

Share-based payments - - - 10,623 - 10,623 - 10,623<br />

Non-controlling interests - acquisitions - - - - - - (44) (44)<br />

Transactions with owners - - - 10,623 5 10,628 (44) 10,584<br />

Profit for the financial period - - - 84,173 - 84,173 (950) 83,223<br />

Other comprehensive income<br />

Cash flow hedges<br />

- recognised in the period - - - - (4,801) (4,801) - (4,801)<br />

- reclassified and reported in net profit - - - - (13,100) (13,100) - (13,100)<br />

Actuarial losses on defined benefit pension schemes - - - 2,077 - 2,077 - 2,077<br />

Fair value adjustment in respect of available-for-sale financial assets - - - 1,531 - 1,531 - 1,531<br />

Taxation - - - 4,276 - 4,276 - 4,276<br />

Translation differences - Group - (12,656) - - - (12,656) - (12,656)<br />

Translation differences - associates - 286 - - - 286 - 286<br />

Total comprehensive income for the period - (12,370) - 92,057 (17,901) 61,786 (950) 60,836<br />

At 24 April 2011 (85,088) 28,263 (6,094) 440,931 (47,266) 330,746 389 331,135<br />

Issue of ordinary shares - - - - 5 5 - 5<br />

Share-based payments - - - 20,643 - 20,643 - 20,643<br />

Deferred tax on share schemes - - - 14,176 - 14,176 - 14,176<br />

Non-controlling interests - acquisitions - - - - - - (327) (327)<br />

Transactions with owners - - - 34,8<strong>19</strong> 5 34,824 (327) 34,497<br />

Profit for the financial period - - - 106,<strong>19</strong>8 - 106,<strong>19</strong>8 (567) 105,631<br />

Other comprehensive income<br />

Market value of shares transferred to EBT 51,590 - (51,590) - - - - -<br />

Difference between cost and market value of shares transferred to EBT<br />

Cash flow hedges<br />

(22,341) - - 22,341 - - - -<br />

- recognised in the period - - - - (1,305) (1,305) - (1,305)<br />

- reclassified and reported in net profit - - - - 8,086 8,086 - 8,086<br />

Actuarial losses on defined benefit pension schemes - - - (5,501) - (5,501) - (5,501)<br />

Fair value adjustment in respect of available-for-sale financial assets - - - 160 - 160 - 160<br />

Taxation - - - 1,483 - 1,483 - 1,483<br />

Translation differences - Group - 80 - - - 80 - 80<br />

Translation differences - associates - (2,381) - - - (2,381) - (2,381)<br />

Total comprehensive income for the period 29,249 (2,301) (51,590) 124,681 6,781 106,820 (567) 106,253<br />

At 29 April <strong>2012</strong> (55,839) 25,962 (57,684) 600,431 (40,480) 472,390 (505) 471,885<br />

The Company holds 42,000,000 ordinary shares in Treasury.<br />

The foreign currency translation reserve is used to record exchange differences arising from the translation of the financial statements of foreign<br />

subsidiaries and associates.<br />

The accompanying accounting policies and notes form part of these financial statements.<br />

Total<br />

(£’000)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)