Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

102 / FINANCIAL STATEMENTS AND NOTES<br />

notes to the Financial Statements<br />

For the 53 weeks ended 29 April <strong>2012</strong><br />

29. Acquisitions<br />

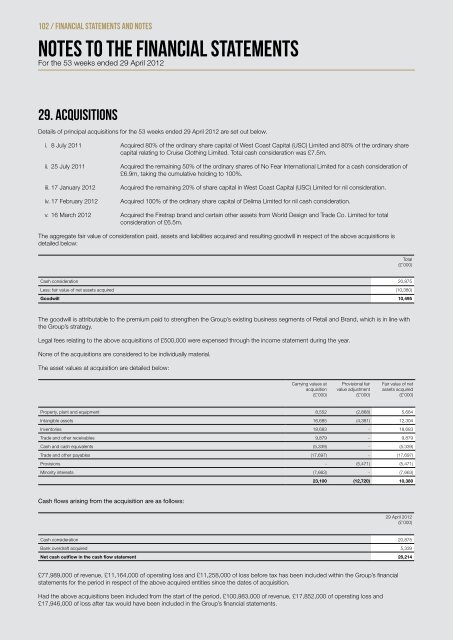

Details of principal acquisitions for the 53 weeks ended 29 April <strong>2012</strong> are set out below.<br />

i. 8 <strong>July</strong> 2011 Acquired 80% of the ordinary share capital of West Coast Capital (USC) Limited and 80% of the ordinary share<br />

capital relating to Cruise Clothing Limited. Total cash consideration was £7.5m.<br />

ii. 25 <strong>July</strong> 2011 Acquired the remaining 50% of the ordinary shares of No Fear <strong>International</strong> Limited for a cash consideration of<br />

£6.9m, taking the cumulative holding to 100%.<br />

iii. 17 January <strong>2012</strong> Acquired the remaining 20% of share capital in West Coast Capital (USC) Limited for nil consideration.<br />

iv. 17 February <strong>2012</strong> Acquired 100% of the ordinary share capital of Delima Limited for nil cash consideration.<br />

v. 16 March <strong>2012</strong> Acquired the Firetrap brand and certain other assets from World Design and Trade Co. Limited for total<br />

consideration of £6.5m.<br />

The aggregate fair value of consideration paid, assets and liabilities acquired and resulting goodwill in respect of the above acquisitions is<br />

detailed below:<br />

Cash consideration 20,875<br />

Less: fair value of net assets acquired (10,380)<br />

Goodwill 10,495<br />

The goodwill is attributable to the premium paid to strengthen the Group’s existing business segments of Retail and Brand, which is in line with<br />

the Group’s strategy.<br />

Legal fees relating to the above acquisitions of £500,000 were expensed through the income statement during the year.<br />

None of the acquisitions are considered to be individually material.<br />

The asset values at acquisition are detailed below:<br />

Carrying values at<br />

acquisition<br />

(£’000)<br />

Provisional fair<br />

value adjustment<br />

(£’000)<br />

Total<br />

(£’000)<br />

Fair value of net<br />

assets acquired<br />

(£’000)<br />

Property, plant and equipment 8,552 (2,868) 5,684<br />

Intangible assets 16,685 (4,381) 12,304<br />

Inventories 18,683 - 18,683<br />

Trade and other receivables 9,879 - 9,879<br />

Cash and cash equivalents (5,339) - (5,339)<br />

Trade and other payables (17,697) - (17,697)<br />

Provisions - (5,471) (5,471)<br />

Minority interests (7,663) - (7,663)<br />

23,100 (12,720) 10,380<br />

Cash flows arising from the acquisition are as follows:<br />

29 April <strong>2012</strong><br />

(£’000)<br />

Cash consideration 20,875<br />

Bank overdraft acquired 5,339<br />

Net cash outflow in the cash flow statement 26,214<br />

£77,989,000 of revenue, £11,164,000 of operating loss and £11,258,000 of loss before tax has been included within the Group’s financial<br />

statements for the period in respect of the above acquired entities since the dates of acquisition.<br />

Had the above acquisitions been included from the start of the period, £100,983,000 of revenue, £17,852,000 of operating loss and<br />

£17,946,000 of loss after tax would have been included in the Group’s financial statements.

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)