Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

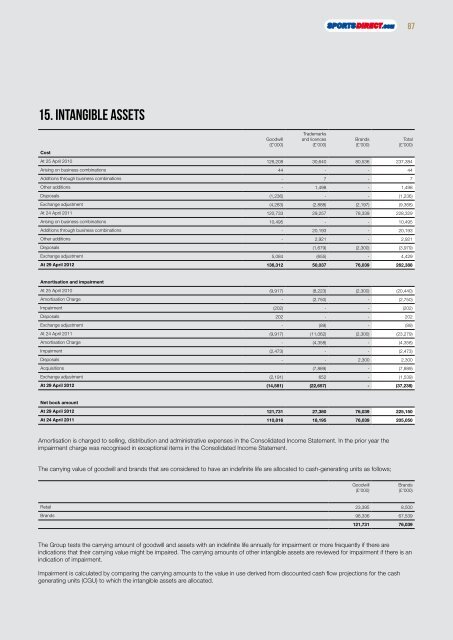

15. Intangible assets<br />

Cost<br />

Goodwill<br />

(£’000)<br />

Trademarks<br />

and licences<br />

(£’000)<br />

At 25 April 2010 126,208 30,640 80,536 237,384<br />

Arising on business combinations 44 - - 44<br />

Additions through business combinations - 7 - 7<br />

Other additions - 1,498 - 1,498<br />

Disposals (1,236) - - (1,236)<br />

Exchange adjustment (4,283) (2,888) (2,<strong>19</strong>7) (9,368)<br />

At 24 April 2011 120,733 29,257 78,339 228,329<br />

Arising on business combinations 10,495 - - 10,495<br />

Additions through business combinations - 20,<strong>19</strong>3 - 20,<strong>19</strong>3<br />

Other additions - 2,921 - 2,921<br />

Disposals (1,679) (2,300) (3,979)<br />

Exchange adjustment 5,084 (655) - 4,429<br />

At 29 April <strong>2012</strong> 136,312 50,037 76,039 262,388<br />

Amortisation and impairment<br />

At 25 April 2010 (9,917) (8,223) (2,300) (20,440)<br />

Amortisation Charge - (2,750) - (2,750)<br />

Impairment (202) - - (202)<br />

Disposals 202 - - 202<br />

Exchange adjustment - (89) - (89)<br />

At 24 April 2011 (9,917) (11,062) (2,300) (23,279)<br />

Amortisation Charge - (4,358) - (4,358)<br />

Impairment (2,473) - - (2,473)<br />

Disposals - - 2,300 2,300<br />

Acquisitions (7,889) - (7,889)<br />

Exchange adjustment (2,<strong>19</strong>1) 652 - (1,539)<br />

At 29 April <strong>2012</strong> (14,581) (22,657) - (37,238)<br />

Net book amount<br />

At 29 April <strong>2012</strong> 121,731 27,380 76,039 225,150<br />

At 24 April 2011 110,816 18,<strong>19</strong>5 76,039 205,050<br />

Amortisation is charged to selling, distribution and administrative expenses in the Consolidated Income Statement. In the prior year the<br />

impairment charge was recognised in exceptional items in the Consolidated Income Statement.<br />

The carrying value of goodwill and brands that are considered to have an indefinite life are allocated to cash-generating units as follows;<br />

Retail 23,395 8,500<br />

Brands 98,336 67,539<br />

Brands<br />

(£’000)<br />

Goodwill<br />

(£’000)<br />

Total<br />

(£’000)<br />

Brands<br />

(£’000)<br />

121,731 76,039<br />

The Group tests the carrying amount of goodwill and assets with an indefinite life annually for impairment or more frequently if there are<br />

indications that their carrying value might be impaired. The carrying amounts of other intangible assets are reviewed for impairment if there is an<br />

indication of impairment.<br />

Impairment is calculated by comparing the carrying amounts to the value in use derived from discounted cash flow projections for the cash<br />

generating units (CGU) to which the intangible assets are allocated.<br />

87

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)