Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Dave Forsey Chief Executive 19 July 2012 - Sports Direct International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Shareholders<br />

No shareholder enjoys any special control rights, and, except as<br />

set out below, there are no restrictions in the transfer of shares or of<br />

voting rights.<br />

Mike Ashley and the Company have entered into a Relationship<br />

Agreement, pursuant to which Mike Ashley undertook to the<br />

Company that, for so long as he is entitled to exercise, or to<br />

control the exercise of, 15% or more of the rights to vote at general<br />

meetings of the Company, he will;<br />

• conduct all transactions and relationships with any member of<br />

the Group on arm’s length terms and on a normal commercial<br />

basis and with the approval of the Non-<strong>Executive</strong> <strong>Direct</strong>ors;<br />

• exercise his voting rights or other rights in support of the<br />

Company being managed in accordance with the Listing<br />

Rules and the principles of good governance set out in the UK<br />

Corporate Governance Code, and not exercise any of his voting<br />

or other rights and powers to procure any amendment to the<br />

Articles of Association of the Company;<br />

• other than through his interest in the Company, not have<br />

any interest in any business which sell sports apparel and<br />

equipment subject to certain rights, after notification to the<br />

Company, to acquire any such interest of less than 20% of<br />

the business concerned, and certain other limited exceptions,<br />

without receiving the prior approval of the Non-<strong>Executive</strong><br />

<strong>Direct</strong>ors; and not solicit for employment or employ any senior<br />

employee of the Company.<br />

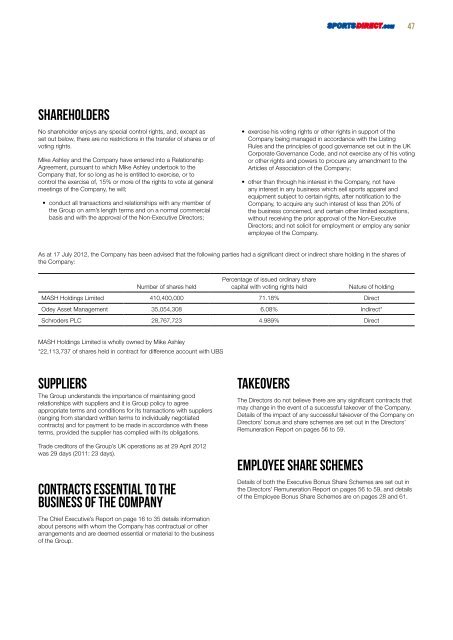

As at 17 <strong>July</strong> <strong>2012</strong>, the Company has been advised that the following parties had a significant direct or indirect share holding in the shares of<br />

the Company:<br />

Number of shares held<br />

Percentage of issued ordinary share<br />

capital with voting rights held Nature of holding<br />

MASH Holdings Limited 410,400,000 71.18% <strong>Direct</strong><br />

Odey Asset Management 35,054,308 6.08% Indirect*<br />

Schroders PLC 28,767,723 4.989% <strong>Direct</strong><br />

MASH Holdings Limited is wholly owned by Mike Ashley<br />

*22,113,737 of shares held in contract for difference account with UBS<br />

Suppliers<br />

The Group understands the importance of maintaining good<br />

relationships with suppliers and it is Group policy to agree<br />

appropriate terms and conditions for its transactions with suppliers<br />

(ranging from standard written terms to individually negotiated<br />

contracts) and for payment to be made in accordance with these<br />

terms, provided the supplier has complied with its obligations.<br />

Trade creditors of the Group’s UK operations as at 29 April <strong>2012</strong><br />

was 29 days (2011: 23 days).<br />

Contracts essential to the<br />

business of the Company<br />

The <strong>Chief</strong> <strong>Executive</strong>’s Report on page 16 to 35 details information<br />

about persons with whom the Company has contractual or other<br />

arrangements and are deemed essential or material to the business<br />

of the Group.<br />

Takeovers<br />

The <strong>Direct</strong>ors do not believe there are any significant contracts that<br />

may change in the event of a successful takeover of the Company.<br />

Details of the impact of any successful takeover of the Company on<br />

<strong>Direct</strong>ors’ bonus and share schemes are set out in the <strong>Direct</strong>ors’<br />

Remuneration Report on pages 56 to 59.<br />

Employee share schemes<br />

Details of both the <strong>Executive</strong> Bonus Share Schemes are set out in<br />

the <strong>Direct</strong>ors’ Remuneration Report on pages 56 to 59, and details<br />

of the Employee Bonus Share Schemes are on pages 28 and 61.<br />

47

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/19248141/1/184x260/our-ref-sports-direct-international.jpg?quality=85)

![Our ref: [ ] - Sports Direct International](https://img.yumpu.com/18440214/1/184x260/our-ref-sports-direct-international.jpg?quality=85)