Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Executive</strong> Bonus Share Scheme<br />

The <strong>Executive</strong> Bonus Share Scheme was approved at the<br />

Company’s Annual General Meeting in September 2010 to motivate<br />

and help improve the retention of the <strong>Executive</strong>s and to drive<br />

Underlying Group EBITDA in line with Group strategy.<br />

Subject to continued employment, each <strong>Executive</strong> and two<br />

members of Senior Management will receive one million shares<br />

each in the Company in January 2014 as the Company has<br />

attained the following targets:<br />

Underlying EBITDA of £<strong>19</strong>5m (Net of the cost of the scheme) in<br />

2010-2011; and<br />

Underlying EBITDA / Net Debt ratio of 2 or less at the end<br />

of 2010-11.<br />

The <strong>Executive</strong> Bonus Share Scheme will operate again in 2011.<br />

Each <strong>Executive</strong> and two members of Senior Management will be<br />

granted an award of one million shares each which will vest if the<br />

Company attains all the following targets:<br />

Underlying EBITDA of £215m in <strong>2012</strong><br />

Underlying EBITDA of £250m in 2013<br />

Underlying EBITDA of £260m in 2014<br />

Underlying EBITDA of £300m in 2015<br />

Individual satisfactory employment performance<br />

The bonus will vest in 2017 subject to continuous employment to<br />

this date. The targets and vest dates are in line with the Employee<br />

Bonus Share Scheme.<br />

<strong>2012</strong> Super Stretch <strong>Executive</strong> Bonus Share Scheme for<br />

Mike Ashley<br />

The Company is seeking shareholder approval at its <strong>2012</strong> AGM for<br />

a Super Stretch Share Scheme for the benefit of Mike Ashley. As<br />

<strong>Executive</strong> Deputy Chairman, Mike receives no remuneration for his<br />

substantial contribution to the business and does not participate in<br />

the above <strong>Executive</strong> Bonus Share Scheme.<br />

The full details of the proposed scheme are contained with the<br />

AGM notice.<br />

If given approval Mike will be given the option to acquire eight<br />

million shares in the Company at no cost, if all four “Super Stretch<br />

Targets” are met.<br />

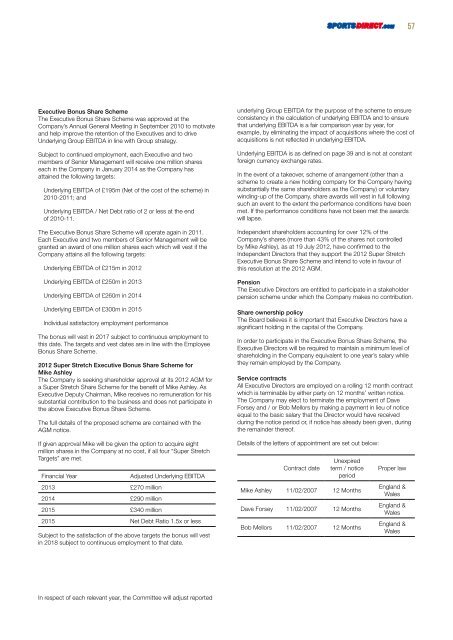

Financial Year Adjusted Underlying EBITDA<br />

2013 £270 million<br />

2014 £290 million<br />

2015 £340 million<br />

2015 Net Debt Ratio 1.5x or less<br />

Subject to the satisfaction of the above targets the bonus will vest<br />

in 2018 subject to continuous employment to that date.<br />

In respect of each relevant year, the Committee will adjust reported<br />

underlying Group EBITDA for the purpose of the scheme to ensure<br />

consistency in the calculation of underlying EBITDA and to ensure<br />

that underlying EBITDA is a fair comparison year by year, for<br />

example, by eliminating the impact of acquisitions where the cost of<br />

acquisitions is not reflected in underlying EBITDA.<br />

Underlying EBITDA is as defined on page 39 and is not at constant<br />

foreign currency exchange rates.<br />

In the event of a takeover, scheme of arrangement (other than a<br />

scheme to create a new holding company for the Company having<br />

substantially the same shareholders as the Company) or voluntary<br />

winding-up of the Company, share awards will vest in full following<br />

such an event to the extent the performance conditions have been<br />

met. If the performance conditions have not been met the awards<br />

will lapse.<br />

Independent shareholders accounting for over 12% of the<br />

Company’s shares (more than 43% of the shares not controlled<br />

by Mike Ashley), as at <strong>19</strong> <strong>July</strong> <strong>2012</strong>, have confirmed to the<br />

Independent <strong>Direct</strong>ors that they support the <strong>2012</strong> Super Stretch<br />

<strong>Executive</strong> Bonus Share Scheme and intend to vote in favour of<br />

this resolution at the <strong>2012</strong> AGM.<br />

Pension<br />

The <strong>Executive</strong> <strong>Direct</strong>ors are entitled to participate in a stakeholder<br />

pension scheme under which the Company makes no contribution.<br />

Share ownership policy<br />

The Board believes it is important that <strong>Executive</strong> <strong>Direct</strong>ors have a<br />

significant holding in the capital of the Company.<br />

In order to participate in the <strong>Executive</strong> Bonus Share Scheme, the<br />

<strong>Executive</strong> <strong>Direct</strong>ors will be required to maintain a minimum level of<br />

shareholding in the Company equivalent to one year’s salary while<br />

they remain employed by the Company.<br />

Service contracts<br />

All <strong>Executive</strong> <strong>Direct</strong>ors are employed on a rolling 12 month contract<br />

which is terminable by either party on 12 months’ written notice.<br />

The Company may elect to terminate the employment of <strong>Dave</strong><br />

<strong>Forsey</strong> and / or Bob Mellors by making a payment in lieu of notice<br />

equal to the basic salary that the <strong>Direct</strong>or would have received<br />

during the notice period or, if notice has already been given, during<br />

the remainder thereof.<br />

Details of the letters of appointment are set out below:<br />

Contract date<br />

Unexpired<br />

term / notice<br />

period<br />

Mike Ashley 11/02/2007 12 Months<br />

<strong>Dave</strong> <strong>Forsey</strong> 11/02/2007 12 Months<br />

Bob Mellors 11/02/2007 12 Months<br />

Proper law<br />

England &<br />

Wales<br />

England &<br />

Wales<br />

England &<br />

Wales<br />

57

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)