Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

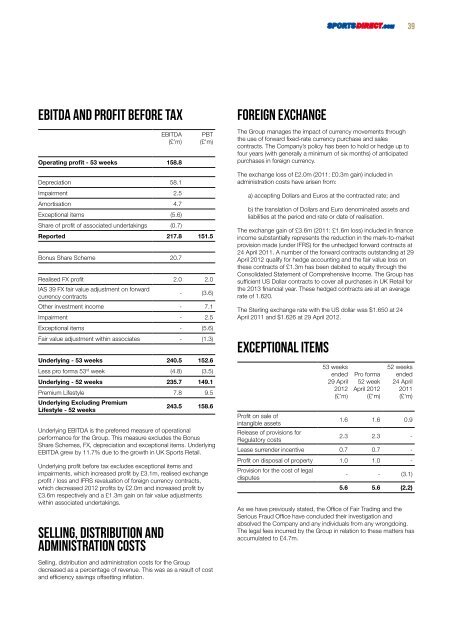

Ebitda and profit before tax<br />

EBITDA<br />

(£’m)<br />

Operating profit - 53 weeks 158.8<br />

Depreciation 58.1<br />

Impairment 2.5<br />

Amortisation 4.7<br />

Exceptional items (5.6)<br />

Share of profit of associated undertakings (0.7)<br />

PBT<br />

(£’m)<br />

Reported 217.8 151.5<br />

Bonus Share Scheme 20.7<br />

Realised FX profit 2.0 2.0<br />

IAS 39 FX fair value adjustment on forward<br />

currency contracts<br />

- (3.6)<br />

Other investment income - 7.1<br />

Impairment - 2.5<br />

Exceptional items - (5.6)<br />

Fair value adjustment within associates - (1.3)<br />

Underlying - 53 weeks 240.5 152.6<br />

Less pro forma 53 rd week (4.8) (3.5)<br />

Underlying - 52 weeks 235.7 149.1<br />

Premium Lifestyle 7.8 9.5<br />

Underlying Excluding Premium<br />

Lifestyle - 52 weeks<br />

243.5 158.6<br />

Underlying EBITDA is the preferred measure of operational<br />

performance for the Group. This measure excludes the Bonus<br />

Share Schemes, FX, depreciation and exceptional items. Underlying<br />

EBITDA grew by 11.7% due to the growth in UK <strong>Sports</strong> Retail.<br />

Underlying profit before tax excludes exceptional items and<br />

impairments, which increased profit by £3.1m, realised exchange<br />

profit / loss and IFRS revaluation of foreign currency contracts,<br />

which decreased <strong>2012</strong> profits by £2.0m and increased profit by<br />

£3.6m respectively and a £1.3m gain on fair value adjustments<br />

within associated undertakings.<br />

Selling, distribution and<br />

administration costs<br />

Selling, distribution and administration costs for the Group<br />

decreased as a percentage of revenue. This was as a result of cost<br />

and efficiency savings offsetting inflation.<br />

Foreign exchange<br />

The Group manages the impact of currency movements through<br />

the use of forward fixed-rate currency purchase and sales<br />

contracts. The Company’s policy has been to hold or hedge up to<br />

four years (with generally a minimum of six months) of anticipated<br />

purchases in foreign currency.<br />

The exchange loss of £2.0m (2011: £0.3m gain) included in<br />

administration costs have arisen from:<br />

a) accepting Dollars and Euros at the contracted rate; and<br />

b) the translation of Dollars and Euro denominated assets and<br />

liabilities at the period end rate or date of realisation.<br />

The exchange gain of £3.6m (2011: £1.6m loss) included in finance<br />

income substantially represents the reduction in the mark-to-market<br />

provision made (under IFRS) for the unhedged forward contracts at<br />

24 April 2011. A number of the forward contracts outstanding at 29<br />

April <strong>2012</strong> qualify for hedge accounting and the fair value loss on<br />

these contracts of £1.3m has been debited to equity through the<br />

Consolidated Statement of Comprehensive Income. The Group has<br />

sufficient US Dollar contracts to cover all purchases in UK Retail for<br />

the 2013 financial year. These hedged contracts are at an average<br />

rate of 1.620.<br />

The Sterling exchange rate with the US dollar was $1.650 at 24<br />

April 2011 and $1.626 at 29 April <strong>2012</strong>.<br />

Exceptional items<br />

53 weeks<br />

ended<br />

29 April<br />

<strong>2012</strong><br />

(£’m)<br />

Pro forma<br />

52 week<br />

April <strong>2012</strong><br />

(£’m)<br />

52 weeks<br />

ended<br />

24 April<br />

2011<br />

(£’m)<br />

Profit on sale of<br />

intangible assets<br />

1.6 1.6 0.9<br />

Release of provisions for<br />

Regulatory costs<br />

2.3 2.3 -<br />

Lease surrender incentive 0.7 0.7 -<br />

Profit on disposal of property 1.0 1.0 -<br />

Provision for the cost of legal<br />

disputes<br />

- - (3.1)<br />

5.6 5.6 (2.2)<br />

39<br />

As we have previously stated, the Office of Fair Trading and the<br />

Serious Fraud Office have concluded their investigation and<br />

absolved the Company and any individuals from any wrongdoing.<br />

The legal fees incurred by the Group in relation to these matters has<br />

accumulated to £4.7m.

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)