Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

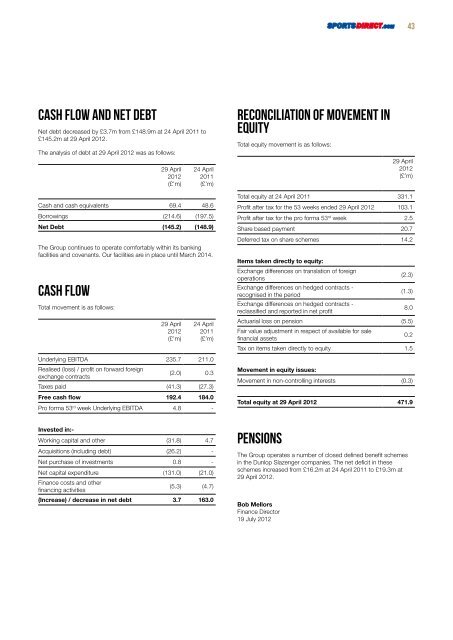

Cash flow and net debt<br />

Net debt decreased by £3.7m from £148.9m at 24 April 2011 to<br />

£145.2m at 29 April <strong>2012</strong>.<br />

The analysis of debt at 29 April <strong>2012</strong> was as follows:<br />

29 April<br />

<strong>2012</strong><br />

(£’m)<br />

24 April<br />

2011<br />

(£’m)<br />

Cash and cash equivalents 69.4 48.6<br />

Borrowings (214.6) (<strong>19</strong>7.5)<br />

Net Debt (145.2) (148.9)<br />

The Group continues to operate comfortably within its banking<br />

facilities and covenants. Our facilities are in place until March 2014.<br />

Cash flow<br />

Total movement is as follows:<br />

29 April<br />

<strong>2012</strong><br />

(£’m)<br />

24 April<br />

2011<br />

(£’m)<br />

Underlying EBITDA 235.7 211.0<br />

Realised (loss) / profit on forward foreign<br />

exchange contracts<br />

(2.0) 0.3<br />

Taxes paid (41.3) (27.3)<br />

Free cash flow <strong>19</strong>2.4 184.0<br />

Pro forma 53 rd week Underlying EBITDA 4.8 -<br />

Invested in:-<br />

Working capital and other (31.8) 4.7<br />

Acquisitions (including debt) (26.2) -<br />

Net purchase of investments 0.8 -<br />

Net capital expenditure (131.0) (21.0)<br />

Finance costs and other<br />

financing activities<br />

(5.3) (4.7)<br />

(Increase) / decrease in net debt 3.7 163.0<br />

Reconciliation of movement in<br />

equity<br />

Total equity movement is as follows:<br />

29 April<br />

<strong>2012</strong><br />

(£’m)<br />

Total equity at 24 April 2011 331.1<br />

Profit after tax for the 53 weeks ended 29 April <strong>2012</strong> 103.1<br />

Profit after tax for the pro forma 53 rd week 2.5<br />

Share based payment 20.7<br />

Deferred tax on share schemes 14.2<br />

Items taken directly to equity:<br />

Exchange differences on translation of foreign<br />

operations<br />

(2.3)<br />

Exchange differences on hedged contracts -<br />

recognised in the period<br />

(1.3)<br />

Exchange differences on hedged contracts -<br />

reclassified and reported in net profit<br />

8.0<br />

Actuarial loss on pension (5.5)<br />

Fair value adjustment in respect of available for sale<br />

financial assets<br />

0.2<br />

Tax on items taken directly to equity 1.5<br />

Movement in equity issues:<br />

Movement in non-controlling interests (0.3)<br />

Total equity at 29 April <strong>2012</strong> 471.9<br />

pensions<br />

The Group operates a number of closed defined benefit schemes<br />

in the Dunlop Slazenger companies. The net deficit in these<br />

schemes increased from £16.2m at 24 April 2011 to £<strong>19</strong>.3m at<br />

29 April <strong>2012</strong>.<br />

Bob Mellors<br />

Finance <strong>Direct</strong>or<br />

<strong>19</strong> <strong>July</strong> <strong>2012</strong><br />

43

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)